Europe looks set for a relatively mixed open on Tuesday as concerns of a Greek default continue to weigh on sentiment following the government’s decision on Monday to call in all public sector cash reserves.

The move by the government to effectively confiscate cash reserves from public sector purses throughout Greece is very worrying for two reasons; it reeks of desperation and it gives the impression that they are not optimistic of a deal being reached on reforms. It’s believed that this extraordinary measure will raise just over €2 billion which will buy the government a little more time but I don’t know what it hopes to achieve.

It appears they are running out of ideas and starting to panic. It’s about time that they accept that they are not going to get their own way on this matter. They do not hold the winning hand and their poker face is becoming horribly transparent. You just worry about how much damage they are doing in the meantime and exactly how far back they are setting the country in the process.

The odds of a deal being reached at the eurogroup meeting on Friday were already very slim but this desperate move by the government suggests there’s now no chance. This is looking like a kamikaze mission from Alexis Tsipras’ government and I am beginning to worry that by the time they accept defeat, it will be too late. At the very least, Greece will have sustained a significant amount of damage.

In a way, Syriza’s stance throughout this process is admirable and probably reflects the views of many in Greece that enough is enough. The Greeks wanted a party that would stand up to the Troika and no longer bow to their every request and that’s what they are doing. Unfortunately, that may not be in the best interest of the country in the longer term and Tsipras is fast running out of options.

It’s now only a matter of time until we see capital controls being installed in Greece as there can’t be much confidence left in the banks. Once the European Central Bank pulls the plug on emergency liquidity assistance (ELA) for Greece, it’s game over. We can’t be too far away from that now.

With the day ahead being light on the data side, focus will remain on the Greek story and any developments are likely to be the main driver of market sentiment. We saw the euro looking very heavy yesterday while European stock markets were being largely supported by the large stimulus efforts of the People’s Bank of China.

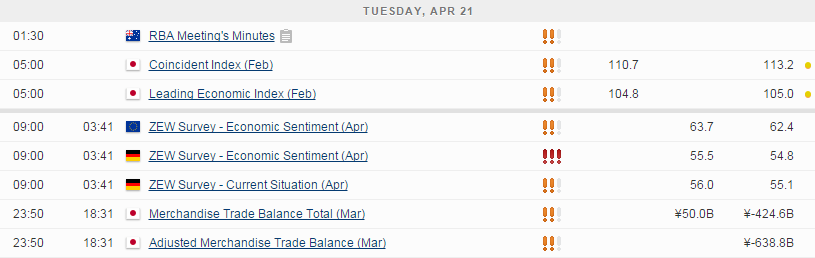

We will get economic sentiment readings from ZEW for Germany and the eurozone shortly after the European open. Both are currently seen rising in April to 55.5 and 63.7, respectively, probably largely helped by the weakness in the euro. I wouldn’t be surprised though to see the Greek situation weighing on sentiment a little as a “Grexit” would have an impact on the wider eurozone economy, whether we want to accept it or not.

The FTSE is expected to open 6 points lower, the CAC 4 points higher and the DAX 19 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.