Is Gold still sensitive to risk trends? It’s yes and no. Price gained D/D, in line with US stocks closing slightly lower, suggesting that prices are indeed following risk trend. However, it should be noted that risk appetite during US session wasn’t really that bearish, and stocks actually closed higher open/close basis. Furthermore, stock prices (or at least S&P 500) did manage to break a soft resistance and stayed above it despite weaker than expected ADP employment numbers, highlighting the strong bullish sentiment during yesterday’s US session. Hence, it is clear that gold is not exactly having the highest sensitivity to risk appetite right now.

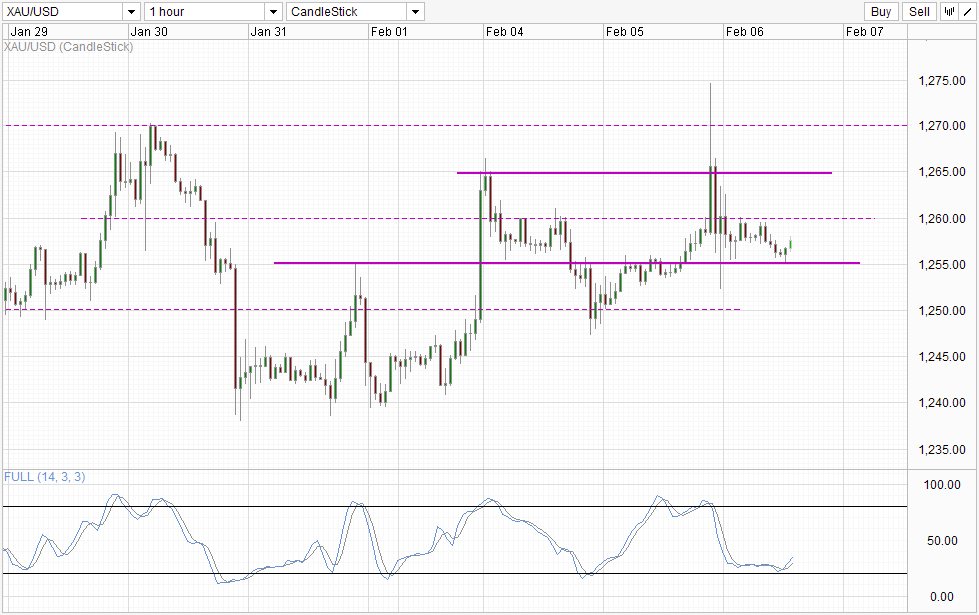

Does this mean underlying sentiment of Gold is bullish? There are some fundamental justification with demand for physical gold increasing, but somehow this increase in physical demand has failed to translate into a pick up in spot Gold prices. Also, if market is indeed bullish about gold, we should have seen much more bullish traction after the ADP employment release. Instead, prices fell quickly and went back to a low of 1,252 before rebounding up again, staying below 1,260. Therefore, it seems that price may be more influenced by all the support/resistance levels seen on the hourly chart below.

Hourly Chart

If the above assertion is true, then the likelihood of 1,255 holding and a move towards 1,260 increases. Stochastic curve has also started to point up higher and is giving us a bullish cycle signal. If the signal proved to be right, a move towards 1,265 may even be possible especially if risk appetite in Europe and US deteriorate (note: Gold is not as sensitive to risk appetite right now but that doesn’t mean that prices is immune to the ebb and flow of risk trend, and any extra bit of bullish influence doesn’t hurt).

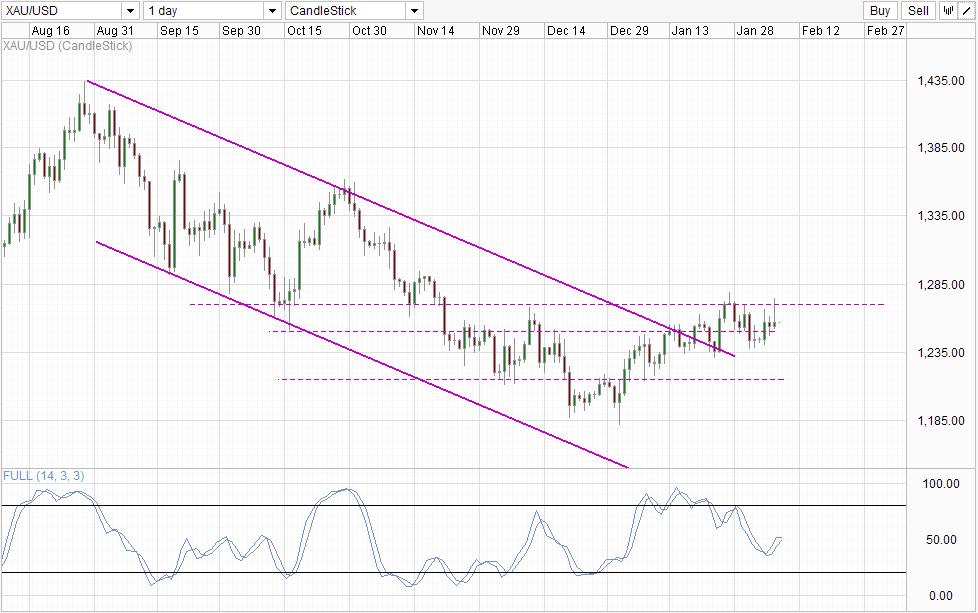

Daily Chart

Daily Chart doesn’t really provide much clarity. Stochastic readings that was pointing higher has since flatten, suggesting that the bearish cycle may return in play soon. There is a bearish rejection off 1,270 resistance but as price remains above 1,250 we can only ascertain that bullish momentum from Jan 2014 has been stalled, which is a distance away from saying that bearish momentum is in play. Therefore, conservative traders will need to wait a while more fore signs of directionality.

More Links:

GBP/USD – Continues to Find Support at 1.6250

AUD/USD – Maintains Breaks Through 0.89

EUR/USD – Runs into Resistance around 1.3550

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.