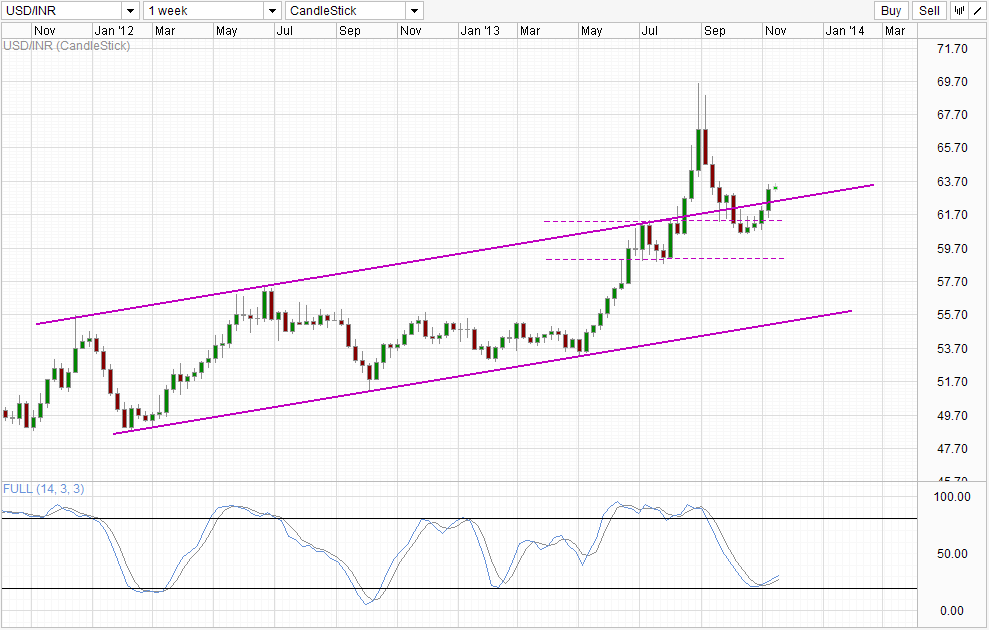

Weekly Chart

USD/INR pushed up higher last week, breaking the Channel Top resistance and suggesting that the uptrend that was previously in play is now back. This notion is supported by Stochastic indicator that is pointing higher after forming a trough above the 20.0 mark – not traditionally a “proper” bullish signal but nonetheless shouldn’t be ignored considering that there are precedence for such occurrence as recent as Feb 2013. This open up 70.0 as a bullish target and perhaps even open up the possibility of a new 2013 high considering that current bullish signal is only in its early stages.

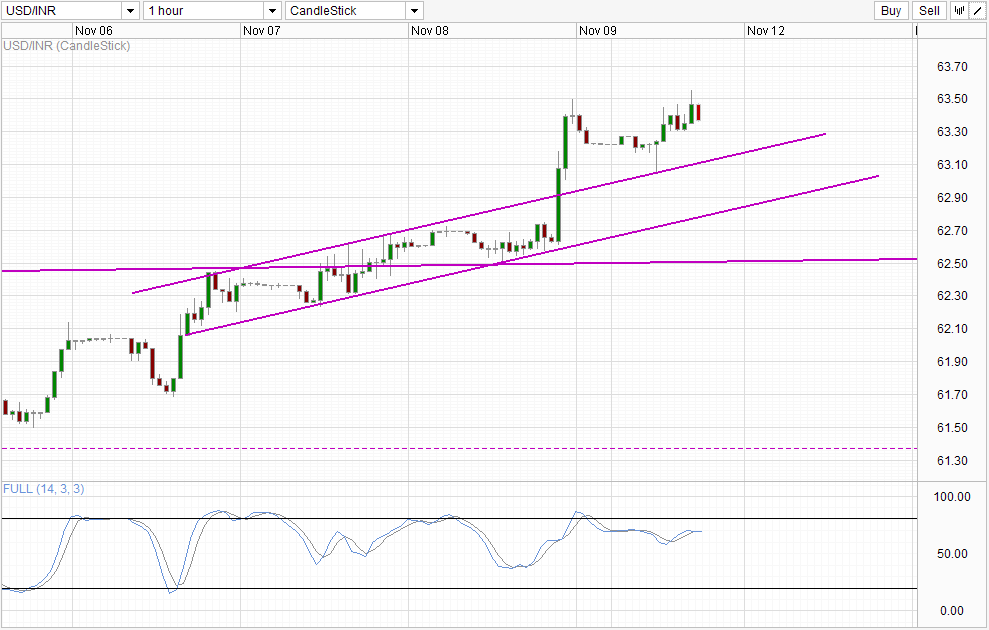

Hourly Chart

Short-term Chart disagree though, as price have not really moved much after the post NFP rally. In fact, prices actually traded lower during early Asian hours only to be rebuffed by the rising Channel Top, and the subsequent rebound failing to stay above the soft ceiling of 63.40 not to mention last Friday’s swing high of 63.50. Furthermore, Stochastic readings are close to Overbought, which suggest that price may not be able to stretch much higher before an inevitable bearish pullback. If you look were to follow Stochastic strictly, the momentum is actually bearish since the peak from last Friday, and implies that a retest of the trendline below may be favored.

Nonetheless, with fundamentals continuing to favor a stronger USD moving forward, USD/INR is in a good position for further bullish gains in the long run as India’s Central Bank continues to flounder in their attempt to tackle both rising inflation and decreasing economic activity. Even though RBI’s latest bout of changes to policy repo rate and banking facility rate appears to be courageous, Governor Rajan has a high chance of accomplishing neither objectives as they appears to be mutually exclusive right now. Hence, the outlook for INR remains weak, giving yet another reason for USD/INR to propel upwards strongly in Q4 2013 and Q1 2014.

More Links:

EUR/USD Technicals – Slight Bearish Potential But Mostly Supported Post NFP

Gold Technicals – 1,300 Broken, But Further Bearish Acceleration Suspect

AUD/USD Technicals – Post NFP Pullback Seen, Downside Bias Remain

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.