US futures are pointing slightly to the downside again on Thursday ahead of the release of some key inflation, spending, income and labour market data.

I think investors are a little downbeat today following Wednesday’s FOMC statement which may have been more hawkish than some were expecting. While policy makers did acknowledge the slowdown in the economy, the statement stressed that this period of lower growth is believed to be transitory and they see inflation returning to 2% in the medium term.

That would suggest they have not been deterred from raising rates this year as some may have hoped. The first quarter was certainly one to forget for the US but there were so many temporary factors driving that slowdown and companies will adjust to the stronger dollar in time. I think it would have been a big mistake for the Fed to push back plans for a hike based on that quarter alone.

It just comes to show what kind of environment we’re in when unemployment is at 5.5%, job creation has been strong for a long time barring the occasional blip as seen in March, CPI core inflation is at 1.8% and wage growth is good, yet people are still calling for extraordinarily low levels of interest rates. Regardless, I think this still makes a September rate hike likely while June seems off the cards now.

The eurozone managed to escape deflation in April following a four month stretch of falling prices. The ECBs quantitative easing program appears to have been largely responsible for upward price pressure returning, along with the bounce in oil prices. With indicators now pointing to moderate improvements in the eurozone economy going forward, the threat of long term deflation appears to have been reduced. We’ll probably continue to see low levels of inflation due to low oil prices and large amounts of slack in the economy but this is still progress.

The S&P is expected to open 6 points lower, the Dow 60 points lower and the Nasdaq 21 points lower.

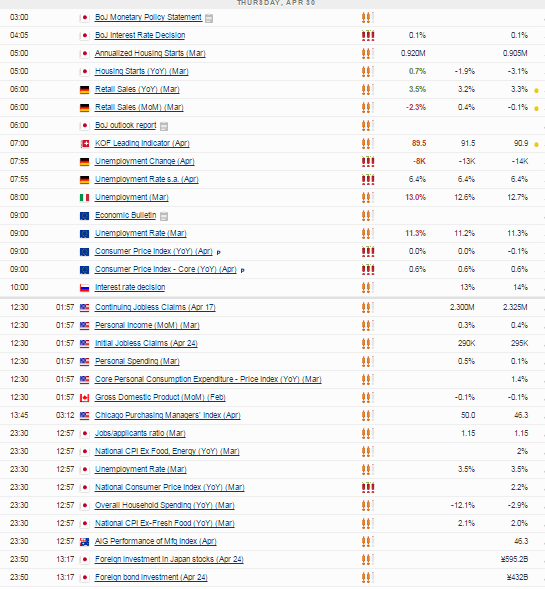

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.