Inflation has been a huge talking point this year, with central banks around the world cutting interest rates in a bid to stave off the devastating threat of deflation. Lower oil prices have been primarily responsible for tumbling rates of inflation and yet central banks are concerned that it could develop into something more nasty and have therefore attempted to nip it in the bud.

The result of this has been a small currency war between many central banks as each attempts to offset the disinflation that each easing bank effectively exports onto everyone else. As of yet, two of the only central banks that have not involved themselves in this are the Bank of England and the Federal Reserve due to their stronger economies and belief that this will bring inflationary pressures to allow them to hit their inflation targets. However, you can guarantee that this stance will only last as long as the data continues to support that and they will not hesitate to jump on the bandwagon the instant that changes.

Today we’ll get the latest inflation figures from both of these central banks, starting with the BoE early in the European session. BoE Governor Mark Carney has conceded in recent months that the rate of inflation is likely to fall into deflation territory but stressed that this should only be temporary, with expectations being that it will rise back towards 2% within the forecasting period.

Today’s release is expected to show it falling close to deflation – 0.1% – in February but the important thing is what drives the move. If lower oil and food prices continue to be the driver then people won’t be too worried. It’s if it spreads to other areas that we should start to worry about it becoming more broad-based, which is when the BoE will be forced to rethink its monetary stance.

The same will be true when the US CPI is released this afternoon. This is actually expected to rise slightly in February following a slight bounce in oil prices, although this is only expected to be temporary meaning further disinflation should come. It should also be noted that while this is not the Fed’s preferred measure of inflation, it does provide insight into what areas of the economy are experiencing deflationary pressures so it’s still certainly worth paying attention to.

Also this morning we’ll get the latest flash manufacturing and services PMI readings for Germany, France and the Eurozone. All are expected to improve slightly as the weaker euro continues to support the minor recovery the region is experiencing following five miserable years of recessions and austerity. We certainly can’t get carried away with any of this data yet, not with so many headwinds still facing the Eurozone including ongoing bailout talks with Greece and elections in Spain where we’ve also seen the rise of an anti-austerity party – Podemos. Not to mention the deflation threat which is potentially more serious than anywhere else right now.

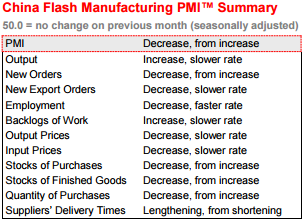

Inflation is also a worry for China at the moment, where low export demand, weak domestic demand, falling commodity prices and an declining property market remain major concerns for the country. Today’s manufacturing PMI further highlighted some of these worries, as the new sub orders index, new export orders and employment all fell to bring the overall number back into contraction territory from 50.7 in February to 49.2 in March. Needless to say this did nothing to lift sentiment overnight although it has prompted further talk of additional monetary stimulus in the coming months.

*These were taken from the HSBC Purchasing Managers Index Press Release. The full report can be found here.

The FTSE is expected to open 5 points lower, the CAC 5 points lower and the DAX 22 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.