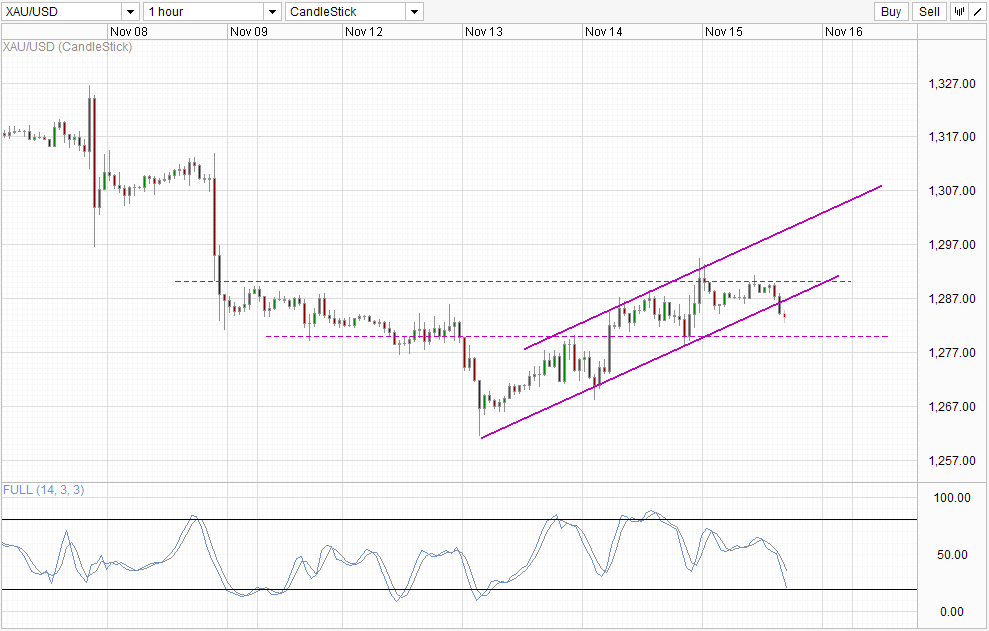

Hourly Chart

Despite all the hoo-hah following Janet Yellen’s comments, Gold prices remain broadly bearish. Prices did rally higher on speculation that a December Taper event will not happen, but we were still unable to make any significant bullish headway. When we consider that market may be unreasonably bullish (borderline irrational) in their interpretation of what Yellen said, the failure of Gold to make any major advancement implies that underlying sentiment is heavily bearish. Case in point, prices have pulled back rather significantly since the peak formed during yesterday’s US session. Prices have now broken the Channel Bottom – a representation of the bullish response brought by the speculative play – which opens up 1,280 support as the next target.

What happens at 1,280 will be the watershed moment for S/T Gold direction. Should prices break 1,280 by the end of today and a bearish acceleration happened early Monday morning, next week may be a bearish week for price to test 1,260 and potentially beyond. However, should 1,280 holds, a retest of 1,290 may be possible and the bearish momentum may be delayed.

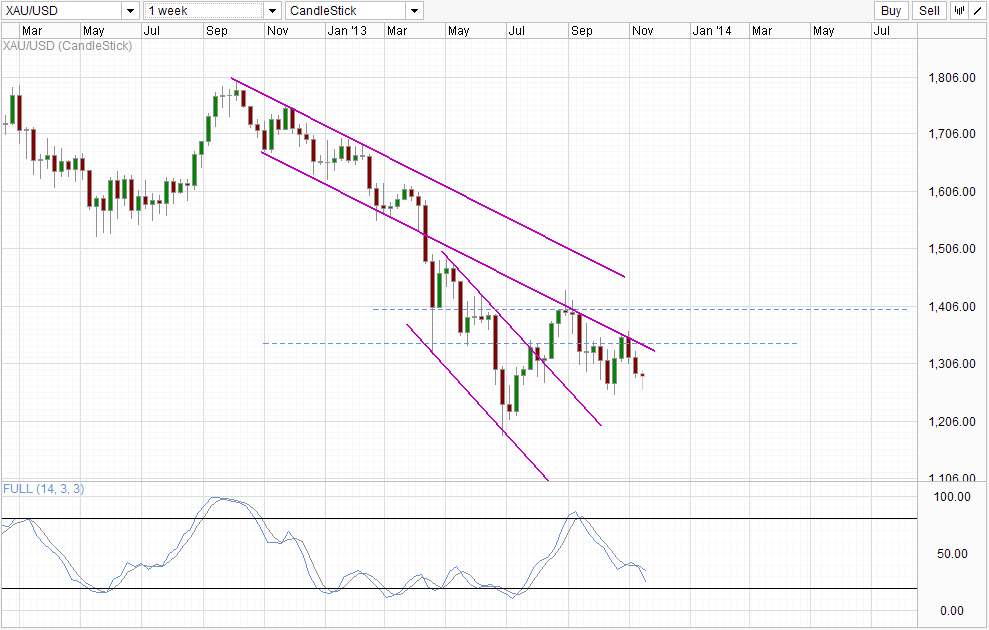

Weekly Chart

Weekly Chart remains bearish, but conviction has weakened significantly as we are no longer trading below the soft support of 1.272. Should price close around this level today, we will be having a long legged doji, which may be the primer for a bullish reversal “morning star” pattern. There is nothing that suggest that bullish momentum is in play right now, but traders should certainly be aware that such a possibility exist, especially since Stochastic readings are close to the Oversold level amidst a “support band” between 15.0 – 30.0 seen between Jan – June 2013. Hence do not be surprised if Stoch curve manage to reverse from here without warning.

More Links:

EUR/USD Technicals – Weakness Seen In S/T Uptrend Intact

GBP/USD – Pound Keeps Rolling, Shrugs off Weak Retail Sales

USD/CAD – Pushes Above 1.05 on Weak Unemployment Claims

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.