Indian Rupee stayed stable today, with muted reaction following the latest Reserve Bank of India policy announcement. To be fair the central bank did not surprise the market, opting to hold interest rates at 8% as expected. What is more surprising was the accompanying statement in which Governor Rajan said that the Central Bank will not be tighten monetary policy further if inflation remains on path to the bank’s target.

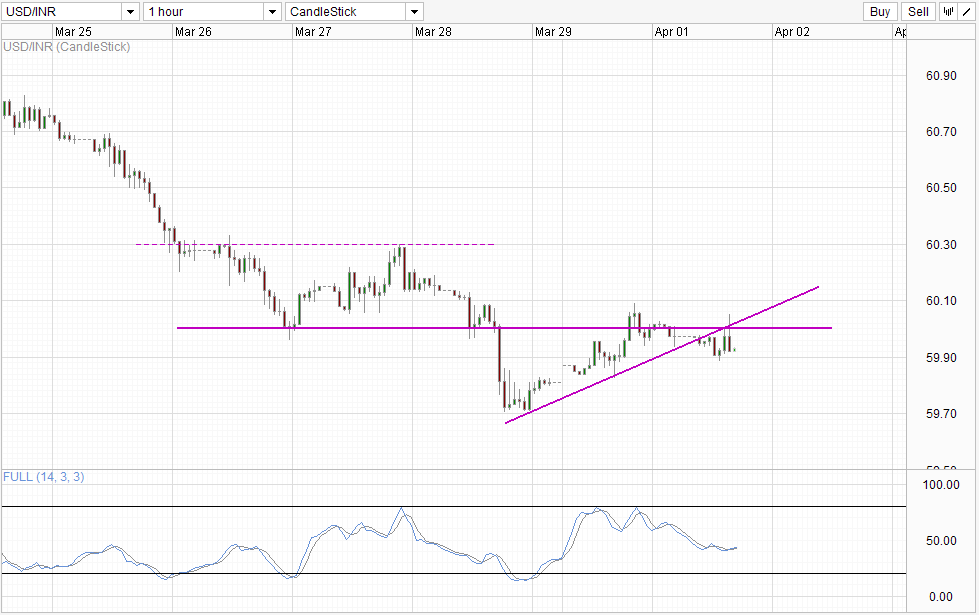

Hourly Chart

This is actually a relatively dovish stance and we should have seen some sort of weakness in INR but that did not happen. Prices did rebound from a day low of 59.90 and pushed all the way up to 60.05 in the couple of hours that followed, but USD/INR quickly fell back once again.

From a technical perspective, this suggest that bearish momentum in USD/INR remains strong as we are trading below the rising trendline and confluence with 60.00 round figure. Also, the latest rally failed to even create a new weekly high even though the fundamental case for USD/INR to rally was stronger compared to yesterday. These suggest that prices may be able to retest current day low and the likelihood of a move towards last Friday’s low and further bearish extension is possible if bearish sentiment continues to reign for the rest of this week.

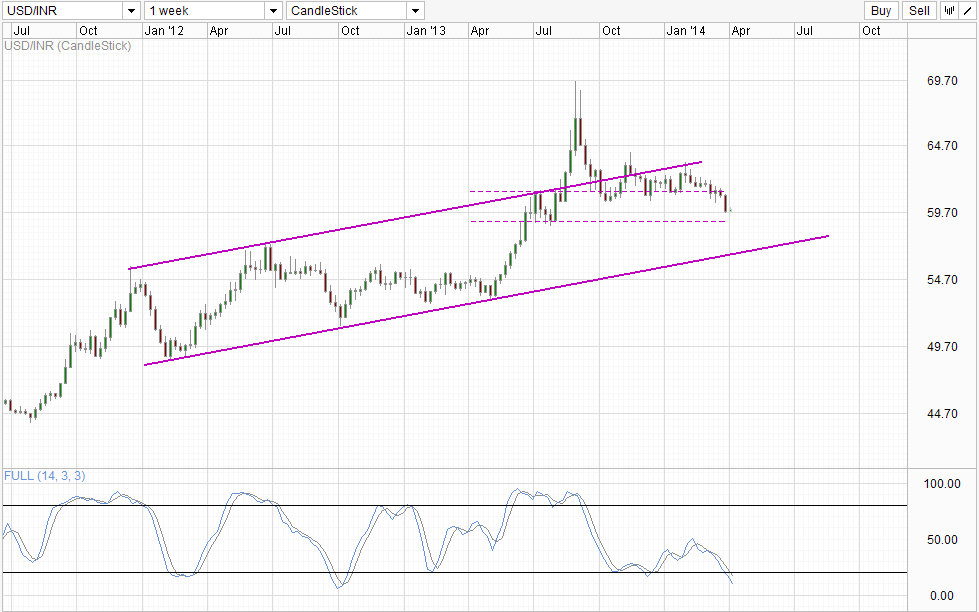

Weekly Chart

Weekly Chart is less optimistic about bearish prospect though, as prices is likely to find support from the 59.0 round figure which was the support floor of the consolidation zone seen in July 2013. Stochastic readings agree as the indicator is at the most Oversold levels in a year, favoring bullish movements from here out. This may not necessarily invalidate the bearish momentum but at the very least we could see some form of bullish pullback towards the aforementioned consolidation ceiling before a move towards rising Channel Bottom can commence.

Fundamentally, nothing much has changed. India’s inflation remains high while economy continues to remain in the pits. The only difference right now is that market is more optimistic towards emerging markets, resulting in a broad strengthening of emerging market stocks and currency. On the other hand, the USD strengthening narrative has gotten stronger due to Fed Chairman Janet Yellen’s hint of earlier than expected rate hikes. Given this, we should be expecting higher USD/INR instead of lower, and current bearish momentum may be hard to sustain in the long run.

More Links:

Gold Technicals – Staying On The Bearish Road Towards 1,270

AUD/USD – Rejected By 0.93 Resistance

GBP/USD – Pound Remains Firm After Dovish Yellen Comments

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.