Gold prices pushed back higher slightly today after rebounding off the 1,280 round figure level, once again going against risk trends which are clearly bullish. Nonetheless, we shouldn’t be surprised as Gold has been moving on its own bearish accord in the past 2 weeks, and latest upward movement should be regarded as a mere correction rather than an indication that sentiment is bullish (with implication that prices can push up even more aggressively if risk trends reverse).

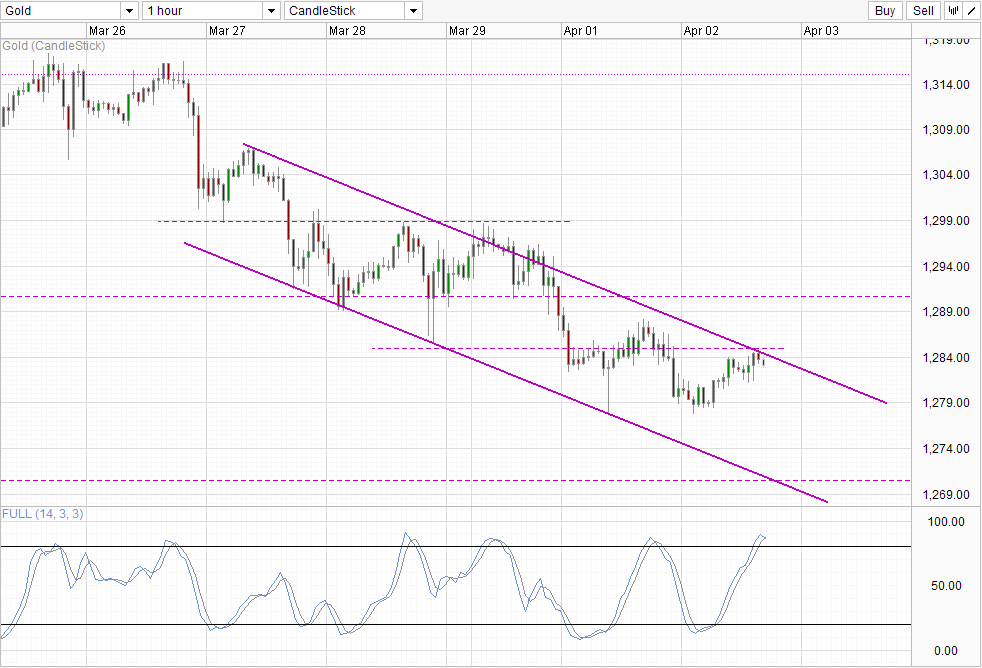

Technicals agree as well with prices failing to overcome 1,285 soft resistance and the newly drawn descending Channel Top. Stochastic indicator echoes the same with stoch curve likely to reverse lower and produce a bearish cycle signal after crossing the Signal line. All these favor a bearish movement in the immediate near term, and we could see prices move towards 1,270, or Channel Bottom as bearish targets.

On the fundamental side of things, Fed’s Yellen appears to be back pedaling on the hawkish speak during the recent FOMC policy announcement, where her “around 6 month” timeline shocked market who interpreted her words to mean an earlier than expected rate hike. However, in a more recent speech, Yellen reiterated that the Fed will continue to maintain loose monetary policy in order to support growth in US, which resulted in some analysts and market watchers speculating that the Fed may even slowdown the pace of QE tapering since recent economic data from US have been less than what we previous expect. The rot is not restricted to US region only, with global economic gauges falling below expectations as well.

But amidst all these, Gold prices remained firmly bearish, suggesting that sentiment of Gold is strongly bearish. Furthermore, latest Commitment of Traders report reflected the first decline in net long positions by speculators. Hence, there is a risk that financial institutions are starting to liquidate their previously held long positions, or at the very least no longer buying Gold – and that is yet another bearish pressure which will send Gold further lower if such trend continues.

More Links:

NZD/USD Technicals – Sharp Decline But Bull Trend Intact

WTI Crude – Staying Above 100.0 After Yesterday’s Sell-Off

S&P 500 – Weak Fundamentals? Market Does Not Care As Record High Reached

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.