European indices are seen opening slightly in the green on Wednesday, ahead of the latest monetary policy decision and press conference from the European Central Bank.

The ECB is extremely unlikely to announce a change to the €60 billion per month quantitative easing (QE) program that began last month as it’s still far too early to determine how much of a success or failure it has been. Any benefit that we’ve seen so far has predominantly been in confidence surveys, which is of course an encouraging sign but this could quickly fizzle out as we’ve seen repeatedly in recent years.

Exporters also appear to be benefiting from the weaker currency, which began its rapid decline long before last month on the expectation that it was coming. This is likely to continue going forward, while the tourism industry could be in for a bumper summer as foreigners look to take advantage of the cheaper holidays that the eurozone now has to offer.

I think what we’ll see in the press conference today is a more upbeat Mario Draghi (ECB President) based on what we’ve seen so far but he’ll be keen to highlight the many headwinds that still exist making an recovery far from certain. He may also respond to recent speculation that the ECB could end QE before September 2016 which could weigh on the euro during the press conference.

While I would never suggest that an ECB press conference will be uneventful, I do think today is likely to be one of the less exciting affairs simply because its QE program has only just got under-way. That said, never underestimate Draghi or the markets because both have the potential to create mayhem from nothing.

Chinese data released overnight was pretty grim as many people would have expected. Growth in the world’s second largest economy was at its lowest in six years in the first quarter, falling to 7% compared to the same quarter a year earlier. A deteriorating housing market, weak external demand, lower commodity prices and weak domestic spending all weighed on growth in the quarter despite efforts from the People’s Bank of China to support the economy.

Released at the same time was industrial production, retail sales and fixed asset investment data for March and even these disappointed across the board. With these only being the latest in a long line of disappointing economic figures for China, it seems the PBOC really needs to step up its stimulus efforts if the country is going to achieve its 7% growth target this year.

Further cuts to interest rates and the reserve requirement ratio are expected in the coming months, which would often have lifted equity markets following the release as it makes these cuts more probable and potentially more aggressive, but it appears investors were unwilling to take the positives from the data on this occasion.

The FTSE is expected to open 1 point lower, the CAC 18 points higher and the DAX 27 points higher.

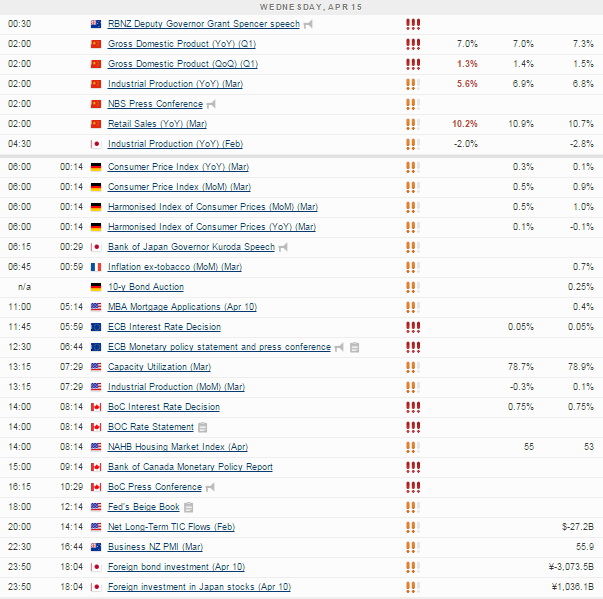

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.