Natural Gas prices continue to push lower as spring blooms. The lack of strong economic sanctions by Euro zone on Russia over the Crimea secession also means that Nat Gas supplies from Ukraine and Russia continue to flow freely, and there is no panic in the market to buy and stock inventories in case there is a supply crunch. The combination of both factors allowed Nat Gas to hit a recent low of 4.47, ignoring the bullish inventory numbers reflected by EIA weekly report which came in at -59B vs expected -48B cubic feet. This is a clear sign that market is extremely bearish and further selling activities should be expected moving forward.

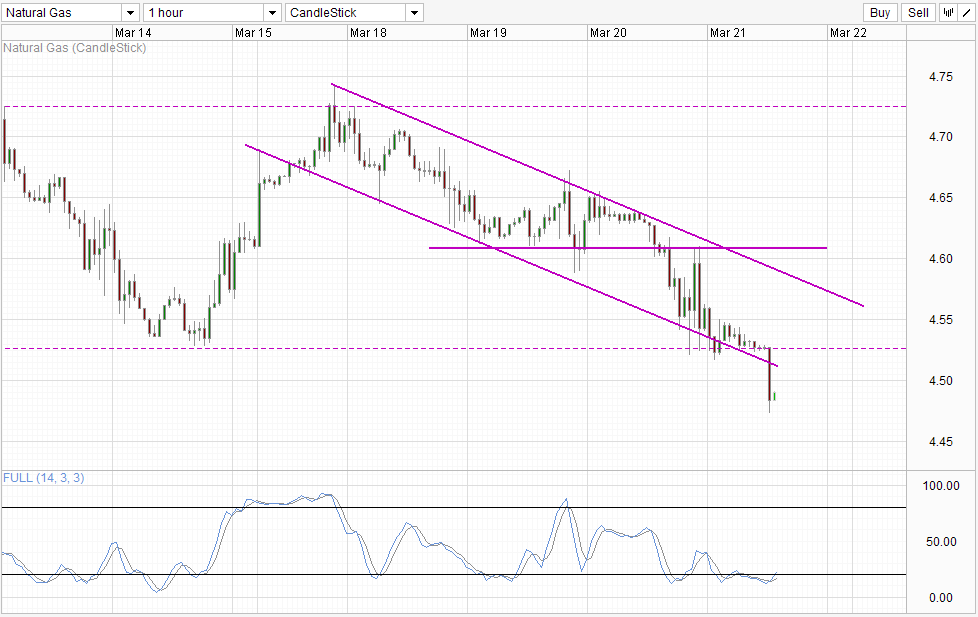

Hourly Chart

From a technical perspective, the break of 4.525 support and Channel Bottom suggest that bearish momentum may be accelerating. This also allow us to ignore the bullish cycle signal seen on Stochastic indicator as such indicator tend to be unreliable during strong trends such as now.

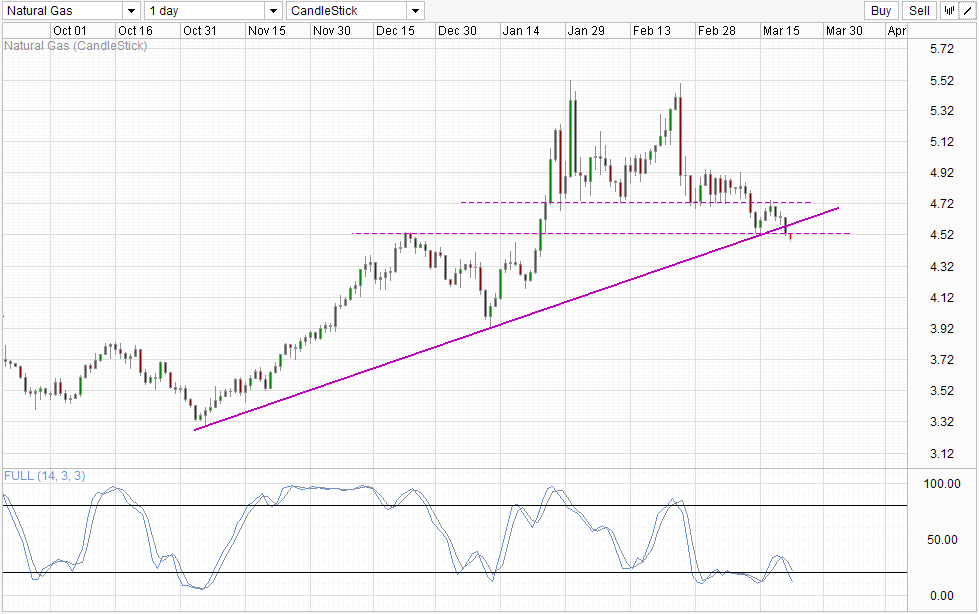

Daily Chart

The same could be said about Stochastic indicator on the Daily Chart, which is within the Oversold region, but just like the hourly chart, bearish momentum is strong and bullish momentum is heavily impaired with the rising trendline broken. Furthermore, the Double Top pattern is currently in play, suggesting that the ultimate bearish objective may be as low as 3.32. Hence, just because Stochastic readings are Oversold does not mean that bearish momentum is over, and even though a bullish pullback is favored moving forward, we could still see prices at least moving further lower within the mid Dec – mid Jan consolidation range before a pullback is seen.

More Links:

USD/JPY – Dollar Spanks Yen After Yellen Rate Comments

EUR/USD – Euro Slide Continues After Yellen Remarks

AUD/USD – US Dollar Surges After Fed Remarks

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.