European futures are pointing to a slightly more positive start to the trading session on Thursday as attention shifts briefly away from the Greek bailout saga to a number of key economic data released that are due out this morning.

It’s not that the markets are not as sensitive to Greek developments as they have been, if anything they will become increasingly so as the country approaches default, it’s just that no developments are expected this week. The eurogroup meeting takes place tomorrow and the two sides appear no closer to a deal on reforms than they were two months ago. This could go even closer to the wire than we’ve ever seen before.

The problem is no one really knows exactly when that date is. Greece appears to have bought itself a little extra time when it forced public sector entities to park all reserves at the Greek central bank in order to fund its obligations, but that is unlikely to even fund it through May.

It will be interesting to see how much this saga with Greece is impacted confidence in the eurozone, which has been on a good run since the end of last year. It’s predominantly been the encouraging improvement in these survey’s that has given people confidence that the eurozone is turning a corner. Unfortunately, confidence in the euro area is like a house of cards, it doesn’t take much for the whole thing to fall apart.

The German ZEW survey earlier may have acted as a warning for today’s flash PMI readings, as it shown current sentiment at a near four year high and yet economic sentiment which is an assessment of optimism for the next six months fell. This suggests that while the country is benefiting from the weaker euro, people are not overly optimistic because of the situation in Greece. I think today’s survey’s may reflect something similar.

Data from the UK will be of significant interest today, not least because in comes only a couple of weeks before the general election. While the retail sales reading may, as always, grab the attention of the markets because of how important it is to the UK economy, I think today’s public sector net borrowing figure may have the greatest potential to impact them in the longer term.

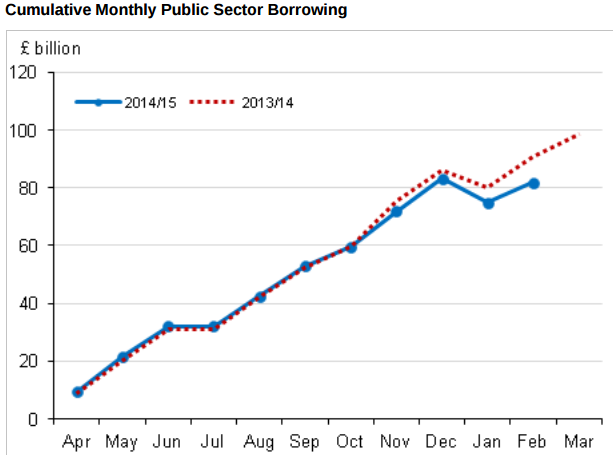

Borrowing in March is expected to have been around £6.6 billion, which would bring the total for the 2014/15 year to £88.4 billion, down around £10 billion from a year ago.

*The above was taken from February’s Public Sector Finances report from the Office for National Statistics. The full report can be found here.

In an election that is centered around the economy and deficit reduction, today’s figure could have a real impact on who gets elected. When the two sides have such different plans on how to run the country in the next parliament, this is a massive deal and therefore today’s borrowing number could realistically have a big impact on what happens in the next five years.

For example, a dramatic increase in borrowing in March would really eat into the £10 billion reduction in borrowing which would mean more money would have to be found by the next government, putting even more pressure on the Conservatives and how they’re going to achieve it. A smaller borrowing figure on the other hand would give them more room to manoeuvre and a nice boost ahead of the election.

The FTSE is expected to open 1 point lower, the CAC 8 points higher and the DAX 24 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.