Gold suffered the first weekly loss since December 2013. This decline has been mostly attributed to the second round of tapering by the Fed during Wednesday’s (Thursday Asian hours) FOMC announcement, which reduced the monthly bond purchases by another $US10 Billion. On the surface, such attribution is reasonable as a lower QE purchase should in theory result in lower inflation and hence lesser demand for inflation protection products such as Gold. However, this notion gets blown out of the water when we look at actual price action – prices actually rallied slightly post FOMC and only started declining a good 3-4 hours after the fact, with the main sell off happening during early Thursday US session.

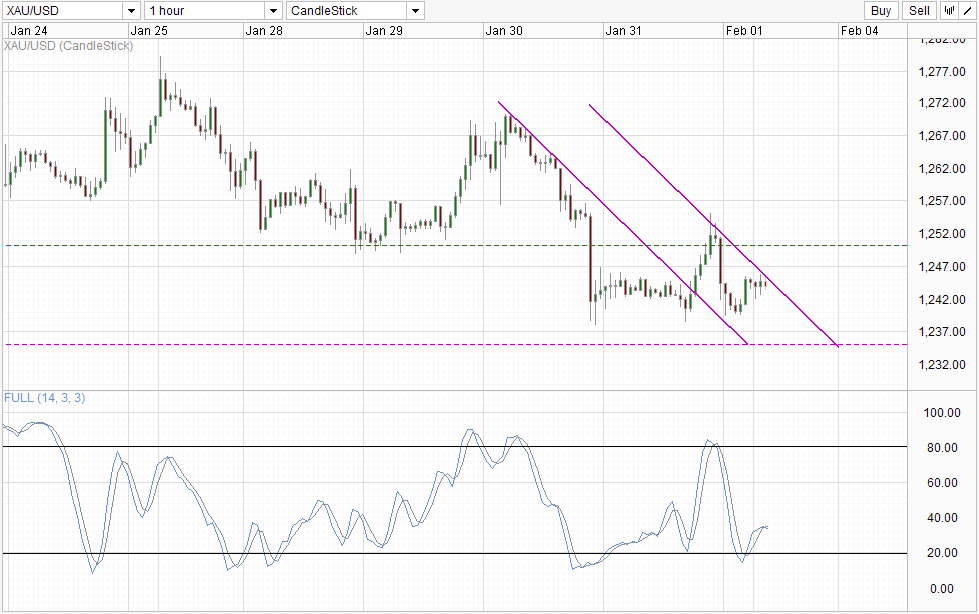

Hourly Chart

The decline in prices on Thursday matched with the timing when stronger than expected US GDP figures were released. Thursday was also a day when US stocks recovered from the bearish slump that started on 22nd Jan, suggesting that it is the positive risk appetite that drove Gold prices lower, and not QE tapering. This explanation is also valid when we look at Friday’s rally, back above 1,250 which coincided with US stocks closing lower (S&O 500 -0.65%, Dow -0.94%).

Certainly technical pressures play a strong part as well. The failure to stay above 1,250 (and forming an Evening Star pattern) pressed prices lower during New York afternoon. But prices managed to rebound up towards the final hours of Friday’s trade without tagging the previous swing low of 1,238.6, suggesting that Gold prices remain broadly supported which is likely due to the continued uncertainty in risk appetite.

Given that stocks in Asian markets are under pressure right now, Gold should be able to enjoy continued bullish support even though prices appears to be currently pressed lower by the descending Channel Top which happens to be the confluence with soft ceiling around 1,245. Immediate bearish target would be around 1,240 soft floor of Friday’s consolidation. 1,235 is also another plausible target but that may be a stretch given the strong “risk off” supporting prices.

On the flip side, should prices stay around current levels for the next few hours and break Channel Top, it is also conceivable that a move towards 1,250 is possible as prices would enjoy bullish technical pressure as well. Hence, traders who want to short Gold right now need to weigh if the potential risk/reward ratio is worth it.

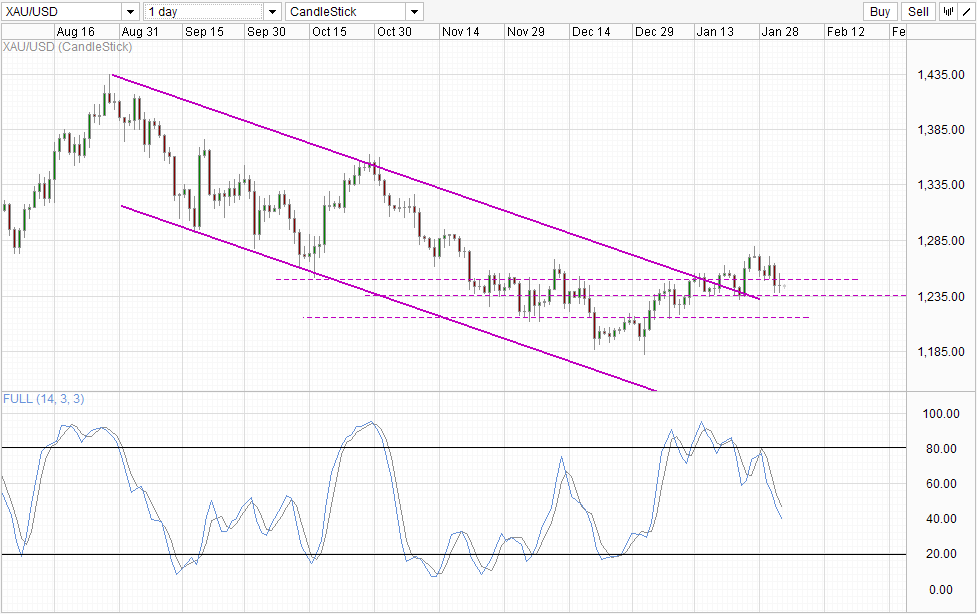

Daily Chart

Daily Chart shows that the recovery in Gold prices that started since the beginning of 2014 remains intact. The bullish momentum may be slower with the break of 1,250, but overall bullish momentum will still remain in play as long as prices stay above 1,235 (or even 1,215 if we are generous). Furthermore, current price is staying above the 38.2% Fib retracement level (not shown on chart) based on trough to peak of 2014 levels, adding yet another technical argument why price will stay lifted in the near term. Stochastic readings are pointing lower, but Stoch curve will be facing “support” level around 31.25, and it will not be surprising to see Stochastic readings rebounding higher as well.

Fundamentally, it should be noted that institutional speculators are still buying up large quantities of Gold. Latest COT numbers reflects a jump of 19,758 contracts in net long positions, the largest increase since late October 2013. Perhaps this demand was a result of hedge funds needing to hedge against declines in stocks, or perhaps this is a genuine speculative move where traders genuinely believe that Gold prices will rally up higher. Either way, it is clear that more people are buying Gold right now and it will certainly be risky to go against this flow right now.

More Links:

GBP/USD – Eases Below Support Level at 1.6450

AUD/USD – Consolidates Below Key Level of 0.88

EUR/USD – Drops Sharply to Two Month Low Below 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.