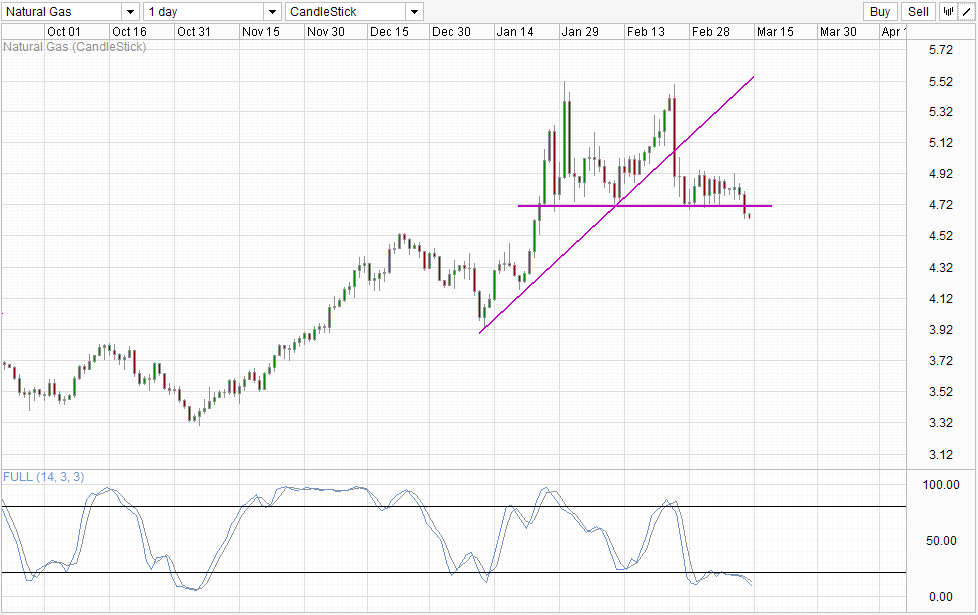

The narrative about how the clearing of US cold weather which should send prices lower is getting really old. This is a reasonable charge as historically Natural Gas prices tend to rally around October and peak in January before coming back down once again. To be fair we did see prices rallying in early November to a peak in December where prices subsequently slide lower in early Jan, but unfortunately bad weather conditions sent prices back up even higher, pushing Nat Gas above 4.72 since.

All these while when prices were above 4.72, there were reports every other day that asserted that the worst of the cold weather is over, which turned out to be patently false as the cold continue to rage on. Hence reasonable doubt should be cast on current claims that weather is indeed improving and demand for Nat Gas for heating will be lower moving forward. Nonetheless, this is the first time prices have broken 4.72 since the cold storm has started, and with Spring coming into full bloom (and summer drawing nearer as well), the claim that the cold weather abating may have a larger dosage of truth compared to before.

Perhaps most importantly is whether market is believing that a long-term bear trend is emerging after all these false start between Jan and Feb. Considering that the interest charge for shorting Nat Gas right now is highly expensive due to the Backwardation nature (OANDA charges more than 39% annualized interest on short positions right now), it is reasonable to believe that traders are more cautious now. From a technical perspective, Stochastic indicator shows that bearish momentum is heavily oversold and this increases the need for further confirmation that what we see here isn’t a “fakeout”.

That being said, the bearish implications should the breakout is confirmed is huge as we have a Double Top pattern which will open up 3.32 as ultimate bearish target. Hence, traders can do afford to wait for confirmation as the opportunity loss for waiting is going to be a drop in the bucket compared to potential gains.

In this regard, traders should keep a keen lookout on the the reaction post Nat Gas Storage report later today. The numbers provided by EIA is expected to reflect a -199B fall in inventories, and should prices fall even though the number turned out to be more bullish than expected or merely meet expectations (e.g. come in at -199B or more negative), it will be a good confirmation for the bearish market sentiment. Similarly, should price rally due to strong bullish print but ultimately fail to claw above 4.72 resistance, the breakout will remain intact and we may see bears start to sell more aggressively moving forward. The only bullish indication would be a break of 4.72 resistance and/or bullish push despite EIA numbers barely meeting expectations. This would imply that market is not convince on the bearish narrative and traders waiting to sell may wish to wait for more indication in the future.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.