Following the less dovish than expected FOMC event, US1oY finally broke 128.0 at the 2nd time of asking. Friday’s price action (Thursday US ) confirmed the 128.0 break, placing bears firmly in the driving seat for the rest of Friday, with 127.50 broken and price closing a mere 6 cents higher from the newly forged weekly low – a very strong bearish sign.

This bearishness was seen once again during Monday open, where prices push to 127.25 almost immediately. However, since the opening dip, price has been recovering, and is currently trading slightly than last Friday’s close, impairing the bearish pressure that originally in play this morning.

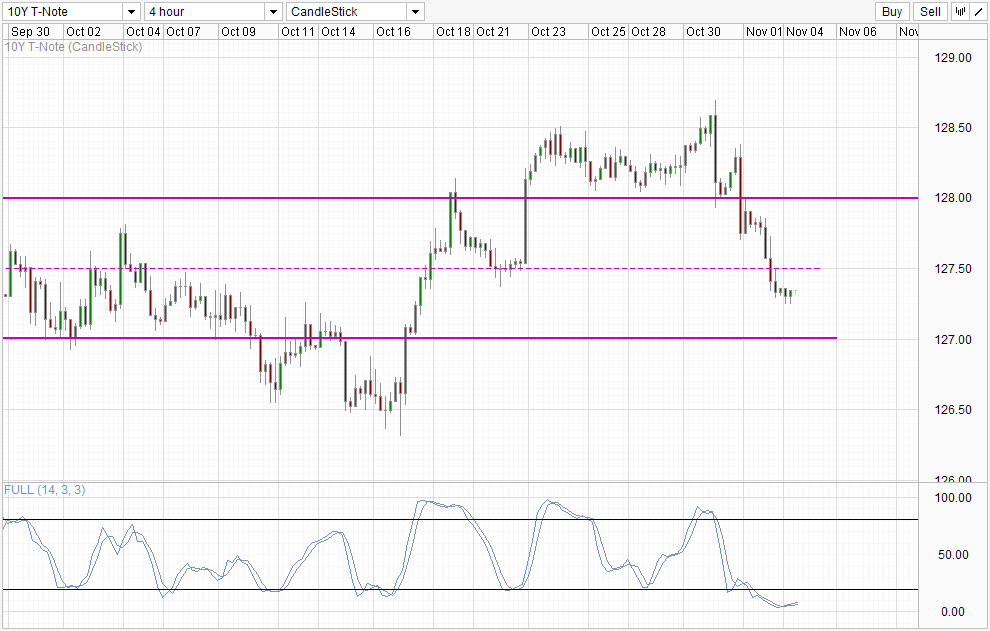

4 Hourly Chart

This opens up a potential move towards 127.5 once again. Stochastic go one step further, and suggest that a full bullish cycle towards 128.0 may be possible especially if Stoch curve cross 20.0 in conjunction with a 127.50 break. However, if 127.5 holds with Stoch rebounding off 20.0 level, the likelihood of price moving towards 127.0 becomes higher.

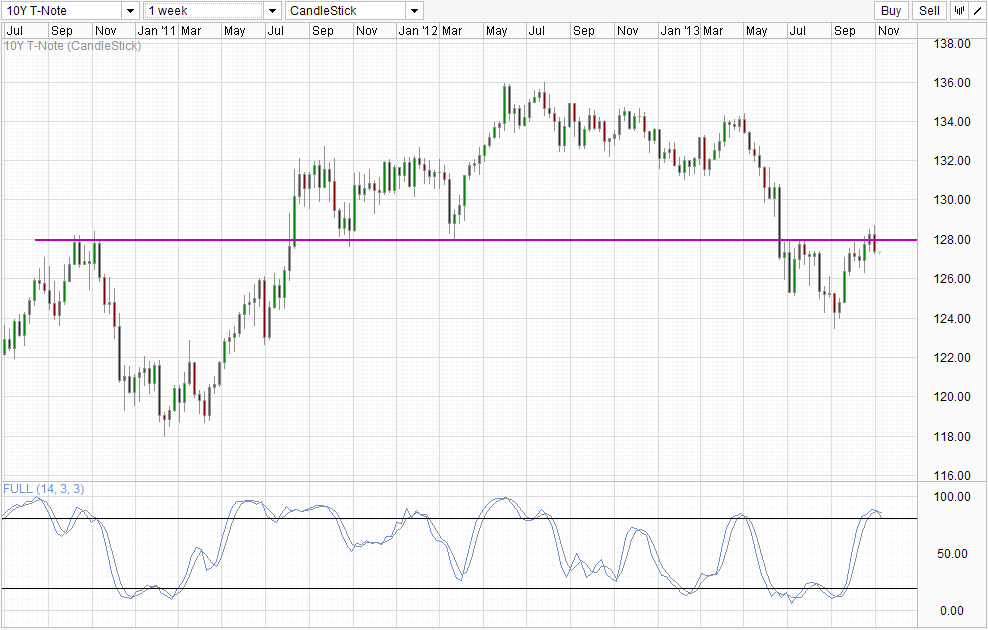

Weekly Chart

Long-term chart is much more bearish though. Not only has price is showing a bearish rejection from the 128.0 resistance, the bearish engulfing candle suggest that bearish momentum from here out may be strong. Stochastic readings agree as well, with readings topping. However, a full proper bearish cycle signal is not yet formed, and we may need to see prices heading slightly lower more before the signal is formed. This is in line with what short-term chart shows above, where price is expected to accelerate lower should 127.0 and preferably 126.5 is broken.

More Links:

EUR/USD Technicals – 1.35 Broken But L/T Bearish Movement Unlikely

AUD/USD – Higher On Stronger Retail Sales, Weekend Chinese Data

Gold Technicals – Slight Bearishness Seen As Bearish Momentum Continues

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.