There appears to be a little optimism in the markets ahead of the European open on Friday, with indices currently seen opening around half a percentage point higher while the euro is paring some of yesterday’s gains having rallied to a one week high following “constructive” talks between Greek Prime Minister Alexis Tsipras and German Chancellor Angela Merkel.

I think this optimism may be quite premature though and therefore would not be surprised to see it fizzle out as the day goes on. While we were hoping that today’s eurogroup meeting would bring a resolution to reform negotiations between Greece and its creditors and once again kick the can a little further down the road, it’s become quite clear this week that this is very unlikely to be the case and therefore this sage is likely to roll on for a few more weeks yet.

Yesterday’s chat between Tsipras and Merkel may appear to be a positive development but we don’t really know what was said in this meeting. The rhetoric from most people involved in the process has been more negative and it sounds as though both sides are still far apart on what they want.

The next eurogroup meeting will take place on 11 May, a day before Greece has to make further loan repayments. It’s far more likely that a deal will be reached then, although even that depends on whether Greece has enough money in the kitty to fund it beyond those repayments, in which case this could drag on a while yet. Neither side wants to appear weak and it appears the only way for that to happen is for this to go all the way to the wire. Eventually I do believe a deal will be done and unfortunately for Tsipras and Greece, I don’t think it’s going to work much in their favour. They don’t have as much leverage as they make out.

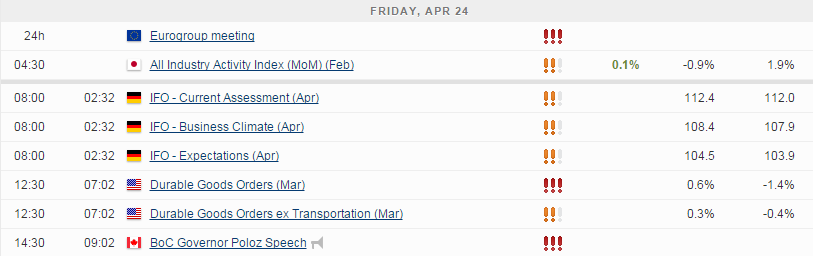

Away from the eurogroup meeting, we’ll get the latest German IFO business climate survey results this morning. I expect this will go in much the same way as all the other survey’s we’ve seen this week with current assessment either matching or beating expectations, as companies continue to benefit from the weaker euro, while expectations will fall short on concerns over the prospect of Greek default and exit from the eurozone.

Confidence in the eurozone is fragile and there’s only so much that the central bank can do to help, if Greece defaults and leaves, everyone will suffer and businesses are well aware of that.

Later on we’ll get durable goods data from the US, as well as another batch of earnings reports for the first quarter, although it’s much quieter on this front today than it has been for much of the week.

The FTSE is expected to open 20 points higher, the CAC 21 points higher and the DAX 67 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.