Crude Oil remained mostly stable this today even though the Crimean referendum pushed the region 1 step closer to unification with Russia. This calmness and stability is not limited to Oil, with Precious Metals, Equities and Fixed Income products staying mostly flat as market already expected the Russian majority to vote for secession. The outcome was skewed in the favor of pro Russian supporters when oppositions choose not to vote, claiming that the referendum was unconstitutional. Nonetheless, with voting rate of about 80%, it is unlikely that the minority votes would have changed the outcome given current 93% voting in favor.

The question that remains in doubt is whether US and Euro Zone will carry out the economic sanction against Russia as planned. There were reports on Friday saying that sanctions could come in as early as today, but till now we’ve yet to hear anything coming out from either US nor Euro Zone pertaining to the course of action that they would be taking in light of the referendum result. Whatever the case may be, it is clear that we are still a few steps away from military conflict, and there is very little reason for Crude Oil traders to worry right now. Even in the event that energy supply is cut due to extreme economic sanctions/war, it is debatable whether WTI will benefit from it due to export restrictions while other benchmark such as Brent Crude is bound to enjoy a bigger benefit.

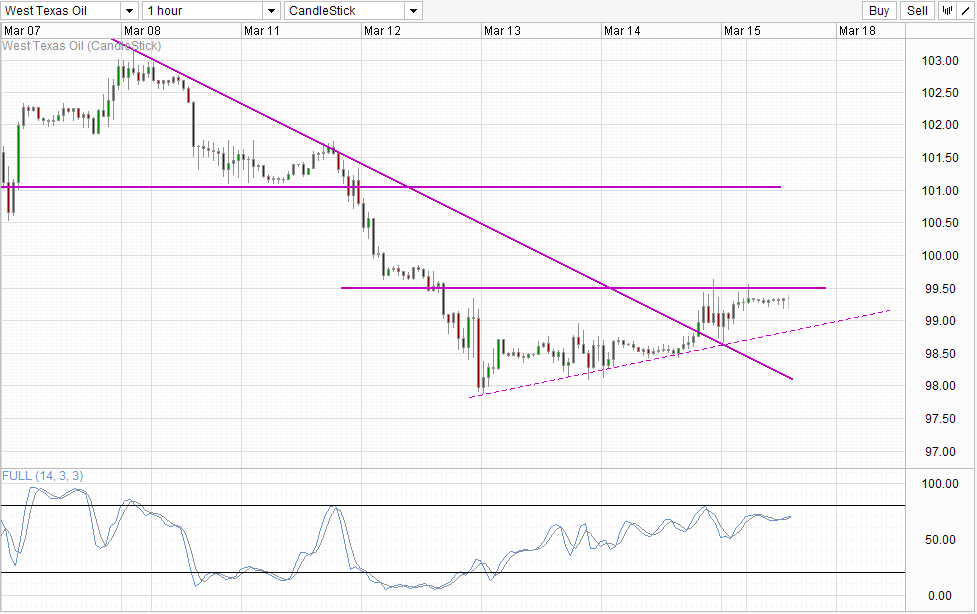

Hourly Chart

From a technical perspective, the overall bearish pressure remains intact as long as we stay below 99.50. However, it should be noted that prices are actually above 99.0 round figure – the levels before a surprising bearish DOE inventory report sent prices packing down to 98.0, suggesting that prices is still relatively bullish and sharp sell-off in Oil is less likely. That being said, if prices break 99.0 and the dotted rising trendline, we could see acceleration towards 98.0 and potentially below for a bearish extension scenario.

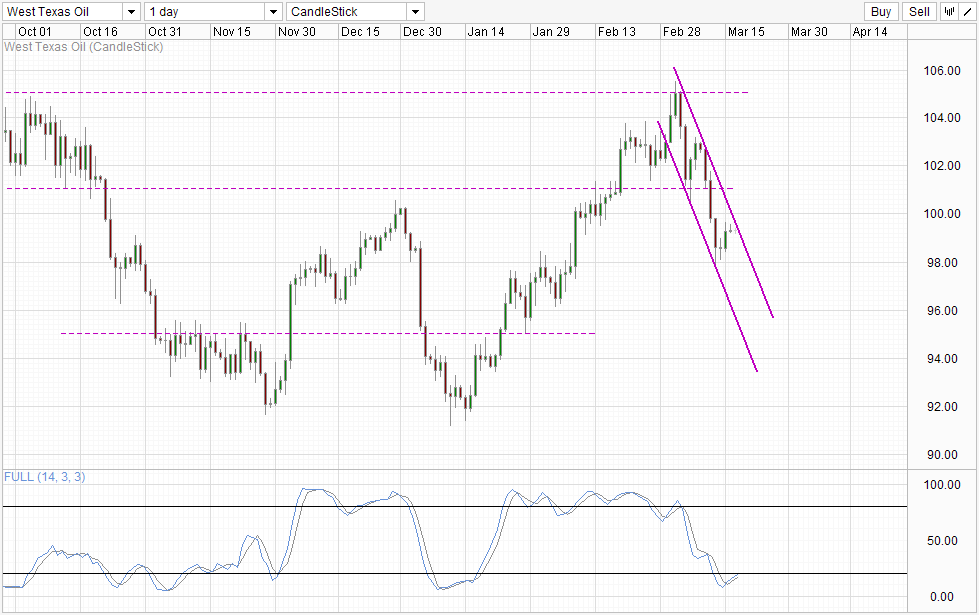

Daily Chart

Daily Chart agrees with the bearish extension scenario as prices appears to be finding resistance from descending Channel Top, which opens up a move towards Channel Bottom which is well below 98.0 and in fact lower than 96.0 right now. Stochastic readings favors bullish scenarios moving forward but if a bullish signal is averted, we could easily see prices pushing lower as that can be a confirmation that bulls are unable to sustain any significant fightback.

More Links:

Gold Technicals – Paring Early Gains As Market Calm After Crimean Vote

EUR/USD Technicals – Stable above 1.39

Week in FX Americas – Jobless Claims Momentarily Breaks USD Downward Trend

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.