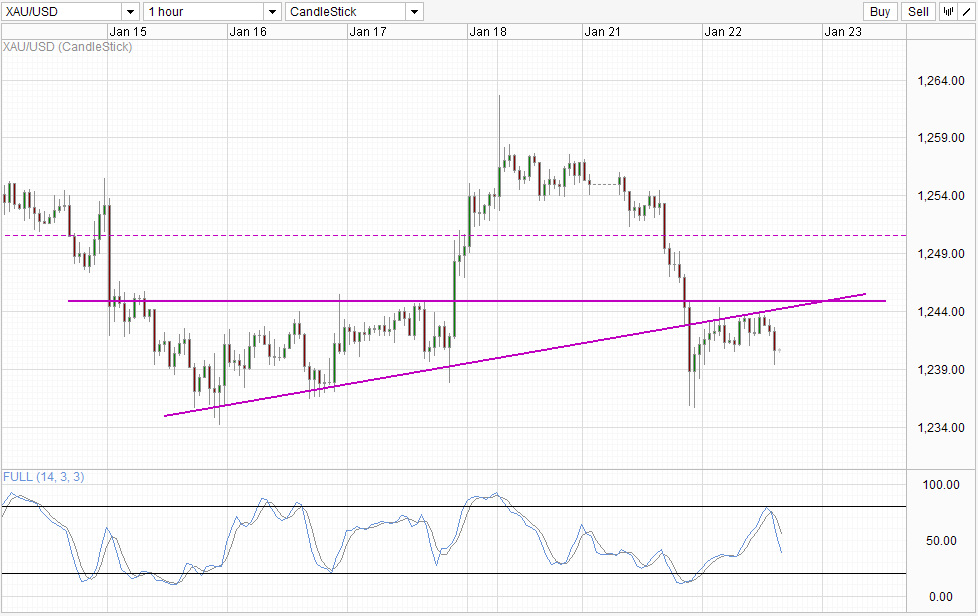

Gold prices remain bearish despite the sudden “risk off” move during early US session. Prices did rebound from yesterday’s low of 1,236 – around the lows on various occasions between 15th – 17th Jan, but that is also capped below the rising trendline and is currently moving towards 1,236 once more. Stochastic readings agree with a bearish cycle signal currently in play, increasing the probability of price tagging 1,236 before we see a significant pullback.

This weakness in Gold is in line with broad long-term fundamentals that do not find any satisfactory reasons for investors to buy gold. Nonetheless, considering that Gold was actually bullish earlier in the week, it is interesting to see how quick the tables have turned even though Hedge Funds/Institutional speculators have supposedly bought more Gold according to latest CFTC data. This week’ COT numbers will be important as we will be able to see if these institutional traders/investors are still interested in Gold. If Net Long positions continue to climb, the likelihood of 1,236 holding increases, and we could even see a move towards 1,255 and beyond (assuming that we have not reach the 2 levels mentioned before the COT numbers are released).

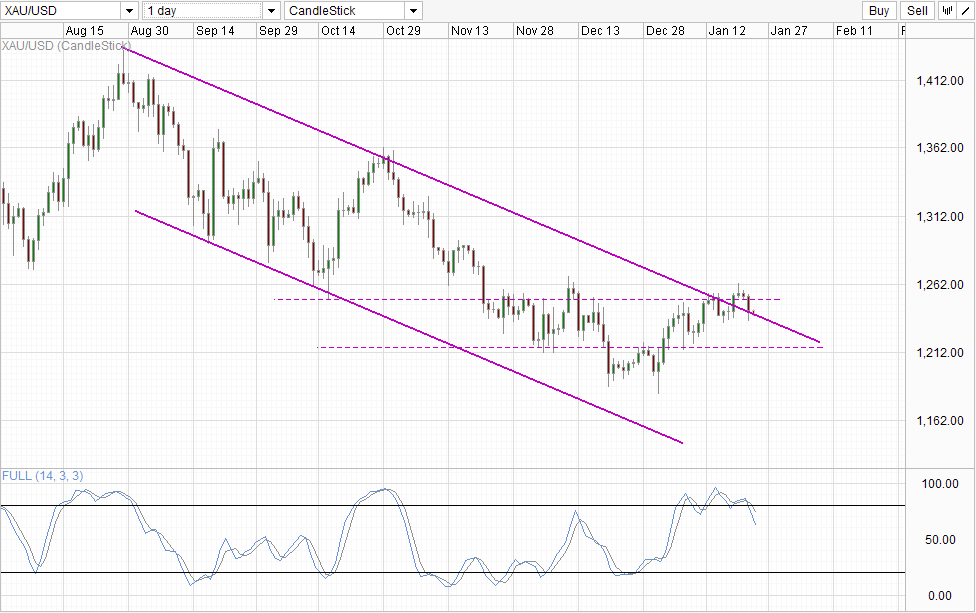

Daily Chart

Long term direction is bearish even though prices have broken above the descending Channel Top. The inability to climb above the swing high of Dec 2013 and staying above 1,250 round figure suggest that we are rather far away from any bullish breakout that can take us closer to 1,300. This opens up a return of previous swing low 1,182 as a viable long-term target. Certainly price may still rebound from the descending trendline, but given current bearish momentum and bearish fundamentals, the higher likelihood may be price straddling Channel Top lower. Should price trade below Channel Top, we could even see bearish acceleration as the bullish pullback that started late Dec/early Jan will be fully invalidated, giving full initiative to bears. Stochastic readings agree with a fresh bearish cycle with Stoch levels already below the peak formed in December. The next significant level of support for Stoch would be the 50.0 mark seen between Sep and Oct 2013. This provide enough space for price to head lower, but it is likely that bears will find significant support when 1,215 is reach.

More Links:

GBP/USD – Breaks Through Resistance at 1.6450

AUD/USD – Surges to One Week High near 0.8870

EUR/USD – Crawls back above Key 1.3550 Level

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.