Turkish Lira has seen better days, but to be fair the European currency has seen much worse days as well. Lira have recovered against most if not all major currencies ever since the Turkish Central Bank tried to stop the slide in Lira by hiking interest rates significantly, and traders are once again wondering if the high carry interest rates is worth the risks right now.

Since this is a carry interest question, it makes the most sense to pair Lira with the currency with the lowest interest yield – Yen. Also, compared to USD and EUR, Yen appears to be the weakest as BOJ is interested to keep Yen weakened for an extended period of time. Hence, TRY/JPY will be able to have both central banks keeping it afloat. On the other hand, Fed remains on track for further tapering action which will drive USD, while various members of ECB has explicitly said that they want EUR to be lower, most if not all of them are reticent about their intention to cut policy rates further, resulting in market suspecting that they will not actually do it, or at least not in the near future. Hence, USD/TRY and EUR/TRY traders may find Lira having a higher chance of weakening against these 2 currencies.

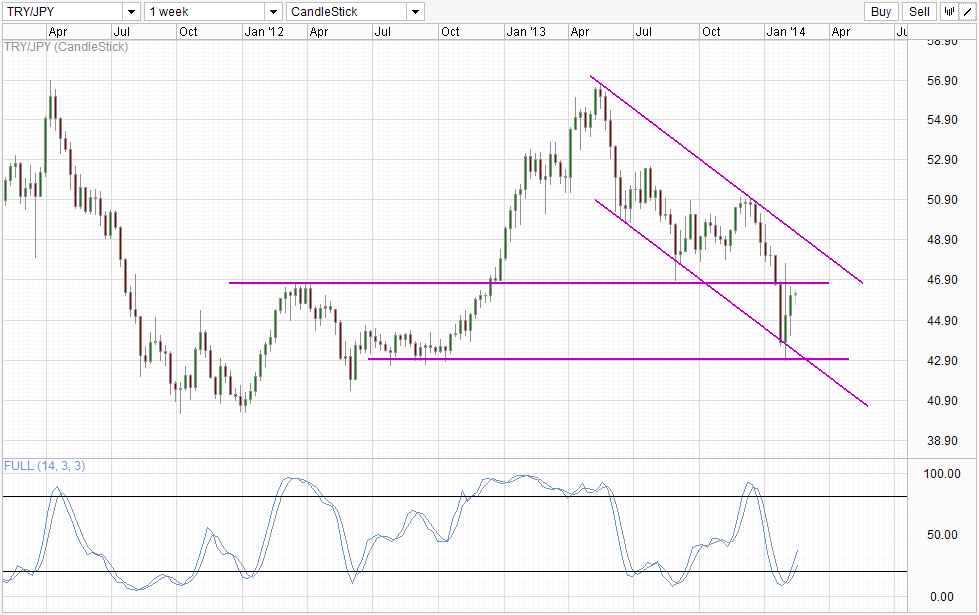

Weekly Chart

However, even though TRY/JPY is the best candidate for carry trade, doesn’t mean that it is a good time to do so. Looking at price action, we can see that despite the rally of past 2 weeks, the downtrend remains intact. Certainly price has rebounded off 43.0 support and Channel Bottom, but we are still below the 46.8 significant ceiling that was in play back in Mar-April 2012 which happens to be the swing low seen on the final week of August 2013. Stochastic readings are certainly bullish which improves the possibility of price breaking 46.8, but even if that is successful bulls will have Channel Top staring at their faces, giving them very little room for further upside.

It should also be noted that TRY/JPY has been trading extremely bearishly in 2013, a year when Yen weakness was for all to see. As such, one wonders if the aforementioned BOJ led Yen weakness is of any significant advantage in this case as Lira’s weakness appears to be trumping everybody else.

Then again, when we execute a carry trade, we are not truly aiming for capital gains (e.g. TRY/JPY trading higher) but simply seeking the interest yields. When the interest yields are high enough, we can even accept certain amount of capital losses (e.g. TRY/JPY falling) as the interest earned will be able to buffer against some loss. In this regard, even though TRY/JPY may not look the most bullish, but as long as prices stay within an acceptable range, it may be still worth it to keep a losing position that is yielding carry interest.

Looking at price action, should Lira weakness continue to reign, it will not be surprising to see prices coming back down to 43.0 and perhaps as low as 40.25. Any lower than that will represent a bearish extension and we could see extreme bearish sell-off below that levels. Hence, conventional carry traders will likely close out below that price. Assuming that 40.25 is our lower limit and we open our position today, that would equate to a loss of 11.85% (current TRY/JPY price of 45.66). If your open your position with OANDA, you will be able to enjoy carry interest of around 7.93% based on interest rates today (note: different brokerages offer different carry interest). Hence in theory, as long as TRY/JPY does not fall below 40.25 within the next 1.5 years, the carry trader will remain in the black. Is it safe to make a 1.5 year bet right now? This is an answer that individual traders need to answer based on their risk appetite.

Alternatively, traders can wait a while more for prices to move lower before entering hence a lower potential loss but higher chance that the S/L will be triggered. Yet another way is to wait for TRY/JPY to recover much more and give additional surety that prices won’t collapse further. But that would also mean that your entry price will be higher, and the potential loss will also be higher. Basically, you cannot have your cake and eat it – taking risks is a must – but since this is a multi year position (as all carry trade should be), traders will do well to make sure that they’ll be comfortable with the potential loss before committing as anything can occur in the long run.

More Links:

Gold Technicals – Bulls Roaming Free After Bears Banished

AUD/USD – Threatening the Resistance Level at 0.90

EUR/USD – Making a Push Through Resistance at 1.3650

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.