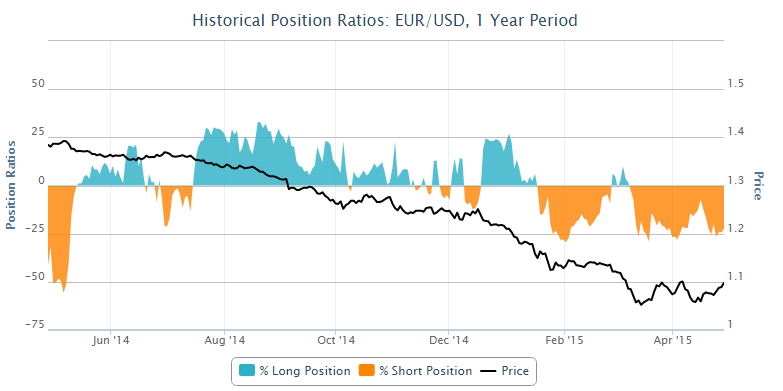

The EURUSD rally has continued today, forcing its way through the 50-day SMA for the first time in almost a year, while the 50-period SMA on the 4-hour chart has crossed above the 200-period SMA. While there is still one major barrier to break down before I’ll declare myself bullish, this is certainly a strong signal of changing momentum, at least for the short to medium term.

The pair is likely to face significant resistance between 1.1025 and 1.1055 where trend lines and past resistance levels – one of which being the upper side of the range it has traded within since the start of March – combine to offer a potentially rally ending barrier.

There’s a few things on the 4-hour chart that tells me that – on the first attempt at least – the pair will fail to break through this big resistance level. The first and most obvious is that recently, every time the pair has made a new high, it has been quickly followed by a correction. That is not a sign of strong trending market conditions.

Supporting this is the stochastic and MACD. The stochastic has been overbought since last Thursday, which is not unusual in trending markets. That said, the last couple of rally’s in price action have been met with lower highs on the stochastic, creating a bearish divergence.

This is a red flag and suggests a reversal may be approaching. When so near to a big resistance level, I find this hard to ignore. Especially when the MACD histogram is similarly showing divergence with price action. Of course, these are secondary indicators to price action and should therefore just be treated as a warning.

If 1.1050 does prove to be too strong a resistance, the 50-day SMA may provide a logical support at which we may see increased buying pressure. This would act as confirmation of the initial break and would be very bullish.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.