It’s been a very slow start to the week in the financial markets with yesterday’s bank holiday in much of Europe and the US severely weighing on trading volumes.

Those markets that were open in Europe suffered a rough start to the week, particularly in the periphery where Spanish regional and local elections highlighted the risks facing the recovery this year while the Greek interior minister confirmed that the country would not be able to pay the IMF next month.

Spain’s economy has really turned a corner recently and was one of the fastest growing EU countries in the first quarter, posting 0.9% growth. Unfortunately, the general election later this year was always going to pose a threat to any recovery this year as despite overseeing a turnaround, the popularity of the ruling People’s Party is at a more than 20 year low.

The voting over the weekend was also very fragmented making an overall majority for any party very unlikely while the rise of parties like Podemos could pose further problems for the eurozone down the road. The success of Podemos at the election later this year could be supported or severely hampered by the success of failure of the Alexis Tsipras’ negotiations with the country’s creditors in the next couple of weeks. Podemos have been likened to Tsipras’ Syriza party and so negotiations here could set a precedent for other similar minded parties in other countries where people are growing tired of austerity.

As it stands, negotiations aren’t going to well for Tsipras and I would bet that the rise of parties like Podemos aren’t helping his cause. Leaders across the eurozone will not want to be seen giving in to the demands of these parties and the harder the stance they take with Tsipras, the less likely it is that they will have to go through it over and over again in the future.

With Greece’s interior minister confirming that the country will not be able to repay €1.6 billion to the IMF in June, it really is now crunch time in talks between both parties. They are set to resume tomorrow and will likely dominate most of the week with it not offering too much on the data front and earnings season having eased off greatly.

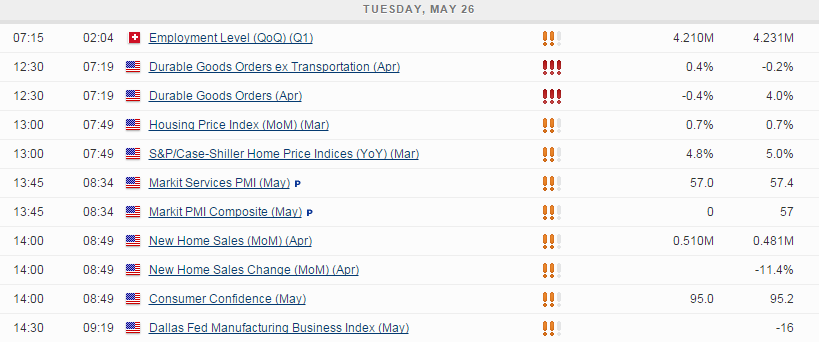

The bulk of today’s data will come from the US where we’ll get the latest durable goods orders for April followed by this month’s CB consumer confidence reading. The UoM consumer sentiment number fell dramatically this month which was quite worrying following the disappointing retail sales figures throughout the winter months. I would expect to see a similar result today, although market expectations are currently for only a small decline to 95.

We’ll also get new home sales from the US as well as the May services and composite PMI readings. On top of this we’ll hear from Fed member Stanley Fischer who is due to speak about the global economic outlook at Tel Aviv University.

The FTSE is expected to open 1 point higher, the CAC 11 points lower and the DAX 48 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.