Sing dollar has weakened against Greenback by 0.84% since the turn of the year, but this shouldn’t really come as a great surprise as USD has strengthened significantly due to the tapering of their QE program. To be fair, SGD is mostly stable, weakening by 0.65% against a basket of 7 major currencies. Comparatively, the currency of the city state has fared much better than regional counterparts such as Philippine Peso, Malaysian Ringgit, Thai Baht and Indonesian Rupee, which are all at or close to multi-year lows against the Greenback.

That being said, it is not all rosy for SGD right now. The multiple cooling measures the Government has enacted in the past few years is starting to bear fruit, with private homes sales hitting a 5 year low. This may seem like a non-issue prima facie, but Singapore is unique in this regard as private homes in the island is mostly owned by foreigners and not the local populace. As such, a dip in private homes is a clear sign that lesser foreign funds will be entering the local economy – a net bearish impact for SGD. On top of this, rising global rates expectations have increased risk premiums of investing in emerging economies such as Singapore. As Singapore are best known for its listed Real Estate Investment Trusts (Reits), increasing yields on bonds and sovereign debt would make such high dividend yielding financial products less attractive. As such, stock prices outlook for Singapore will be lower, and we could see even more funds exiting the economy, weighing SGD down further.

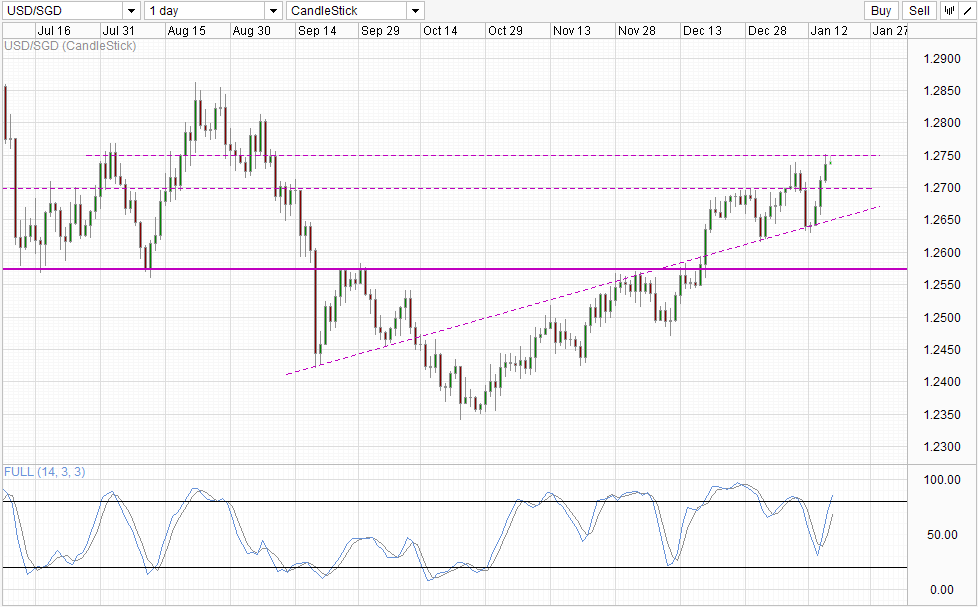

Daily Chart

Central Bank MAS goal to keep SGD on a mild appreciative curve will certainly help to keep a lid on USD/SGD rallies though, but as USD/SGD is still considered low by historical standards, it is unlikely that MAS will intervene aggressively against current rally. MAS may still interject on and off just to smooth volatility, but do not expect huge FX purchases by the Central Bank to prop up SGD to result in a bearish-trend from here out.

On a technical perspective, a temporary pullback is possible given the 1.275 resistance as Stochastic readings are already within the Overbought region. There is no evidence that bullish momentum is reversing or even stalling, but certainly it will be surprising to see prices heading towards 1.285 in one accord without any interim bearish setbacks especially given that 1.275 – 1.285 can be considered a resistance band in itself.

More Links:

AUD/USD – Returns to Familiar Territory Below Resistance Level of 0.90

GBP/USD – Drops Back to Support Level of 1.6350

EUR/USD – Eases Away from Resistance Level at 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.