A slow news day in the markets isn’t getting in the way too much as European stock indices continue their ascent, albeit at a slower pace. US futures are also a little higher following yesterday’s correction as traders locked in a little profit following the dovish Fed statement on Wednesday. Clearly the prospect of a slower pace of rate increases is enough to continue the rally right into the end of the week.

The EU summit in Brussels offered a small opportunity to make some headlines but as expected, very little has been achieved. As expected, EU leaders agreed that the lifting of sanctions on Russian and Ukrainian officials would coincide with the full implementation of a ceasefire which is due at the end of the year. For this to happen, pro-Russian rebels would have to cede control of the eastern border and return it to Ukraine. If we’ve learned anything from the crisis so far it’s that this is very unlikely and therefore very little is going to change.

The other topic of discussion which wasn’t actually scheduled for this meeting until Alexis Tsipras insisted on it, related to the Greek bailout extension. Greece is yet to receive any payment agreed as part of the extension and is due to run out of funding next month unless it offers an acceptable list of reforms to its creditors. Tsipras and Finance Minister Yanis Varoufakis have negotiated hard until now but it appears they are fast running out of ideas. After overnight talks Tsipras agreed to draw up an acceptable list of reforms but if recent months are anything to go by, this is going to be far from straightforward.

Following the surprisingly dovish comments from the Fed on Wednesday, we’ll hear from a couple of members that could shed some light on future rate hikes and what has been behind the change in attitude. We did get some answers to this from the statement and Janet Yellen’s testimony however the more information we can get, the better a judgement we can make now that forward guidance has been scrapped. People’s forecasts for the first hike range from June to 2017 which highlights just how confused people are on the matter.

Following yesterday morning’s paring of dollar losses, it appears to have stabilized over the last 24 hours which has brought some stabilization to commodity markets as well. US crude prices remain around the lower end of the trading range around $43.61, weighed on by another build in inventories, as reported by the Energy Information Administration on Wednesday. While rigs are continuing to be taken offline, production is on the rise and while that continues to be the case, prices are going to remain under pressure.

The S&P is expected to open 7 points higher, the Dow 96 points higher and the Nasdaq 16 points higher.

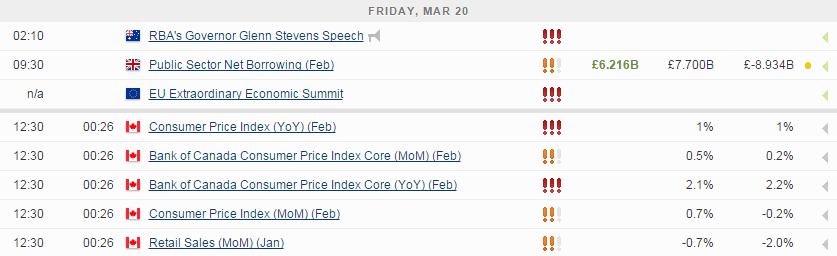

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.