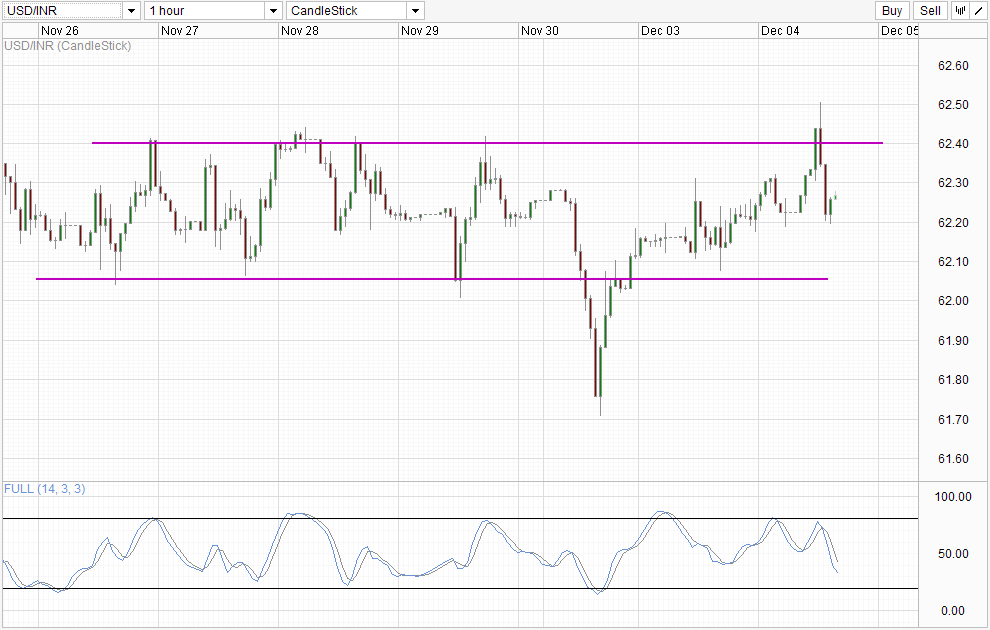

Hourly Chart

USD/INR is currently trading around the closing levels of last Friday, but that does not mean that prices have been staying stagnant. Price has actually been highly volatile, dipping heavily to a low of 61.7 and hitting a high of 62.5 this week. The decline which occurred earlier was attributed to stronger than expected manufacturing PMI numbers which drove Indian stocks even higher, resulting in further inflow of funds and driving Rupee stronger against the Greenback. However, that decline did not last long despite breaking the 62.05 support. Prices rebounded quickly when risk aversion entered the market, which drove US Stocks lower and USD higher. This impacted Sensex as well, which has since fallen and stemmed the inflow of foreign funds that has propped up the Rupee.

This rally may only be temporary though. The reason for risk aversion in the US (brought about by supposed taper fears once again) isn’t very strong, while prices have already rebounded off the 62.4 resistance heading towards the 62.05 floor even though S&P 500 Futures remain bearish with Sensex index being mildly bearish itself. It seems that the market has shrugged off some negativity, and is choosing to place more weight on India’s economic recovery story, which will favor further strengthening of INR in the near term. However, from a pure technical perspective, it may be difficult for price to break 62.05 as bearish momentum as indicated by Stochastic is likely to be Oversold when 62.05 is reached.

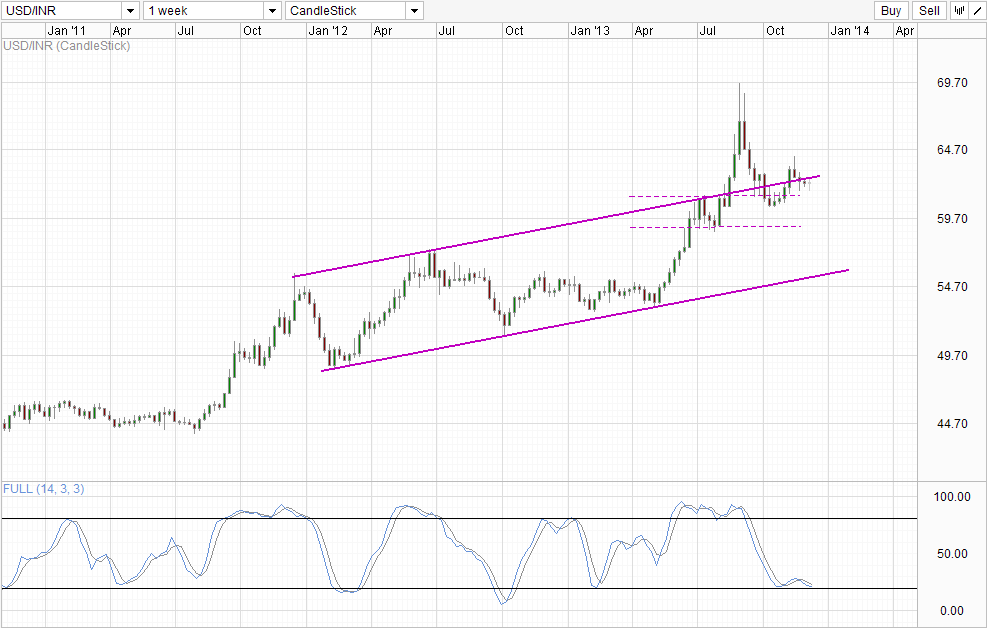

Weekly Chart

No significant changes in the weekly chart (as prices were similar to Monday when the previous analysis was made), with long-term uptrend intact even though prices are trading below the Channel Top. Price would need to breach the 61.3 support and ideally below the recent swing low of 61.5 in order to show strong bearish conviction. This is important as fundamentals still favor a higher USD/INR given that USD is slated to strengthen in 2014 (on QE taper) while India’s slowdown is not expected to bottom out until a few years later at least. Hence, more confirmation is needed to ascertain that market is interested to hold INR for its high carry interest yields.

More Links:

Gold Technicals – Stable Despite Additional QE Taper Fears

GBP/USD – Bounces off Support at 1.6350

AUD/USD – Continues Drive Towards 0.90 with Three Month Low

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.