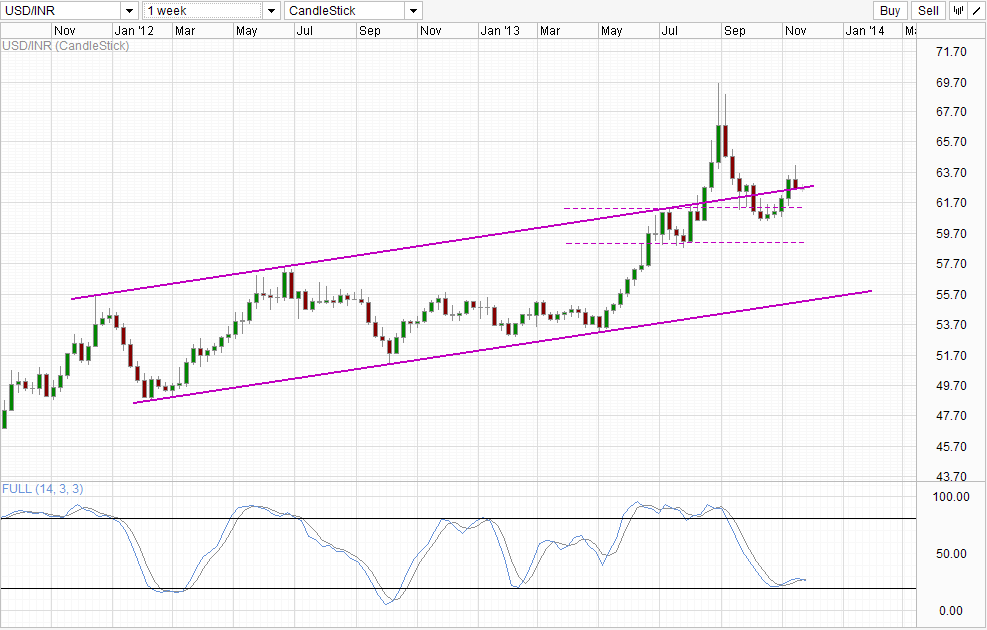

Weekly Chart

The slide in USD last week greatly benefited the battered Rupee, and may have once again saved Rupee from further declines. Prices were threatening to breakout from the Channel Top which would have seen acceleration towards 70.0 in the next few weeks, but that we stopped short by weakness in USD arising from speculators believing that the Fed is no longer exploring a tapering event in December. Whether that is true is highly debatable, as market has gained their belief from Janet Yellen’s supposed “dovish” statements. But the fact remains – USD/INR is pushing lower and threatening to break within the rising Channel once more.

Should Channel Top be breached, the consolidation zone ceiling situated below will be the obvious bearish target. It is possible that prices may find some support there, or perhaps some support just under the ceiling similar to what has happened back in mid October. This is because Stochastic readings suggest that bearish momentum will likely be Oversold when that happens, and considering that overall trend is pointing higher all the way since August 2013, there is always the technical tendency for bulls to snap back. When we couple this with economic fundamentals that continue to favor a weaker INR, the risk for a sudden and unexpected rebound becomes even higher.

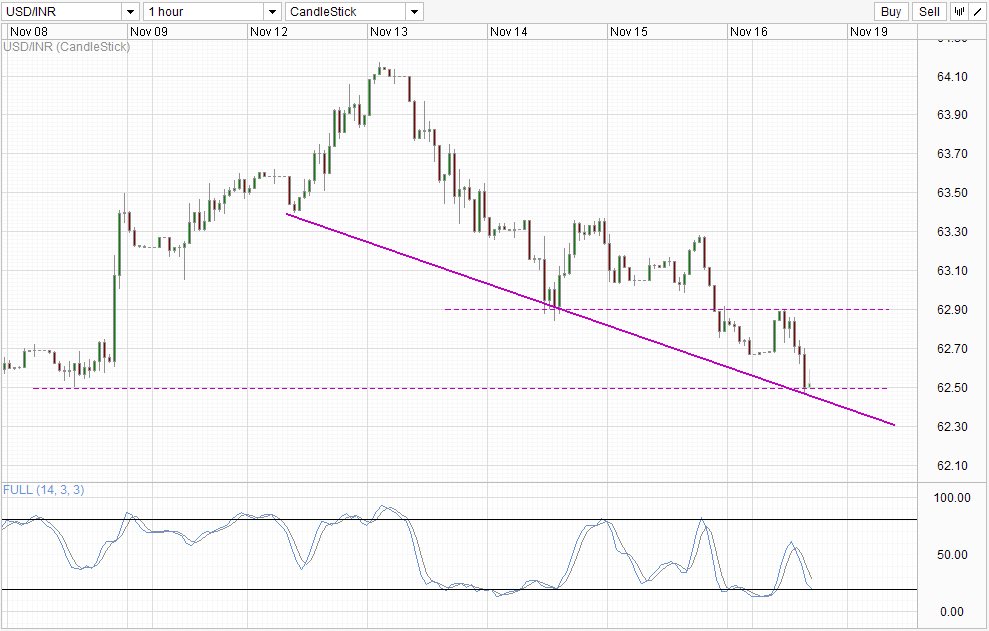

Hourly Chart

Short term pressure continues to favor INR for now, partly due to risk on appetite that has driven Sensex 1.68% higher right now. However the scenario may change quickly with prices facing support from 62.5 round figure which is confluence with 8th Nov swing low. Stochastic readings are also approaching Oversold region with Stoch curve tapering flat. Hence, even if 62.5 is broken, it is likely that price may find support from the descending trendline and rebound higher.

But there might be further saving graces for USD/INR this week. Should US traders maintain their hyper-sensitivity to QE Taper speculation, we may have numerous opportunities for further USD weakness that can send prices lower. US NAHB Housing Price Index, Advance Retail Sales and maybe even CPI numbers may result in huge reactions this week even though such news would have been considered “weak” in the past. Should all the numbers come in weaker than expected, it is likely that USD will push lower even faster, resulting in a lower USD/INR that can bring us back to 61.3 once again.

However astute traders would realize that this will not be able to change the long-term momentum, where Rupee remains inherently weak due to bad economic fundamentals. Case in point, when USD weakened back in August and late September due to US Governmental Shutdown/Debt Ceiling crisis, USD/INR did fell lower but eventually climb back up once again. Hence, do not bet that just because short term news volatility may sink USD/INR, prices will be able to pull off a long-term bearish reversal without RBI doing something drastic to change India’s fortunes.

More Links:

Gold Technicals – Mildly Bearish But Bulls May Lurk

AUD/USD Technicals – Bumpy Journey To 0.943 Expected

EUR/USD Technicals – 1.35 Resistance Holding Strong

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.