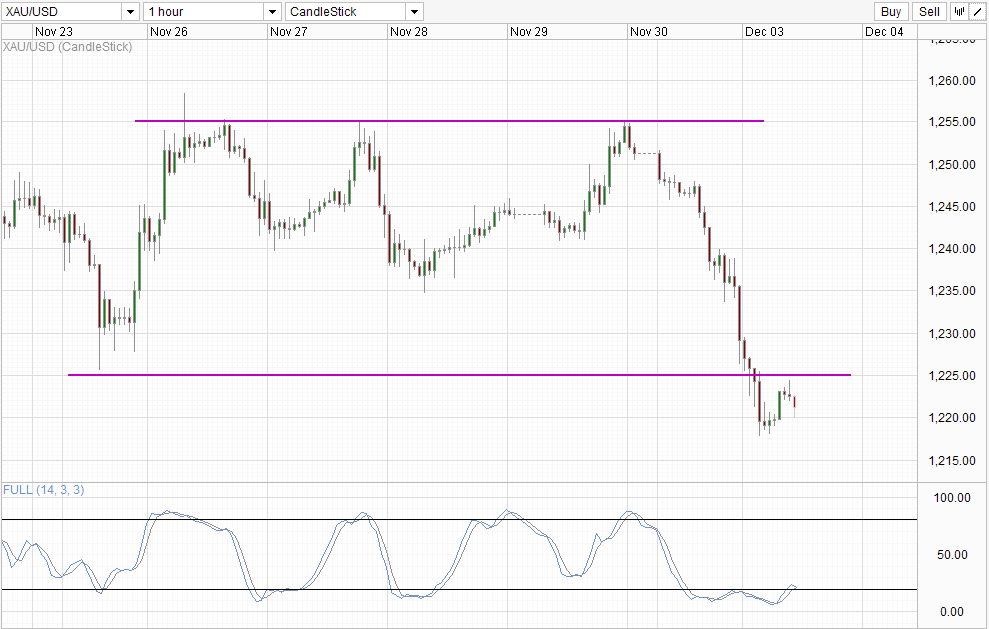

Hourly Chart

Bears have a great start in December with Gold prices shedding $30 USD an ounce yesterday. This is a huge surprise considering that expectations were for prices to trade sideways given all the upcoming news event risk (not least the FOMC December meeting in 2 weeks time) coupled with the slowdown of volume in December. Granted, price has always been bearish below 1,255, but yesterday’s decline was much stronger than expected with 1,235 and 1,225 support levels being broken easily without any significant bullish reply.

There were good reasons for the decline though – US ISM Manufacturing for November came in much stronger than expected yesterday, punching a 57.3 vs the expected 55.1 and 54.3 previous. And this is not the only good news – Markit US PMI was similarly higher at 54.7 vs 54.3 expected, while Construction spending for October grew 0.8% vs an expected 0.4%. Beyond the shores of America, PMI numbers from China, France, UK, Italy and Germany were all better than expected. This increased speculation that the Fed would go ahead with a Taper cut action (most probably in early 2014) and pushed Gold prices.

However, comparing US Stock prices, Gold prices are definitely much more bearish given the same set of economic backdrop. Hence, the risk of a bullish pullback is high as Gold traders may be the only group that is still betting heavily on a “Taper/No Taper” guessing game (most other traders have already moved on and believe that a Dec taper won’t happen). Nonetheless, from a technical perspective, we are still bearish below 1,225, and traders expecting a pullback should seek reversal confirmation as market can definitely stay irrational longer than we are solvent.

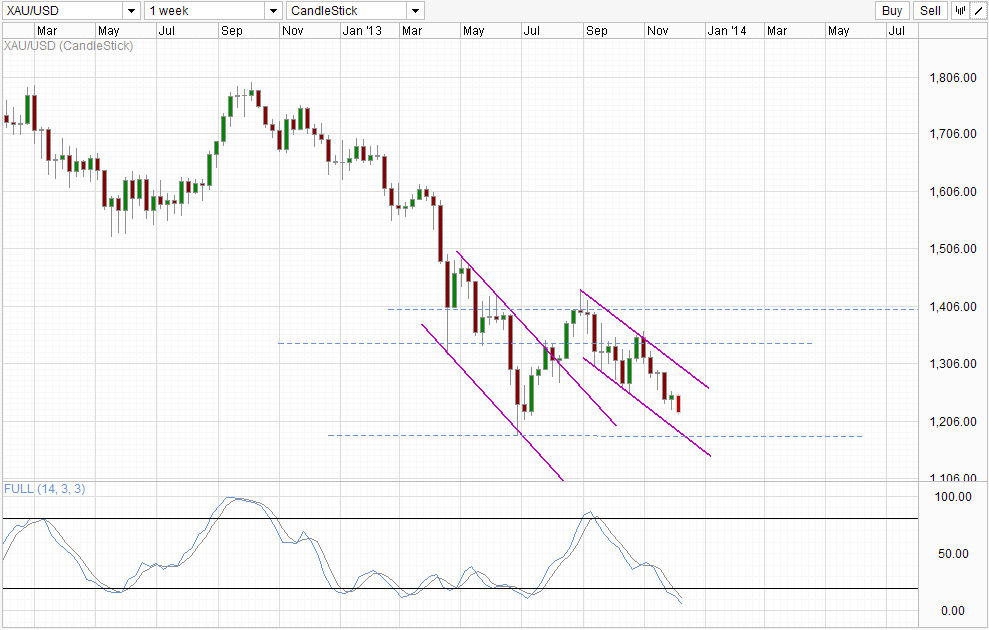

Weekly Chart

Weekly chart remains bearish, but the extent of bearish follow-through for the rest of 2013 may be suspect. Even if we trade lower from here, price will likely find significant support from the 2013 swing low of 1,180 as that is where price action will meet Channel Bottom if current pace of decline continues. Furthermore, Stochastic readings are within the Oversold region currently, favoring a potential bullish pullback moving forward – likely coinciding with a rebound of 1,180 which may open up a move towards Channel Top once again.

Fundamentally, there simply isn’t any good reason to buy Gold right now (was there ever a good reason to buy Gold even?). The risk of inflation is low, while its safe haven properties are not in demand right now with stock markets performing strongly. Also, with Gold set to clock in the first bearish year in 13, we could see further bearish sentiment coming out of the woodwork in early 2014, which may trigger a bearish landslide if the popular opinion about a early 2014 Fed Taper turns out to be correct. However, bearish traders will definitely need to bide their time for now, as Gold traders/speculators are still playing the taper guessing game, which means that should Fed keeps QE as it is in the Dec FOMC meeting as expected, the bullish backlash may be strong. Therefore, caution is still highly advised even though bearish victory is almost assured, and over aggressive bearish plays remain highly risky and ill-advised.

More Links:

GBP/USD – Eases Away from Two Year High towards 1.6350

AUD/USD – Turns Around and Looks Towards 0.90 Again

EUR/USD – Falls back to Key Level at 1.3550

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.