The Reserve Bank of India surprises with a rate hike in the latest Monetary Policy announcement. The key repo rate has been raised to 8.0%, but CRR ratios has been maintained at 4.0%. The reason for this move is to shore up Rupee and keep inflation in check. RBI has also released their inflation outlook with Q1 2014 expected to stand at 9%, which will fall to around 7.5-8.5% in Q1 2015, and said that there will not be any further tightening if inflation moves as expected.

This is very interesting as it suggest prima facie that RBI may be done with rate hikes between now and 2015. On the other hand, it is interesting to see what RBI is thinking as current repo rate is still more than 1 full percentage point below CPI, and hence it doesn’t seem to make sense that inflation will fall as there is no incentive to keep your cash on hand in the bank. As such, one wonders how effective this tightening move will work without any other additional tightening measures.

So where will this additional tightening come from? Perhaps we may not even need any additional measures. RBI’s own GDP growth outlook is more bearish than before. 2014 FY GDP growth may fall below 5%, and that will almost certainly result in a lower inflation rate. But isn’t RBI’s job to ensure that economic growth remains healthy? So wouldn’t it be weird if RBI decides to make use of a slowing down economy to drive inflation lower? Whether this is a smart move to do is another debate altogether, but it is clear that RBI’s current focus is inflation and inflation alone, and they may be willing to sacrifice growth in the near term just to make sure inflation target is reached. This will also translate into higher willingness for intervention for Rupee from now even though RBI says that they won’t be doing anything more on the surface.

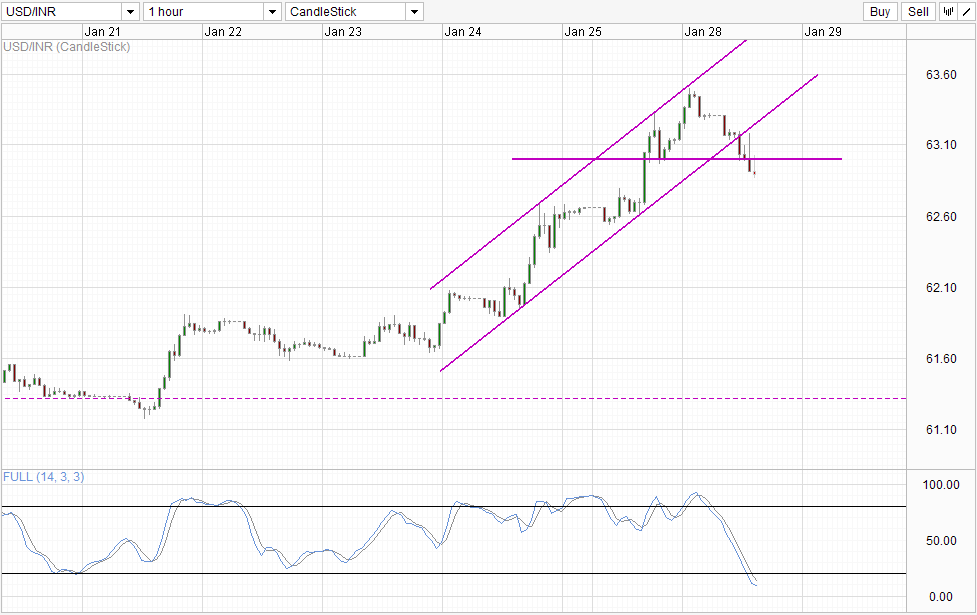

Hourly Chart

In any case, the surprise rate cut has done its initial job – driving USD/INR lower, breaking 63.0 round figure support. However, it should be noted that prices have already been pushing lower earlier even before the announcement. It is possible that traders may have anticipated RBI hiking rates, but the possibility is low given that the popular opinion was that RBI will hold rates. Hence, the decline that happened could have been a combination of technical influence coupled with a less bearish risk aversion market sentiment.

Hence, other than RBI influence, it is likely that price will be facing 2 forces tugging in the near term. The first one would be bearish technical pressure arising from the break of 63.0 which opens up a move towards the consolidation range of 62.35 – 62.7. However, given that risk off sentiment continue to reign, USD will continue to strengthen on safe haven flows. Therefore we will have a opposite force which will prevent prices from going lower quickly, thus ruling out a move towards the lower consolidation around 61.6 – 61.9 without any form of support/pullback in the interim. Stochastic readings agree with Stoch curve currently within the Oversold region, favoring support levels moving forward.

Weekly Chart

Stochastic readings on the Weekly Chart agrees as well, with Stoch curve continuing pointing higher amidst a bullish cycle. Should price manage to break above the rising Channel Top, it is likely that Stoch level will be above the 50.0 “resistance” level, adding further bullish conviction. But bearish scenarios are equally likely from Weekly Chart too, as a move towards 61.3 is possible should the bearish rejection of Channel Top is confirmed, with Stoch curve reversing lower from the aforementioned “resistance”.

Perhaps this encapsulates the fundamental issue with USD/INR. USD is expected to rally with QE tapers and risk trends, while Rupee is expected to stay robust with RBI defending it. It will be hard to tell who will ultimately win, and directionality for USD/INR will be hard to tell moving forward. Traders wanting to speculate on RBI’s commitment to keep inflation down and Rupee afloat may wish to pair it with other stable currencies to avoid this issue altogether.

More Links:

Gold Technicals – Risk Aversion Preventing Bearish Rout

GBP/USD – Surges to Key 1.66 Level

AUD/USD – Rallies Back to 0.8750

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.