A slightly more downbeat feeling greets European investors as they return from the long Easter weekend on Tuesday, primarily driven by the disappointing job creation figures that came from the US on Friday.

European markets have been closed since Thursday and so they have a little catching up to do. Job creation in the US in March was well below what we were expecting as it plummeted to the lowest level since January last year. The poor reading has been taken as a sign that the Fed may delay the timing of the first rate hike which is why markets are higher, a return to the bad news is good news scenario that was inevitable as soon as the Fed withdrew its forward guidance and became entirely data dependent.

I don’t actually think the report was that bad and actually, the market reaction would suggest that investors are totally missing the point. It’s been made clear for months now that job creation is not the issue and is not what is holding the Fed back. The US is at full employment. Wage growth and inflation are the bigger concerns and this report was positive on both of those points. Higher wage growth increases inflation pressures and a higher than expected hourly earnings figure of 0.3% suggests we’ll get just that.

Regardless, we’ve seen this backward scenario in the past and it isn’t always exactly logical. It probably wasn’t helped by yesterday’s weaker ISM non-manufacturing PMI which accompanied the weaker manufacturing PMI reading last week.

We have a very quiet day in store as traders return from their long weekends. This week can sometimes be a little low on volume side as traders often make the most of the bank holidays and turn it into a longer break. As we’ve seen a lot recently though, lower volumes certainly does not mean less volatility.

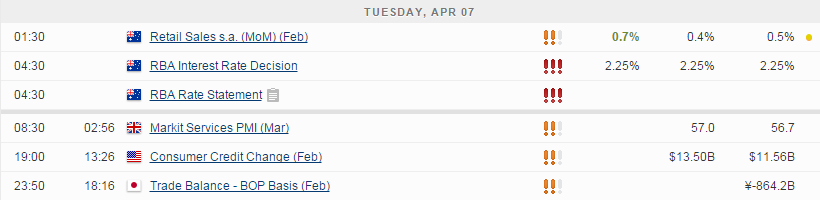

We’ll get final services PMI readings for the Eurozone, Germany, France and the UK this morning. Confidence in the eurozone has been rising recently as the weaker euro boosts exports and lower oil prices put a little more money back into people’s pockets. I imagine confidence will continue to grow into the summer as more people opt to holiday in the euro area and take advantage of the weaker currency.

The RBA opted to keep interest rates on hold this morning at 2.25% despite widespread expectations that they would opt to cut again this month. They did state that further easing may be appropriate in the period ahead but that did not stop the Aussie dollar flying higher. The aussie rallied to 0.77 against the US dollar but this has so far provided solid resistance once again. A number of currencies are repeatedly testing key resistance levels against the US dollar at the moment which suggests another weakening in the dollar may not be far away.

The FTSE is expected to open 31 points higher, the CAC 19 points higher and the DAX 45 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.