Yesterday (EURUSD – Break Lower Looking Increasingly Likely) I noted that despite trading in a range for much of the last month, EURUSD continues to have a slight bearish bias because it:

- remained in the descending channel;

- had formed a pennant during the last month (slight lower highs and higher lows);

- was still trading below the 50-day SMA.

Well, one of those conditions is under threat as today’s euro rally has propelled the pair above the descending trend line that it has traded below since the middle of December.

It’s important to note that there has been no close above the trend line on the 4-hour chart and I would like to see at least this before I view it as a legitimate break, if not on the daily. Lower time frames could also offer useful insight if we see a successful retest.

The fact that yesterday’s 1.08 high has been broken is certainly another red flag though and may suggest that a move towards Friday’s 1.0850 high is on the cards. A break of this level would suggest to me that we could see another test of the 50-day SMA which has proven to be a solid level of resistance in the past.

Should this be broken, it would raise serious questions about whether the upper end of the month-long trading range can hold. It would certainly suggest to me that a more bullish bias has appeared in the market.

The upper end of the trading range around 1.1030 – 1.1050 would be under serious threat in my view and a break of this would suggest the long overdue correction has arrived.

If, on the other hand, this turns out to be a false breakout, which would not be unusual, the 50-period SMA on the 4-hour chart and previous support of 1.0660 could come under serious pressure and quickly.

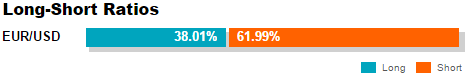

OANDA clients have become increasingly net short over the last 24 hours, with 61.99% now holding a short position. History suggests that is not necessarily a bearish sign though, in fact, it could even be perceived as bullish.

Especially when paired with the COT report that shows net non-commercial positions (those held by large speculators, mainly hedge funds and banks trading currency futures for speculation purposes) for the euro are becoming less short.

Especially when paired with the COT report that shows net non-commercial positions (those held by large speculators, mainly hedge funds and banks trading currency futures for speculation purposes) for the euro are becoming less short.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.