Trading volumes should pick up on Friday as people in Europe return to their desks following yesterday’s bank holiday, although they will probably remain below average as it’s likely many will stay away today and turn it into a long weekend.

The lack of economic data today, particularly in the European session won’t help matters. Although, the market isn’t exactly lacking volatility even in the absence of data at the moment. Moves in the bond markets spurred on by rising inflation expectations and low liquidity are creating plenty of market volatility.

The sell-off in bond markets does appear to be slowing though now following what was quite a dramatic decline in a very short period of time. This was especially surprising considering the ECB is taking the other side of that trade which usually piles downward pressure on yields but it appears that in a low liquidity and highly anxious market, the central bank has met its max.

For once it isn’t Greece that’s the source of the anxiety, although there is a growing risk that it will default on its debt which would create another swathe of panic in the markets. Negotiations over the reform package that Greece needs to implement in order to receive the €7.2 billion bailout funds that were agreed back in February, will continue today although they’re once again unlikely to yield any kind of result.

Despite the positive comments coming from the negotiations, that progress is being made, neither side appears to be backing down in any significant way. Greece has apparently once again offered concessions with the sale of its largest port, Piraeus, but there are a number of other issues that neither side is backing down on. With time running out for Greece, I feel it will need to offer far more concessions if it is serious about striking a deal.

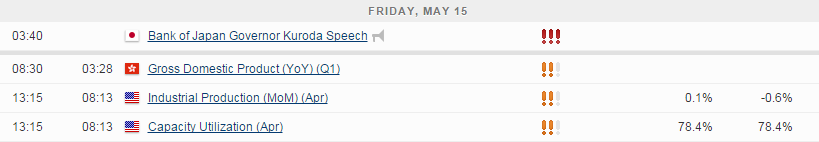

We’ll have to wait for the afternoon for any significant data releases, with the empire state manufacturing index and industrial production figures due out ahead of the opening bell on Wall Street. This will be followed shortly after by the preliminary consumer sentiment reading for May, which despite being near record highs doesn’t seem to be prompting any significant increase in consumer spending.

The FTSE is expected to open 4 points lower, the CAC 13 points lower and the DAX 12 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.