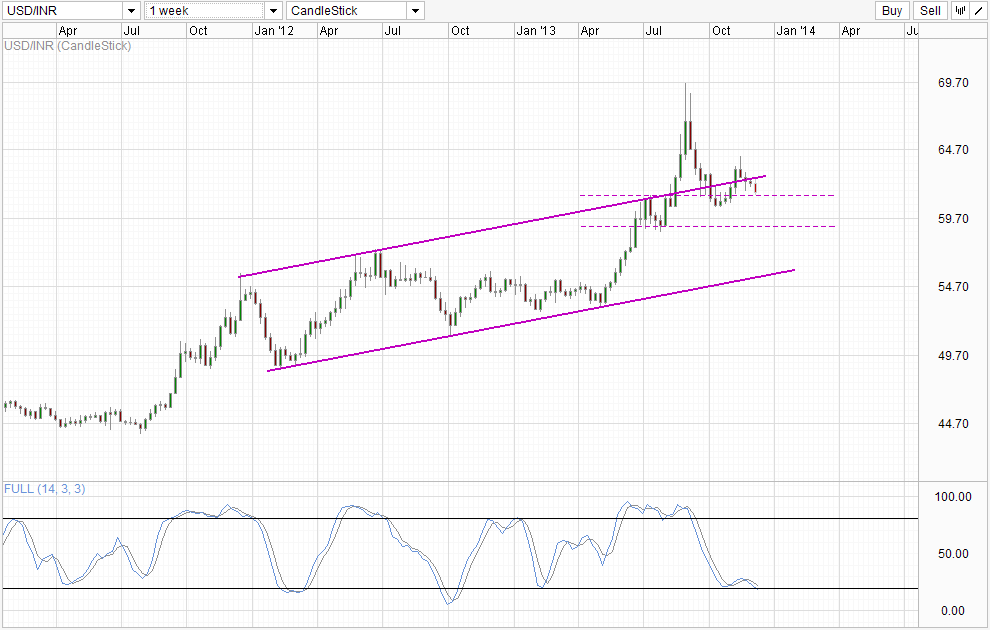

Weekly Chart

Indian stocks rallied strongly, with main equities index Sensex gaining as much as 2.2% after State Election Polls showed strong support for the main opposition party – Bharatiya Janata Party in state elections. BJP is seen as more pro business and anti corruption, instilling confidence from both local and foreign investors who welcome a change of stewardship.

This increase in confidence pulled Rupee higher, driving USD/INR lower from a high of 62.5 yesterday to current latest swing low of 61.41. However, despite such strong bearish movement in USD/INR, we could still see prices rebounding higher from the 61.3 support which is just a hair away. Stochastic readings are close to the Oversold region, suggesting that current bearish momentum may be overstretched. Also, the bullish reaction that the poll data inspired may be too aggressive, as the general elections is only coming in May 2014, hence there is a hint of hysteria in current bullish sentiment, setting us up for a strong bearish pullback potentially (weaker Rupee and higher USD/INR).

On the USD front, it is interesting to note that USD has not been strengthening that much recently despite all the kerfuffle surrounding QE Taper fears (which should drive USD higher). We’ve discussed elsewhere that there may not actually be Taper fears in play right now, especially with Gold prices trading higher (implying that traders are believing Fed will NOT taper if they are even still speculating on the “will they won’t they” game). Hence, there is an added chance of bullish reversal in USD/INR should actual USD strength comes back into play moving forward. This could happen should Fed surprise us with a taper in December FOMC meeting or does that in early 2014. Fundamentally, the recovery story of US economy is a much smoother read than India’s, and this divergence will always favor a upward push for USD/INR. Therefore, USD/INR bears are standing on thin ice right now, and they should be prepared for any sudden bullish shock in the future.

More Links:

Nikkei 225 – Bearish Lately But Don’t Count Bulls Out

WTI Crude – 97.5 Capping Gains Despite Strong Bullish Sentiment

GBP/USD – Maintains above Key Level of 1.6350

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.