Greece remains the main driving force in the markets on Tuesday as the dispute between the countries leaders and its creditors over the reforms necessary to secure the bailout funding needed to avoid default drags on.

The relationship between the two sides appears to have totally collapsed over the last few days and there appears to be no willingness from either to find a solution. Greek Prime Minister Alexis Tsipras has blamed differences between the International Monetary Fund and the E.U. for the problems, while Finance Minister Yanis Varoufakis has bizarrely claimed he has no intention of presenting new proposals at the eurogroup meeting on Thursday.

A deal needs to be agreed in order for funds to be disbursed at the end of the month so that Greece can avoid defaulting on its debt to the IMF and pay public sector wages and pensions. The way things are going that is not going to happen unless Greece once again gets its hands on some form of emergency funding that will nudge the can a little further down the road.

The yields on Greek debt are rising dramatically once again with two-year debt now yielding just below 30% which just goes to show how drastic this has become. Equity markets are also in the red across the board as the uncertainty surrounding Greece acts as a major drag on sentiment. The ZEW economic sentiment figures for the eurozone and Germany this morning highlighted this with both falling far more than expected. German sentiment is now at the lowest levels since November which just goes to show that these talks dragging on does not just harm Greece.

The European Court of Justice this morning ruled in favour of the European Central Banks outright monetary transactions (OMT) program confirming that it is in line with E.U. law. The result was expected despite an insistence in Germany that it would constitute monetary financing even if the purchases took place on the secondary market as the ECB would effectively be using financial institutions as an intermediary. The result is not a big deal at this stage as the crisis has developed since the program was announced in 2012, when yields in Europe were at unsustainable levels. Without the backstop of the program, that was never actually used, the crisis may have been very different over the last few years.

The FOMC begins its two day meeting today at which it will discuss the recent developments in the U.S. economy and come up with new projections for growth and inflation. These will be released tomorrow alongside the latest dot plot, which contains policy makers expectations for rate hikes in the coming years, as well as a statement and press conference. This is a huge event this week and could offer great insight into whether the latest data has been enough to warrant a rate hike at the next meeting in September. Technically, this could come tomorrow but I think most people would be extremely surprised if this happened.

Today we’ll get some housing data from the U.S. with housing starts and building permits numbers for April being released. Both are expected to ease off slightly from last month while remaining close to March’s multi-year highs. This data again supports the view that the US economy is performing much better than some first quarter data suggested.

The S&P is expected to open 6 points lower, the Dow 37 points lower and the Nasdaq 12 points lower.

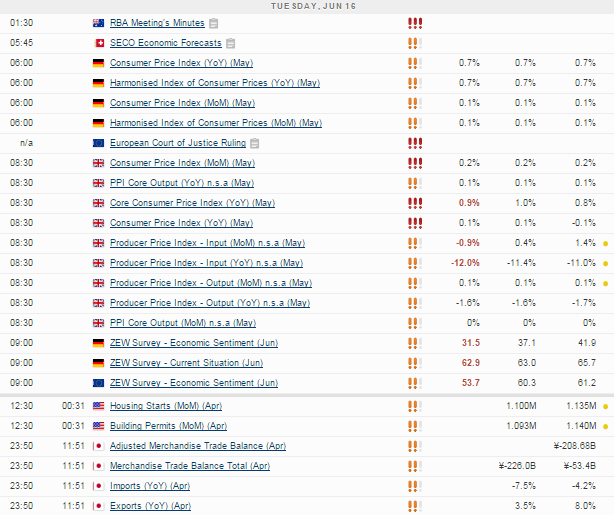

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.