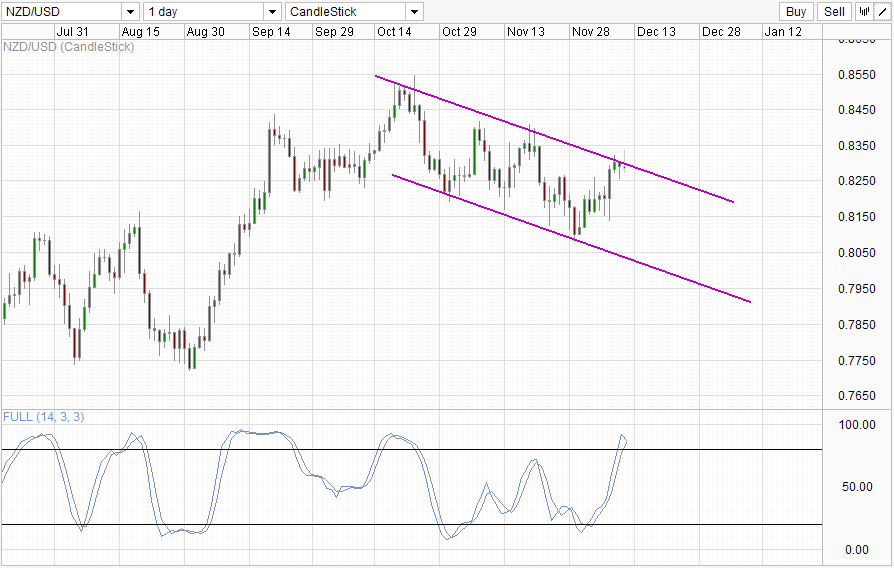

Daily Chart

Kiwi Dollar has been rising consistently ever since the bullish reversal seen on 30th November. This reversal formed the basis of the descending Channel that we are in right now as it provided the 2nd point of reference for the Channel Bottom, with current price finding resistance from Channel Top which opens up a move towards Channel Bottom. Stochastic indicator agrees with Stoch curve currently topping and looking likely to cross the Signal line soon and form a proper bearish cycle signal should 80.0 level is crossed.

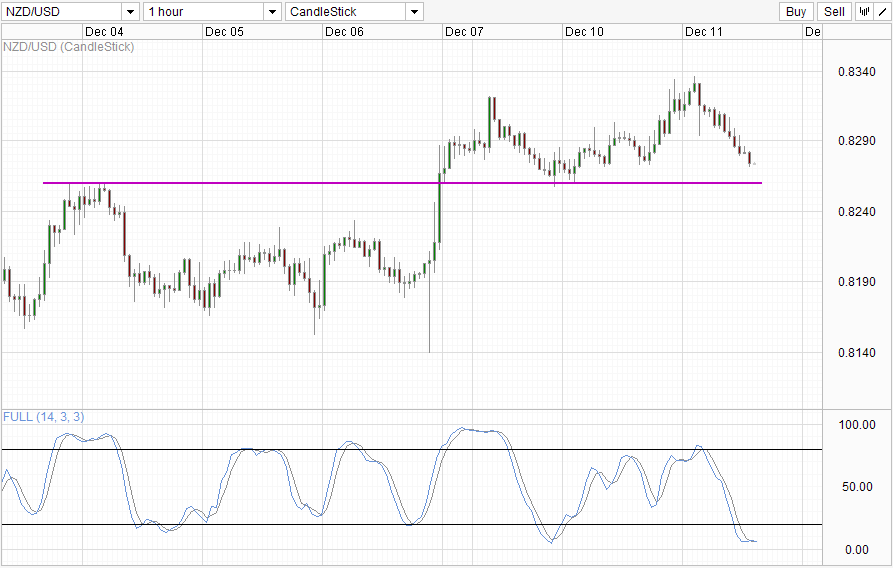

Hourly Chart

Price action on the Hourly Chart is less bearish as price is still above the 0.826 support level with Stochastic readings actually favoring a bullish rebound moving forward as current bearish push may already be overextended. If Hourly Chart has stronger influence compared to the Daily Chart, we should actually see a rebound higher with prices moving back above 0.83 and potentially hitting higher than 0.8335.

However the problem is that there is no telling who has the larger influence here – L/T direction or S/T swing. But this conundrum may be resolved come tomorrow’s RBNZ’s rate decision. The Central Bank is not expected to make any changes to its policy rate tomorrow, but price will still definitely react to forward guidance provided by Governor Wheeler. Most likely Wheeler would be throwing the same hawkish rhetoric about the need to keep monetary policy tighter as interest rates are currently at historical lows, while at the same time NZD will get some mention wherein Wheeler will reiterate his preference for NZD to be weaker and how RBNZ will not hesitate to bring NZD lower if necessary.

All these mentioned above isn’t anything special and market has heard Wheeler saying various variation of this in the past few months. What traders should look out for is the magnitude of reaction AFTER the rate decision. Should prices break 0.826 immediately after the rate decision but climbed back up again shortly after, short-term bullishness may be the one that is playing louder. Conversely, should prices bounce up higher initially on more hawkish than expected statements yet daily chart Channel Top holds firm, we could expect longer-term bearish objective to play a larger part in dictating price action.

More Links:

GBP/USD – Settles at Resistance Level at 1.6450

AUD/USD – Moves to One Week High above 0.9150

EUR/USD – Runs into Resistance Level at 1.38

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.