It’s been a very mixed week in the markets with much of the focus being on Greece and the ongoing battle between the optimistic debtors and far more pessimistic creditors.

On a number of occasions now, Greek officials have suggested that a deal has either been agreed or is very close which would mean four months of painful negotiations are finally reaching a conclusion. Unfortunately, each time we get such a claim, it has been quickly quashed by officials representing the creditors which has created a kind of boy cries wolf scenario in which deal claims from Greek officials fall on deaf ears.

We’re now approaching a big weekend of negotiations for Greece and its creditors with the €300 million repayment to the Intternational Monetary Fund on 5 June now fast approaching. There have been suggestions that the four repayments to the IMF in June totaling €1.6 billion may be bundled together and paid at the end of the month, allowing negotiations to continue for longer but these have been rejected by Greek officials at this stage.

I do find it interesting that despite the rejections of Greek claims of deals being done, investors do appear a little more optimistic that progress is being made and that maybe, this optimism from Greece is being spurred by a willingness by its creditors to offer it a little rope. I don’t see this coming from pension or labour market reforms but they may be willing to ease their stance on fiscal surplus targets and future debt forgiveness if Greece can hit its targets.

I’m sure we’ll hear plenty of noise regarding these negotiations today which could make for some rather volatile market conditions at times. Barring a deal being done or collapsing altogether, I would be surprised to see any substantial moves either way as this could be seen to be quite risky ahead of an important weekend of negotiations and potential deal making.

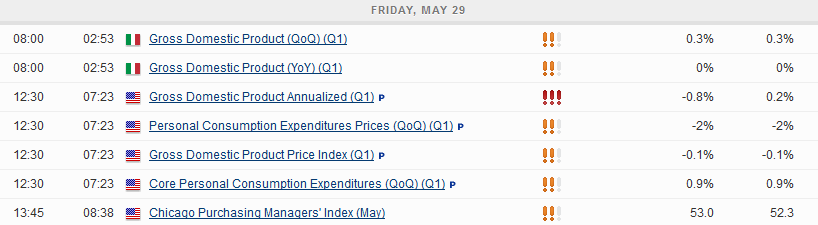

It’s looking a little light on the data side, with the revised reading of U.S. first quarter GDP the only notable release. Unsurprisingly, this is expected to be revised lower to -0.8% from the initial reading of 0.2%. When you consider how bad the data was in the first quarter and the similar downward revisions seen in the same quarter last year, I’m not surprised we’re expecting the same again. In fact, I think the final reading will be much lower than -0.8% again. That said, like last year, I expect the economy to bounce back strongly in the other three quarters this year which should allow the Federal Reserve to hike rates in 2015.

The FTSE is expected to open 5 points higher, the CAC 20 points higher and the DAX 29 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.