Today is the first day of the largest election in the world where over 814 million Indian citizens will hold a ballot vote that will determine the next Government for the next 5 years. This election has been hyped up as the one that would change India’s fortune, as high inflation and lowering production has plagued the developing nation for the past 5 years, and rightly or wrongly the voters are hoping to see a change in administration believing that their economic fortunes will change as well.

This hope for a better future spurred Rupee and main stock index Sensex higher in the past few months, as traders and investors are optimistic following preliminary polls favoring opposition party BJP. Some polls even suggest that the party may even get an outright majority without the need of a coalition. If this indeed happen, it is likely that the new Government will be able to get bills passed in a much easier fashion and allowing the economy to recover in a much more timely and efficient manner (assuming that BJP does indeed turn out to be as pro business as touted).

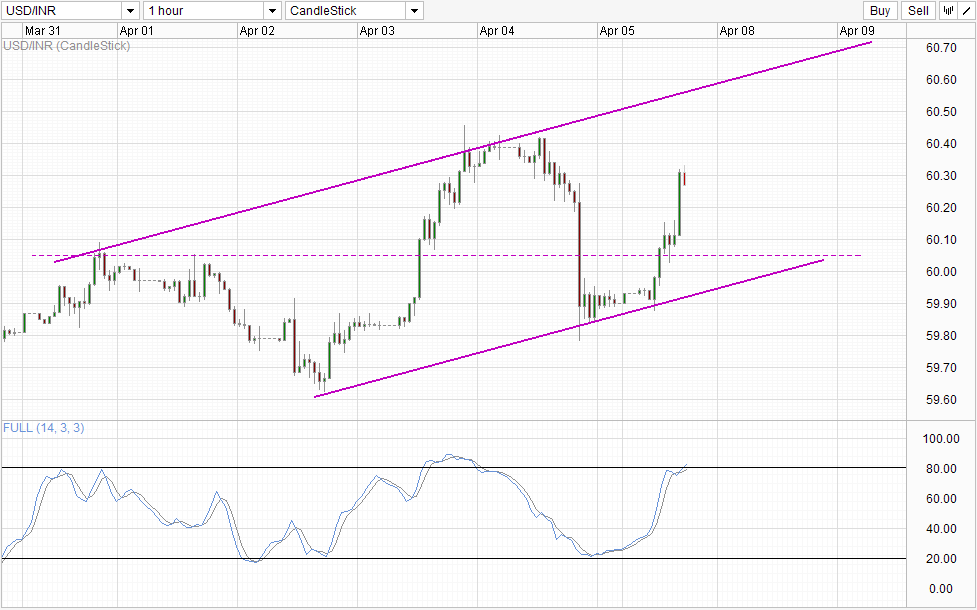

Hourly Chart

However, market response certainly does not reflect the optimism/hopefulness that one would expect with the start of this 6-week long elections. Sensex index is currently trading 0.62% lower while Indian Rupee has also weakened against the USD. One may attribute the broad global risk-off trend to this decline, but that is not accurate as Asian indexes are mostly stable, with most of the indexes paring opening losses for the rest of the day. Price action on the Sensex was the opposite – prices actually started higher but pushed lower subsequently, suggesting that the decline is due to India’s own undoing rather than broad risk trends. The same charge can be levied against the Rupee where other major currencies are actually trading stronger against the USD, instead of weaker.

What does this mean?

It is possible that this is just a blip, and a small case of market buying the rumor and sell the news. However, should weakness in Sensex and Rupee continues for the next few days, we could be seeing a stronger unwinding of gains that have been garnered in the past few months as the market sentiment about the election may have changed.

Short-term technicals favor continued weakness in Rupee as well. Prices appear to be trading within a rising Channel and we could be seeing a push towards Channel Top. Recent swing high around the 60.4 consolidation ceiling seen last Friday may still provide resistance. Given that Stochastic readings are currently within the Overbought region, the likelihood of USD/INR rebounding lower becomes higher. However, if prices continue to shoot up in the short-run, and push above 60.4 without breaking a sweat, the likelihood of a shift in sentiment about the election increases, and further gains in USD/INR can be expected.

More Links:

WTI Crude – 100.5 Critical For S/T Direction

Nikkei 225 – Staying Bullish Ahead Of BOJ Despite Friday’s Slide

Gold Technicals – Staying Above 1,300

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.