Kiwi dollar rallied this morning, dragged along by a stronger AUD following a less dovish RBA statement as market believed that this increases the likelihood of a rate hike by RBNZ in the March policy meeting. Prices broke the 0.813 S/T resistance and reached a high of 0.8164, but that wasn’t enough to keep prices above the 0.815 key support turned resistance (see Daily Chart below).

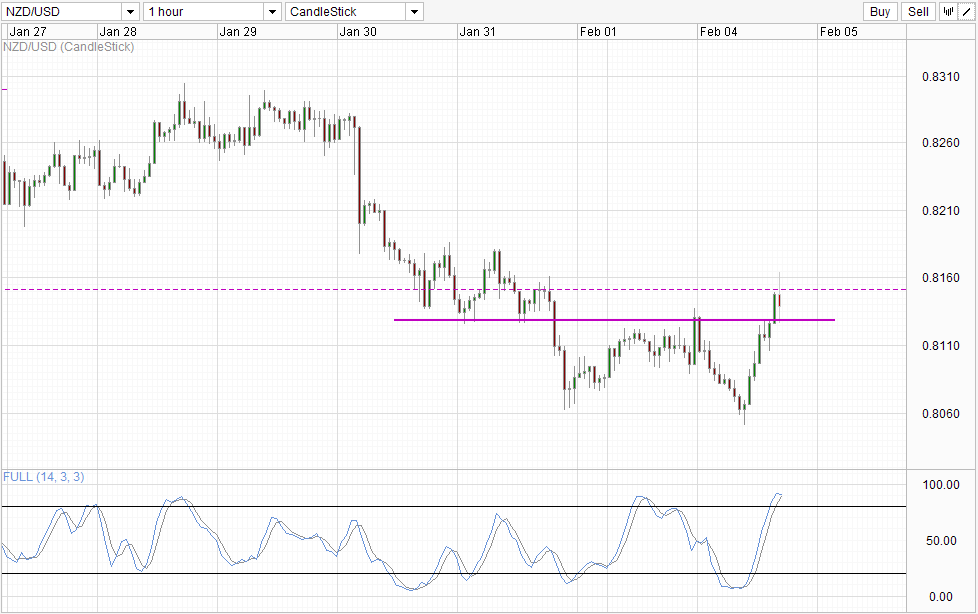

Hourly Chart

With prices trading above the S/T resistance but below the L/T resistance, it is difficult to ascertain which direction we will be heading in the short-term. On balance, bearish scenarios appeals more as Stochastic curve is tapering lower and seems likely to be peaking with a Stoch/Signal cross soon. Also, even if prices manage to break 0.815, we will face resistance around 0.818 and 0.820, which limits the risk/reward ratio and make going long here rather unattractive. On the other hand, should 0.813 is broken, the next significant support will be around 0.806 which gives a much better Risk/Reward ratio. This is also in line with bearish momentum since 29th Jan, hence there is the possibility of bearish extension as well, increasing the Risk/Reward ratio further.

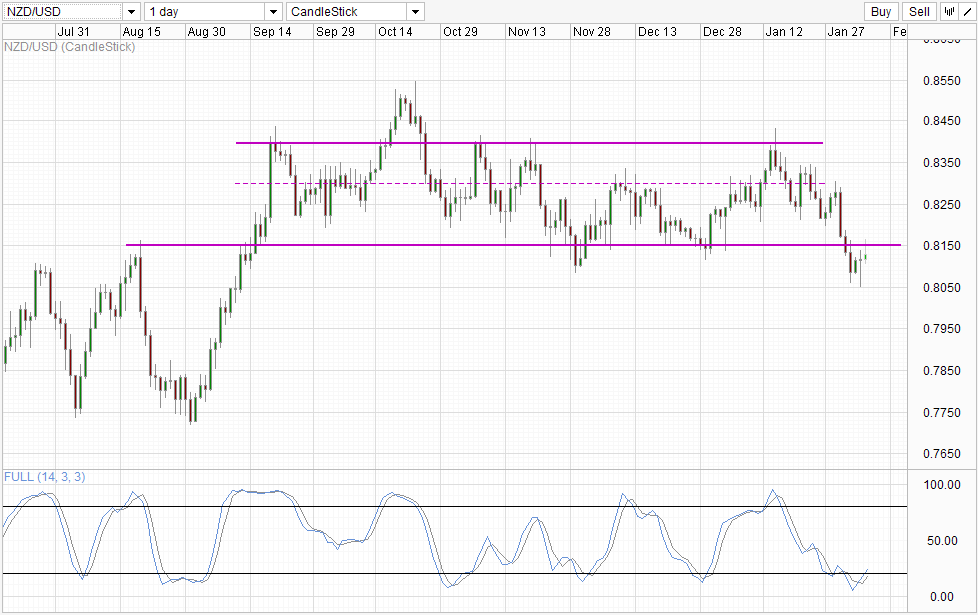

Daily Chart

Long Term Chart is less bullish though, there is a mild bear trend since the peak in October 2013, and the break of 0.815 is merely an extension of the bearish trend. Bearish pressure will undoubtedly increase should the test of 0.815 fails and which will affirm the bearish break and accelerate movement towards the downside. Stochastic readings is currently giving an early bullish cycle signal, but should 0.815 truly held and invalidated the bullish cycle signal, we could see even more bearish acceleration which may bring us to 0.775.

That being said, all these does not really fit into the RBNZ rate hike narrative. As such, it is difficult to imagine NZD/USD continuing to go lower in the long-term. As such, a failed break scenario (where price push above 0.815 and close above) may actually be preferred for a higher probability trade that is coherent with fundamental narrative. Certainly this is not saying that price will hence definitely push up from here, just that declines from here may not be as smooth as stated above, and we could either grind lower due to strong carry support, or bearish traders may even suffer heart attacks time and time again due to strong bullish spikes due to actual rate hike or rate hike speculation/expectation.

Tomorrow’s NZ unemployment data will give us a good indication on what the market is currently thinking. Should price climb despite a weaker than expected unemployment change and stay above 0.815, the likelihood of a false breakout increases. Conversely, should stronger than expected unemployment number fail to keep NZD/USD lifted and price sink below 0.815 once more, this will be yet another confirmation that sentiment is bearish but the incoherence with fundamentals mentioned earlier will remain.

More Links:

AUD/USD – Post RBA Rate Hold Rally May Have Legs To Run

S&P 500 – 1,770 Broken. More To Come?

WTI Crude – No Clear Direction Despite 2 Days Sell Off

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.