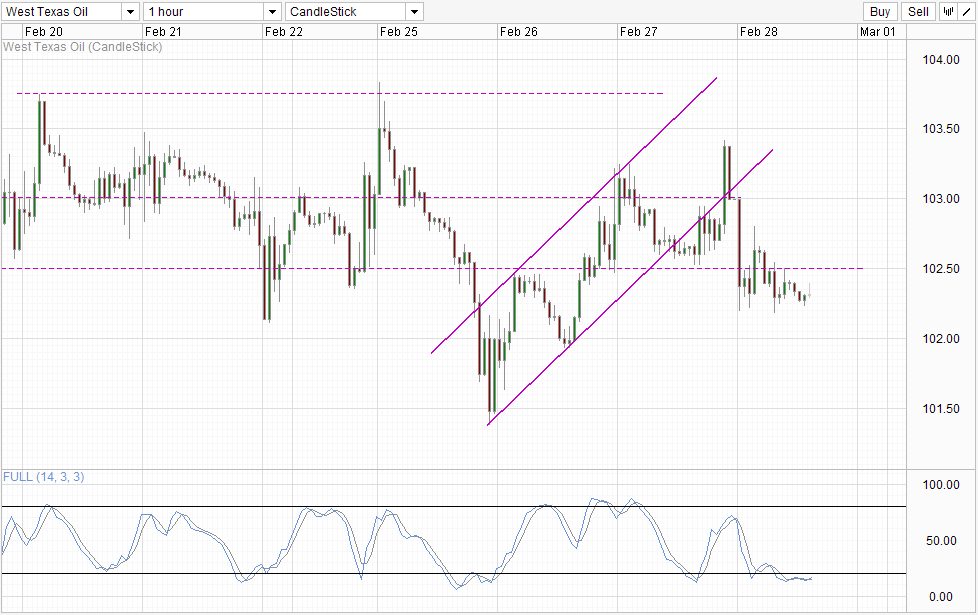

Has the wheels of the bull cart come off? If yesterday’s price action is anything to go by the answer is a resounding yes. WTI Prices has recovered from Tuesday’s low, but the inability to stay above 103.0 already gave us a hint of the bearish sentiment that is to come. This bearish sentiment was further affirmed during early European session yesterday when prices actually tested Channel Bottom after breaking out of it during Asian session. Prices failed to climb back into the Channel predictably and we started moving back lower once more .

However, prices suddenly jumped up once more during US session, led by a sudden spike in risk appetite which may be the spillover effect from an unwarranted rally in US stocks. As there wasn’t any strong fundamental reasons for risk trends to be so bullish, it is not surprising to see WTI prices started falling as quickly as the rally happened especially since sentiment was a little bit bearish to begin with.

Hourly Chart

With prices currently trading below 102.5 support, it is clear bears are in charge. The failure for the bullish rebound which sent prices up above 102.5 during the final hours of US session is yet another confirmation for current bearish bias. However, as today is the final day of trading for Feb and also for the week, we may not be able to see any strong directional push as traders would be winding down their trading activities. Stochastic indicator agrees with Stoch levels currently within the Oversold region, favoring bullish pullback scenarios. As such, conservative traders may wish to wait until Monday and see if the bearish sentiment remains before committing to any short positions.

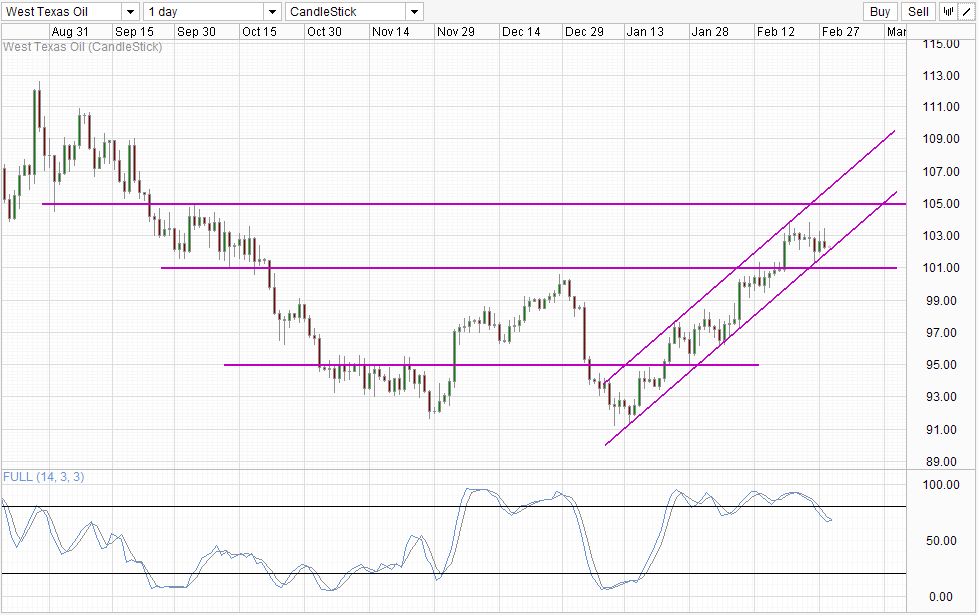

Daily Chart

The need for patience becomes even greater when we look at Daily Chart where price is sitting on Channel Bottom right now. Stochastic curve has also reversed and is currently pointing higher. As such, a move towards Channel Top cannot be ruled out even though short-term sentiment is bearish. A more conservative approach would be to wait for prices to break below Channel Bottom and preferably below 101.0 support which will invalidate current bullish recovery momentum and usher in a strong bear wave towards low 90s.

More Links:

GBP/USD – Dealing with Resistance at 1.67

AUD/USD – Trying to Claw Back to Key 0.90 Level

EUR/USD – Regains Lost Ground back above Key Level of 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.