The week ahead in the financial markets will certainly be an interesting one, with a plethora of big economic data being released, central bank announcements and corporate earnings season getting into full swing after Alcoa got things under way last week.

Already this morning we’ve had the March trade figures from China which didn’t exactly get the week off to the most positive of starts, although investors don’t exactly appear too worried about them as the Shanghai Composite sits 1.5% higher on the day.

Exports fell by 15% compared to the same month last year, an enormous miss from the 12% rise that was forecast, while imports also fell short of expectations, falling by 12.7%. At first glance, it’s easy to be disappointed but once February’s 48.3% surge in exports are taken into consideration, the forecasts seem quite optimistic. The January and February figures are usually averaged out to account for the impact on the Lunar New Year but when you see a number like that in February, you have to expect it to impact the March reading which I think it clearly has.

Chinese exporters have also expressed concern about the path of the Yuan and what impact that will have on external demand, which is a very legitimate concern. And while this may have played into this month’s disappointing export figures, I’m sure February’s trade had much more to do with it which is why investors have not been overly concerned by it. That and the fact that, right now, poor data only supports the need for the People’s Bank of China to cut rates further which gives investors that little boost they crave so much.

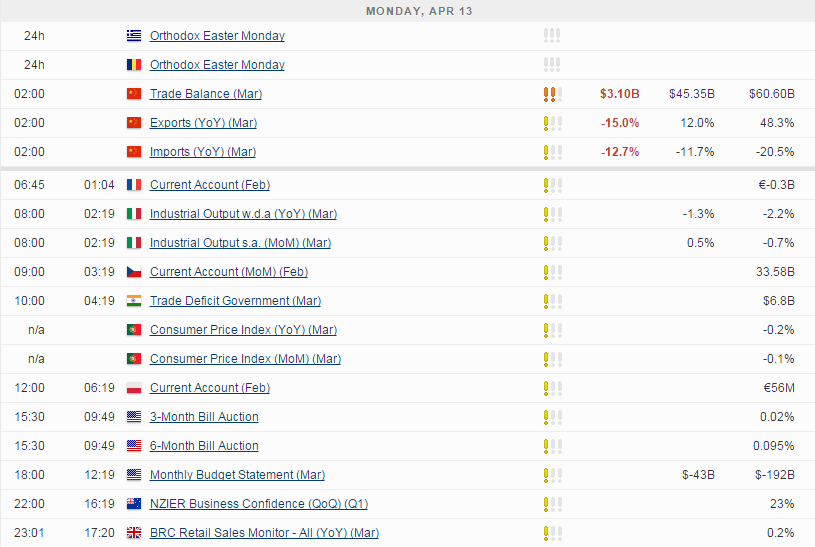

The rest of the day is looking a little quieter with only a few low impact economic reports scheduled for release but with so much to come, I don’t expect this to effect trade much. There are some very important figures being released this week such as U.K. inflation, U.S. retail sales, Chinese first quarter growth, eurozone inflation and U.K. jobs data, not to mention the latest monetary policy decision from the European Central Bank. We quite often see caution creeping in at the start of such an important week and I expect this to be no different.

Compounding this is earnings season, which for the U.S. in particular is expected to be quite gruelling. The strong dollar, challenging weather conditions and lower oil prices are going to be a common theme in the first quarter but with all this priced in, you wonder whether the bar has been set low enough for the usual low expectation rally.

The FTSE is expected to open 4 points lower, the CAC 7 points higher and the DAX 19 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.