The force is strong in Rupee. Even though USD has strengthened against all major currencies, Rupee has held its own against USD, and has retraced all the losses against the Greenback post QE Taper on Christmas Eve. This is a strong indication that market is bullish about the highest interest yielding currency in G20, a push that was further aided by the rising Sensex drawing foreign funds back into India once again.

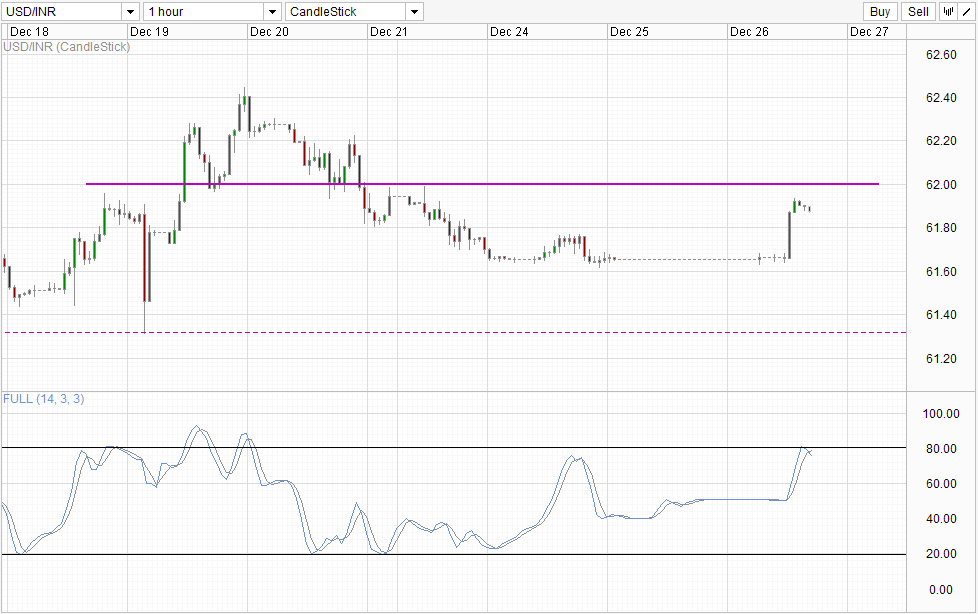

Hourly Chart

Rupee wasn’t able to shield itself from the surge in USD this morning though, with USD/INR climbing up 28 cents during the 1st 2 hours from market open as USD. However, price wasn’t able to tag 62.0 resistance level, and failed to even reach the swing high of Monday, underlining the strong bearish pressure that is in play. Furthermore, with Sensex rallying once more today, the likelihood of USD/INR pulling lower is good. Stochastic agrees too with Stoch curve rebounding lower after entering the Overbought region briefly earlier. This opens up a move back towards 61.65 and may even push all the way to 61.30.

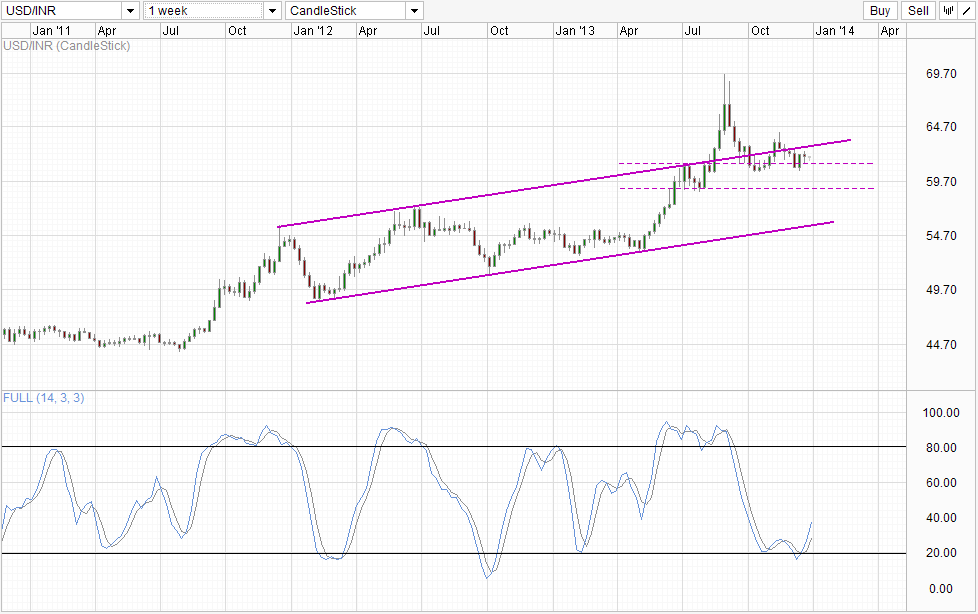

Weekly Chart

Weekly Chart is also encouraging for Rupee bulls, as last week’s rally failed to test Channel Top, and may act as a confirmation for the “break in” of the Channel back in mid November’s bearish reversal. This opens up Channel Bottom as a possible long-term target. The only thing USD/INR bears need to be wary of is the bullish cycle signal that was formed after price rebounded off 61.3 2 weeks ago. However, it will not be surprising if Stoch curve reverse between the 40.0 – 50.0 “resistance” band, hence overall bearish bias is not invalidated despite the bullish signal, just that traders may wish to wait for a breach of 61.3 before entering aggressively especially given that directionality in the next few days will be low due to low trading volume.

More Links:

NZD/USD Technicals – Pushing Lower Towards S/T and L/T Support Levels

AUD/USD Technicals – Mild Support Seen Versus Strong Bearish Backdrop

EUR/USD Technicals – Bearish Pressure Intact But Don’t Expect Sudden Slide

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.