Kiwi Dollar enjoyed a surprising rally around 8am SGT (7pm EST) this morning, pushing from a low of 0.8267 to a high of 0.8309 within a couple of hours. This 40 pip move may not seem a lot, but when put together against Monday’s low volatility, and a falling 24 hours ATR since 5th Feb, this 40 pip jump is an extra ordinary bullish push. Interestingly, the reason for the rally is not related to New Zealand at all, but rather its neighbour Australia who released a stronger than expected growth in prices of homes. Latest surveys conducted by NAB also reflected a more positive sentiment on both current and future outlook of Australia’s economy, while level of investments have increased with growth in Investment Lending gaining pace. Perhaps market interprets these better than expected numbers as a sign that New Zealand’s economy will similarly be better than expected – hence increasing the incentive for central bank RBNZ to hike rates as soon as possible.

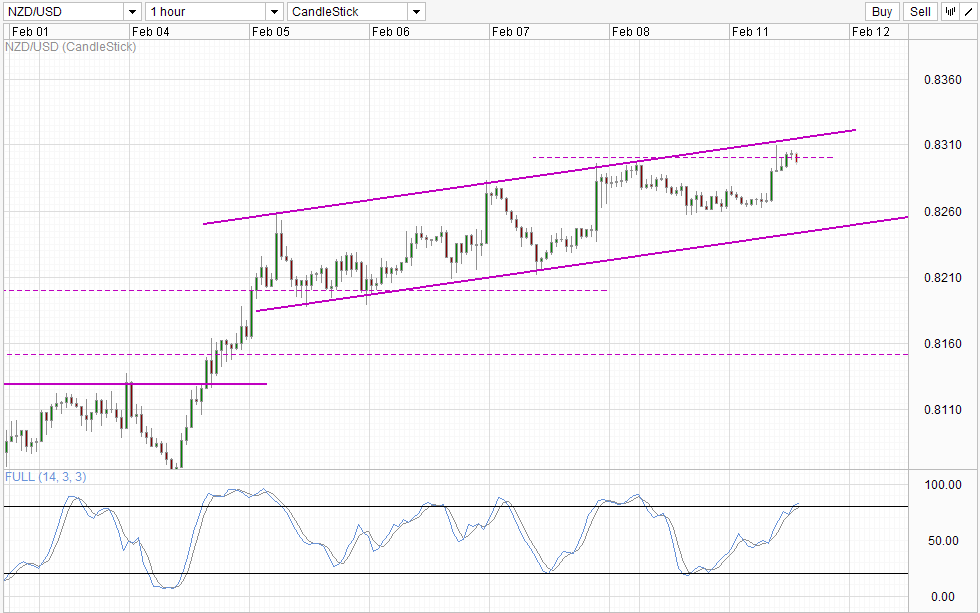

Hourly Chart

However, price is unable to maintain the bullishness, and this cannot be regarded as unexpected as there are strong bearish technical pressure – 0.83 round figure resistance coupled with Rising Channel Top, while Stochastic readings are also entering into the Oversold region as well, favoring a move towards Channel Bottom moving forward.

On the fundamental side, the bullish effect of Australia’s improving economy by proxy should not be more important than New Zealand’s own economic numbers released yesterday. Latest House Prices Index compiled by private firm QV showed a growth of 9.6% which is no doubt high, but a tad softer than previous month’s 10.0%. Hence, it will be unreasonable for traders to put more emphasis on the Australian numbers and ignore New Zealand’s numbers, which limits the growth potential of the rally that resulted from it.

All things said and done, immediate preference for price is to move towards Channel Bottom which is in line with Bearish Technical pressure and Fundamentals that do not agree with continued bullish endeavours. Should price falls below the swing high on Friday coupled with Stoch readings moving below 80.0, the S/T bearish pullback/correction will be confirmed and we could even see a faster pace of selling towards Channel Bottom with 0.826 providing interim support.

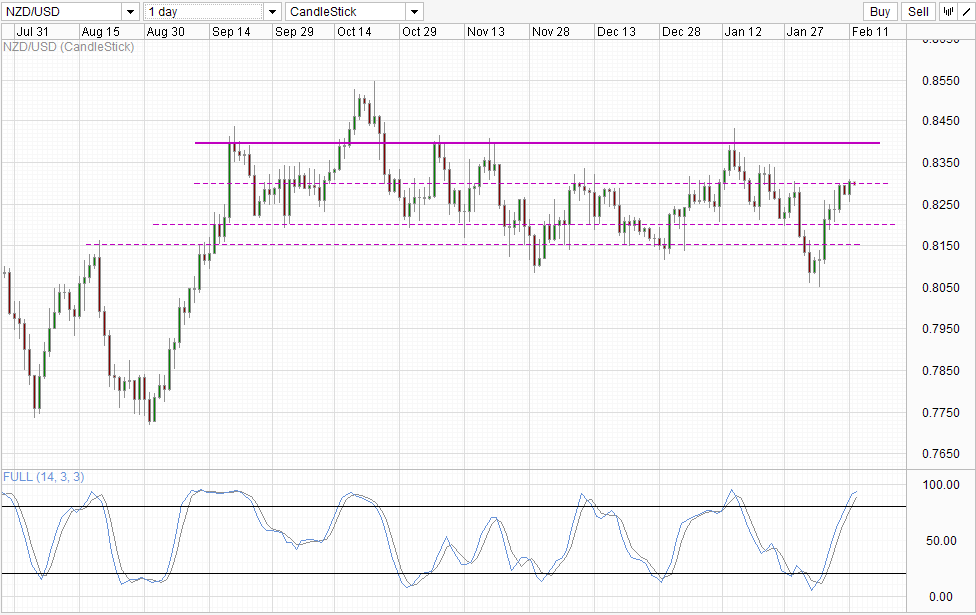

Daily Chart

Long-Term momentum remains on the upside though with consolidation Channel Top 0.84 remain as plausible bullish target after the recent “fakeout” below 0.815. However, momentum is currently Overbought, and as such it may be difficult for price to continue higher without any fundamental help/push. And given that price action can be regarded as slightly bearish if we take the point of view from October 2013, the scenario where price fail to test 0.84 and instead move lower from here and break 0.805 cannot be ruled out.

More Links:

GBP/USD – Moves to One Week High Shy of 1.6450

AUD/USD – Threatening the Resistance Level at 0.90

EUR/USD – Making a Push Through Resistance at 1.3650

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.