Aussie Dollar reached fresh new highs today, breaking 0.94 resistance and hitting as high as 0.944, the highest level reached since 19th Nov 2013. The reason for this strong bullishness is simple – 2 positive economic news in the form of higher than expected Consumer Inflation Expectations and an unexpected decline in Unemployment Rate from 6.1% to 5.8%. The combine bullish impact of these 2 news allowed prices to stay above 0.94 even though latest Chinese data proved to be disappointing once again – Trade balance improved from a deficit of $23 Billion to a $7.71 Billion surplus, but that is only made possible due to a huge decline in exports: -11.3% vs 2.4% growth expected. This huge drop in imports is bound to hit Australia hard as China is the biggest export destination for goods made in Australia. Exports from China has also fallen sharply, suggesting that not only is China not buying, the rest of the world isn’t doing so hot either.

However, it should be noted that the employment data isn’t as bullish as it seems either. The headline figure showed an increase in 18.1K jobs, but the number of Full-Time positions have declined by 18.1K, while part time employment grew by 40.2K. Certainly this is not the worst numbers possible, but it does take out the shine off the significant 0.3% fall in unemployment rate especially when we take into consideration that participation rate has fallen as well.

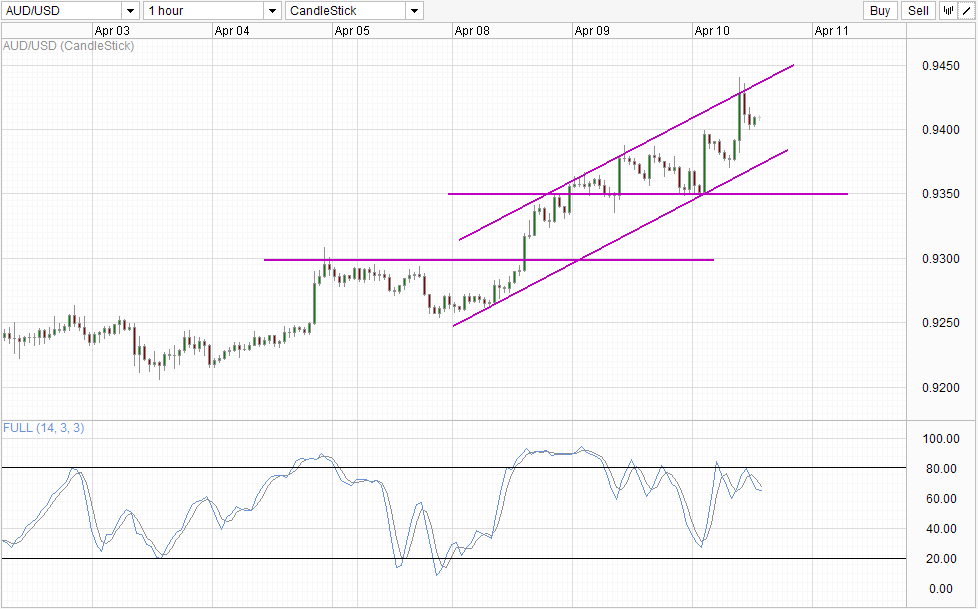

Hourly Chart

Does that mean AUD/USD should be less bullish? Absolutely not. Bullish momentum was already evident at the start of Tuesday, when prices broke above 0.93 and bulls have not looked back since. Given such strong bullish momentum, it is likely that prices may continue higher even without the 2 bullish economic news releases today. As such, the likelihood of 0.94 support holding is high even though Channel Bottom should have been a viable bearish target as we’re rebounding off Channel Top right now. Stochastic indicator suggest that a bearish cycle is in play right now but it should be noted that Stoch curve is flattening head of the “support” level around 60.0. Hence, it will not be surprising to see Stochastic curve reversing from here and negating the bearish cycle signal. This would also mean that prices may push up towards Channel Top once more, with the possibility of a bullish breakout or prices may straddle Channel Top higher to bring us fresh highs again.

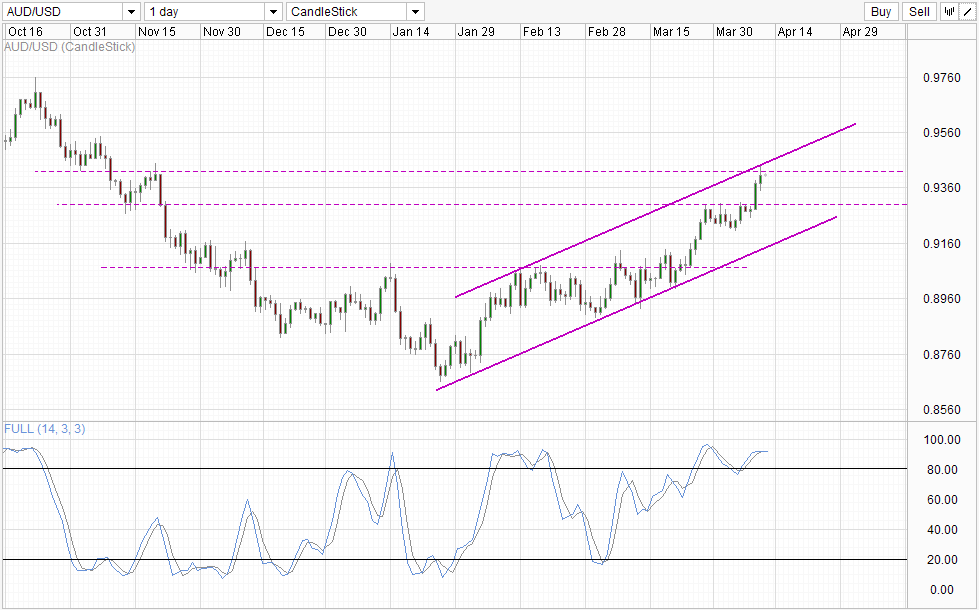

Daily Chart

Daily Chart is not as bullish though, as the decline from Oct 2013 is still visible within the horizon. Hence, it is difficult to imagine currently bullish momentum gaining much headway with broad long-term bearish trend breathing down its neck. Furthermore, the long-term downtrend is not without justification – Australia’s mining sector is starting to slowdown, while US economy is picking up. This would naturally bring AUD/USD lower even before we start talking Central Bank actions. Considering that fundamental factors remain mostly the same, we can interpret current rally as a mere corrective. Stochastic indicator is Overbought as well, favoring bearish correction moving ahead.

More Links:

USD/JPY – Yen Takes Breather After Huge Gains

EUR/USD – Steady At 1.38 As Markets Await Fed Minutes

Gold – Slight Losses As Federal Reserve in Spotlight

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.