European futures are pointing to a higher start on Tuesday although given the choppiness in the markets recently, that could soon change depending on the kind of bond market moves we see after the open along with any developments in Greece.

We were expecting a similarly positive start to trading on Monday but further selling in bond markets soon hit equities again. Bonds did pare losses late in the session which, along with the weaker euro, allowed equities to catch some late bids and even end the session higher in some cases and it may be this strong end that’s supporting it ahead of the open.

As long as bond markets continue to see this kind of volatility and remain prone to large intra-day sell-off’s, I think we’ll continue to see these big intra-day swings in equities. Of course, a lot of this may be impacted by Greece as the country walks blindly towards default.

Negotiations don’t appear to have progressed any further and despite being only two weeks from default, Greek Prime Minister Alexis Tsipras is standing by his red lines. Pension and labour market reforms are the key sticking points although the bizarre decision to rehire around 4,000 public sector staff against the wishes of its creditors doesn’t really help matters either.

This morning there’ll be plenty of other key talking points though with inflation data being released for both the U.K. and the eurozone. Both are currently experiencing no annual inflation largely driven by lower oil and food prices. This is seen as less of a problem in the U.K. as it is still seeing inflation in non-essential purchases and therefore inflation expectations are not being affected, yet. Both April readings are expected to remain at 0% before picking up later in the year.

A dip in the latest ZEW economic sentiment figures for Germany and the eurozone is unlikely to come as a surprise to anyone. The threat of a Greek default or even exit from the eurozone combined with a fragile recovery is more than enough to knock the confidence of consumers and businesses. Equally, if a deal can be reached in the coming weeks, I would expect confidence to bounce back fairly quickly as the weaker euro and stimulus efforts of the European Central Bank continue to provide a supportive environment.

The FTSE is expected to open 12 points higher, the CAC 21 points higher and the DAX 56 points higher.

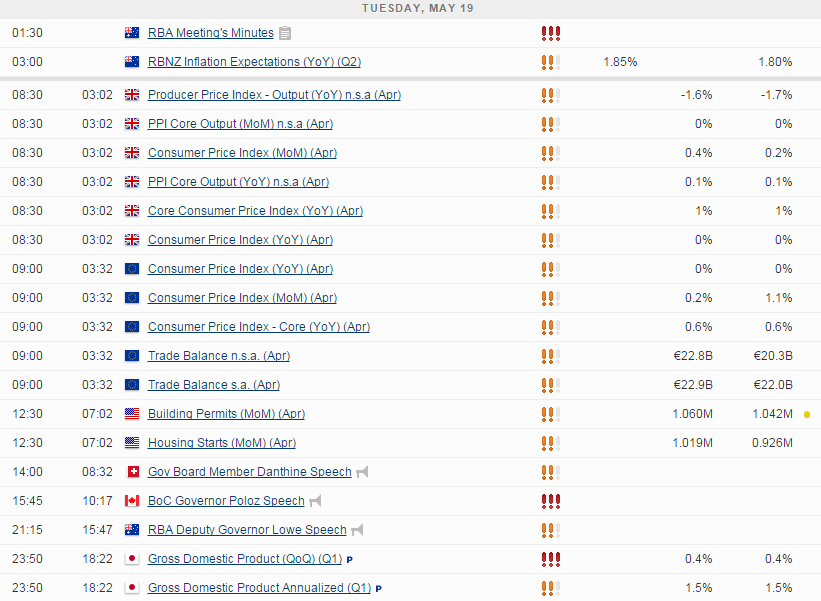

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.