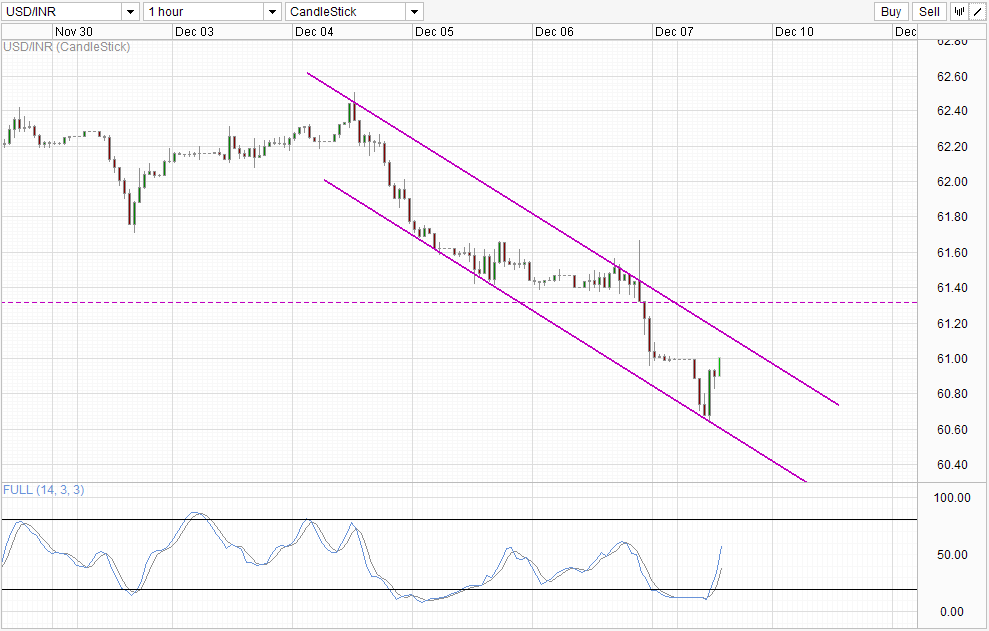

Hourly Chart

Rupee extends gains against the Greenback this morning on positive state election results, pushing USD/INR to a low of 60.65 today. However, USD/INR pulled back higher shortly after tagging Channel Bottom, giving up all the earlier losses and resulting in net gain for the day right now. This rally has been attributed to profit taking activity. Looking at technicals, price has rebounded right around Channel Bottom, which would be a reasonable level for short-term bears to take their profit, lending strength to the assertion that current rally is just a short-term pullback and not a shift in USD/INR sentiment.

This would also imply that bearish sentiment in USD/INR remains in play, which increase the likelihood of Channel Top holding as a resistance and favor a rebound of price towards Channel Bottom eventually. However, there is a possibility that we may not even reach there with Stochastic needing to break the 60.0 “resistance” before the bullish cycle can continue. But regardless where price turnaround, as long as prices stay underneath Channel Top, bearish pressure will remain in play which will open up Channel Bottom once again.

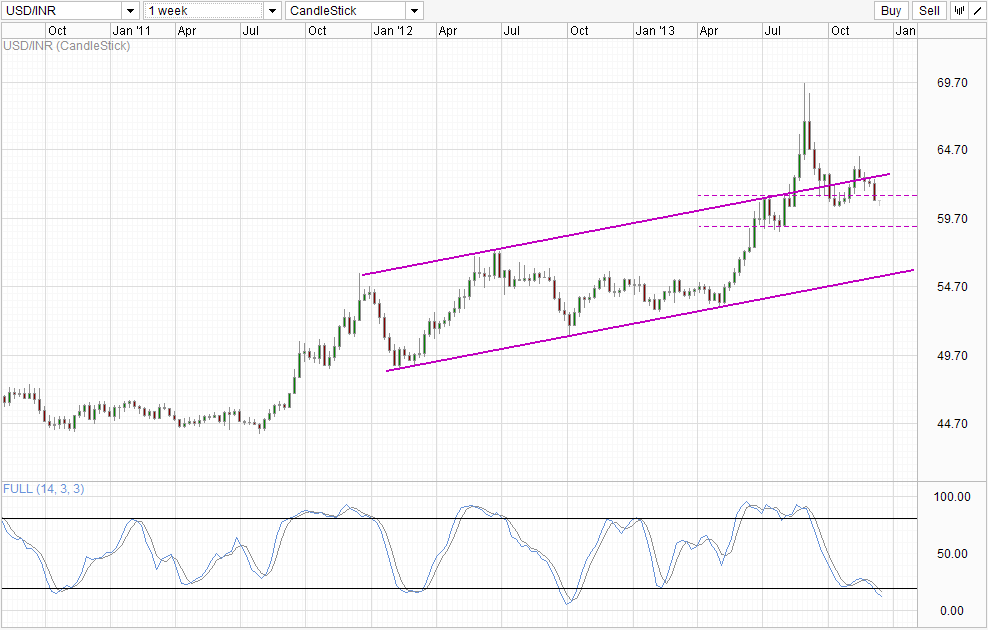

Weekly Chart

Daily Chart shows prices breaking into the 59.0 – 61.3 consolidation, which would open up 59.0 as immediate bearish target with Channel Bottom as the ultimate target. However, prices have rebounded ahead of the 60.5 soft support (based on swing low of early August and mid October), which puts even the immediate bearish target in doubt. Furthermore, Stochastic readings are already within the Oversold region, which suggest that further bearish movement may be difficult without some form of bullish reply. Nevertheless, both Stoch and Signal lines are still pointing lower – showing no evidence that a bullish pullback is currently in play. Hence a bearish move remains in play, just that traders should seek further confirmation for signs of strong bearish conviction/follow-through before over committing.

Fundamentally, nothing has changed. Even though opposition Bharatiya Janata Party (BJP) have won 4 critical victories, moving closer to forming the majority Government in 2014, India’s economy remains weak. Right now investors are only riding on the hope that this likely new Government will somehow be much better than the current incumbent. BJP is supposedly more business-friendly, and investors think that will help the economy to recover, but it should be noted that current incumbent Government isn’t exactly anti-business. The biggest problem for India right now is the current account deficit and the economic slowdown, resulting in lower investor confidence and hence a lower Rupee. This is not something that a new Government can simply wish away, nor is it something that can be resolved by enacting some business friendly bill. Hence, the rot is still there, and current bullish confidence may be grossly misplaced.

More Links:

AUD/USD – Shows Some Resilience Moving above 0.91

EUR/USD – Moves to Six Week High above 1.37

GBP/USD – Settles Around Key Level of 1.6350

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.