EUR/USD broke 1.38 round figure yesterday, but prices failed to push all the way to 1.376 with bears getting stuck at 1.378. This is not entirely surprising as there wasn’t any strong catalyst for EUR/USD to head lower yesterday, with the decline likely just a bearish response following yet another unprovoked sharp rally on Tuesday’s US session.

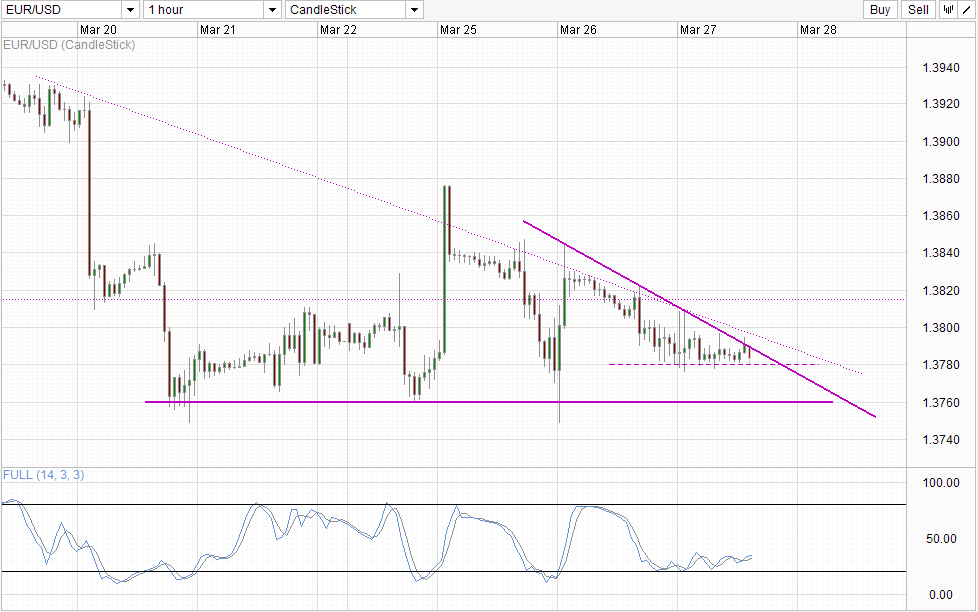

Hourly Chart

Nonetheless, with overall S/T momentum still looking bearish, it is likely that we could see a break of 1.378 soon. However, a break of 1.376 (or 1.375) support is much harder as there isn’t any potential catalyst today. Hence, EUR/USD bears will simply be running on sentiment alone, which has limited follow-through. Stochastic indicator agrees with current bearish cycle close to the end of the cycle. Also, it should be noted that the 2 instances of unexplained rallies occurred during US afternoons, and looking at current pace of decline, it is likely that a test of 1.376/1.375 will occur during then, increasing the risk of yet another unexplained rally which can disrupt bearish efforts.

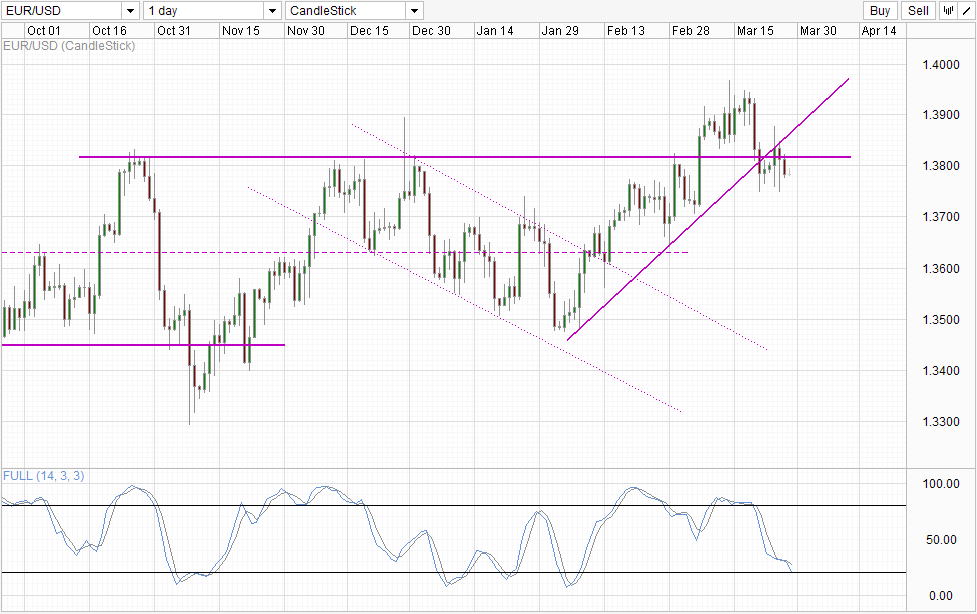

Daily Chart

Price action on Daily Chart suggest that the breakout of 1.3815 has been invalidated, giving initiative to bearish movements. However, as we are also close to the end of current bearish cycle, further confirmation of strong bearish conviction is needed to successfully invalidate the uptrend that has been in play since early Feb. Without which, current bearish response could simply be regarded as corrective in nature, and a push back towards 1.3815 cannot be ignored.

More Links:

GBP/USD – Pound Moves Higher After Mixed US Manufacturing Data

USD/CAD – Little Movement As US Manufacturing Numbers Mixed

USD/JPY – Rangebound Trading Continues

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.