AUD/USD pushed lower this morning, led by weaker than expected Australia Retail Sales which grew 0.2% vs an expected 0.3%. Economic data from China further compounded the misery, with official Non-Manufacturing PMI coming in at 54.5 vs 55.0 previous. The private survey done by HSBC/Markit actually grew from 51 to 51.9, but that provided scant comfort as the Composite PMI compiled index came in at 49.3, suggesting a much faster pace of decline in overall Chinese economy vs previous month’s 49.8 (50 is the par value). Similarly, Trade Balance numbers are much stronger than expected, but the numbers from Feb is still below Jan’s 1.4 Billion AUD, and as such it is not surprising to see little bullish impact arising from it.

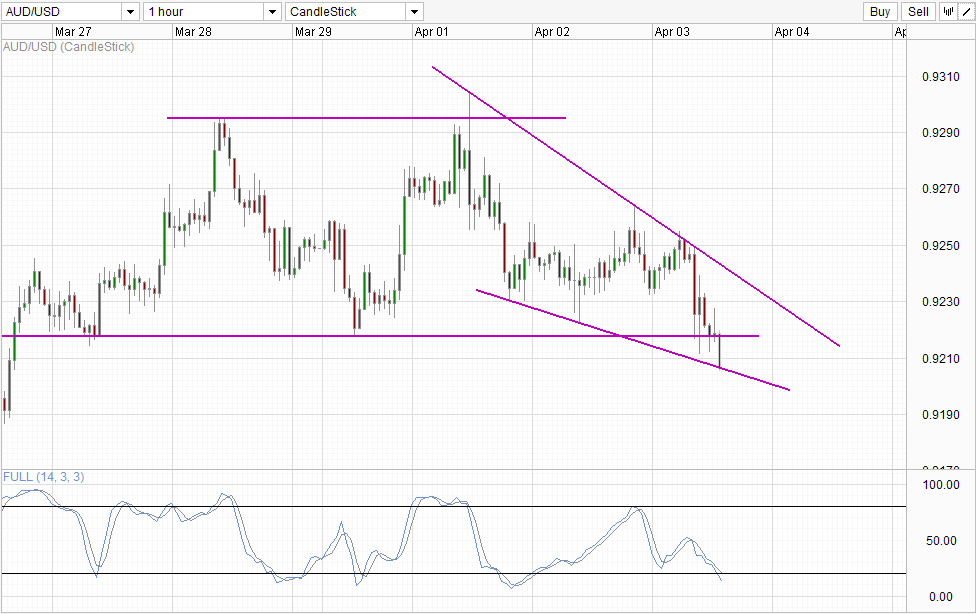

Hourly Chart

It is also perhaps a little fortunate that the Retail Sales disappointment was announced just when price was testing the descending upper wedge and confluence with 0.9255 resistance level. However, as price managed to clear 0.922 support with relatively ease, it is clear that bearish momentum is strong. As such, even though Stochastic readings are currently within the Oversold region, it is still possible for prices to continue straddling lower wedge to push further downwards instead of rebounding from here. Nonetheless, the possibility of a temporary short-term bullish pullback remains in the cards, but a significant push towards upper wedge is unlikely if 0.922 support turned resistance hold.

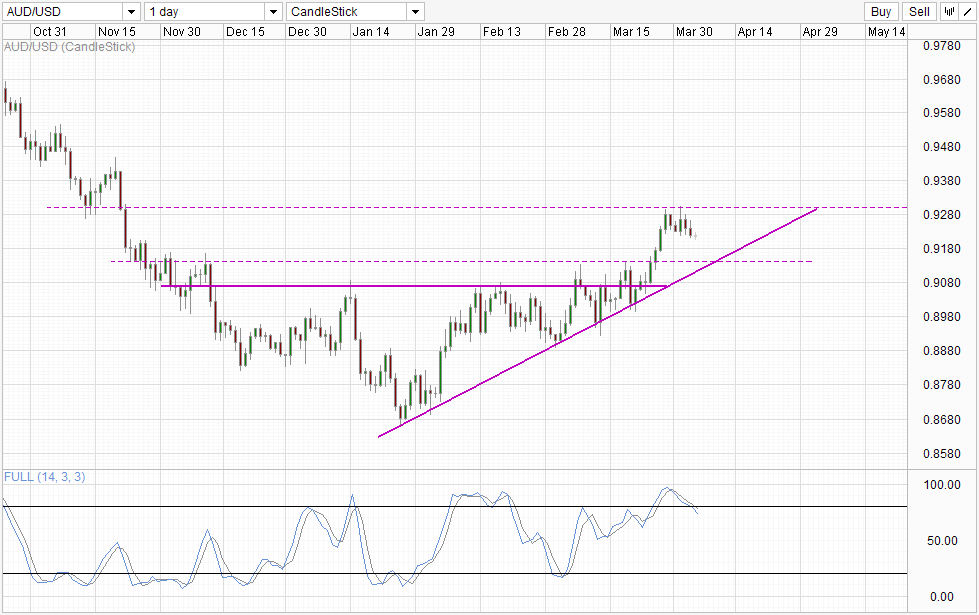

Daily Chart

Daily Chart is bearish with 0.914 as the immediate bearish target. Based on current bearish pace, it is likely that we may hit the intersection point between 0.914 and the rising trendline. Hence, if 0.914 is broken, the bullish momentum will be heavily impaired and we may potentially see acceleration towards 0.888 support.

Fundamentally, the case for an improving Australian economy has just been impaired by today’s Retail Sales miss. There is also talks about increasing sales tax in Australia in order to gather more tax revenue in order for the Government to balance the books which will be a negative impact in the short-run. If next week’s Employment data and Consumer Confidence data disappoint, the recovery narrative will need to be discarded and the fundamental outlook for AUD will be bearish. Couple this possibility with USD that is expected to strengthen further, the outlook for AUD/USD will be heavily bearish.

More Links:

WTI Crude – Bulls Seen Around 99.5 Keeping Price Afloat

S&P 500 – Early Signs Of Break But 1,890 Still Holding For Now

USD/CAD – Steady After Strong ADP Job Numbers

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.