Kiwi dollar has been trading lower lately ever since the recent high reached on 22nd October. The decline can be attributed to the increase in USD strength since following the partial resolution of the Debt Ceiling and US Governmental Shutdown. However, it should also be noted that amongst all the major currencies, NZD is the weakest – losing to all 7 major currencies during the same period, suggesting that this decline can be pinned on NZD’s own structural weakness and not solely the result of a stronger USD.

The reason for the decline appears to be driven by declining rate expectations. 12 month rate outlook for RBNZ has fallen from 97 basis points to 59 in the past month, showing that market is expecting RBNZ to be less hawkish moving forward even though Governor Wheeler has been extremely hawkish in the last rate decision announcement. It seems that market is seriously doubting Wheeler’s ability to raise rates when economic fundamentals of New Zealand has recently been a tad softer, with the current account deficit sticking out like a sore thumb – so much so that rating agency Moody’s announced that it is considering slashing NZ’s triple A credit rating. Furthermore, Wheeler himself has said that the central bank may be able to delay rate hike given that NZD is so elevated right now, increasing speculation that RBNZ will not be as hawkish as expected in tomorrow’s rate announcement and driving NZD/USD further lower.

Hourly Chart

That being said, NZD/USD is looking nicely supported. Prices have managed to rebuff the earlier decline arising from the Moody’s announcement, and is currently trading above the descending channel top that has typified the decline from 22nd Oct high. However, that doesn’t mean that prices will push up higher from here. Firstly, 0.827 resistance remain firm, and Stochastic indicator suggest that we do not have much more bullish space to move with readings already close to the Overbought region and Stoch curve appearing to tapering lower. Hence, we are still looking at continued bearish pressure but it is likely that declines will be slow and steady given that broad support is still present.

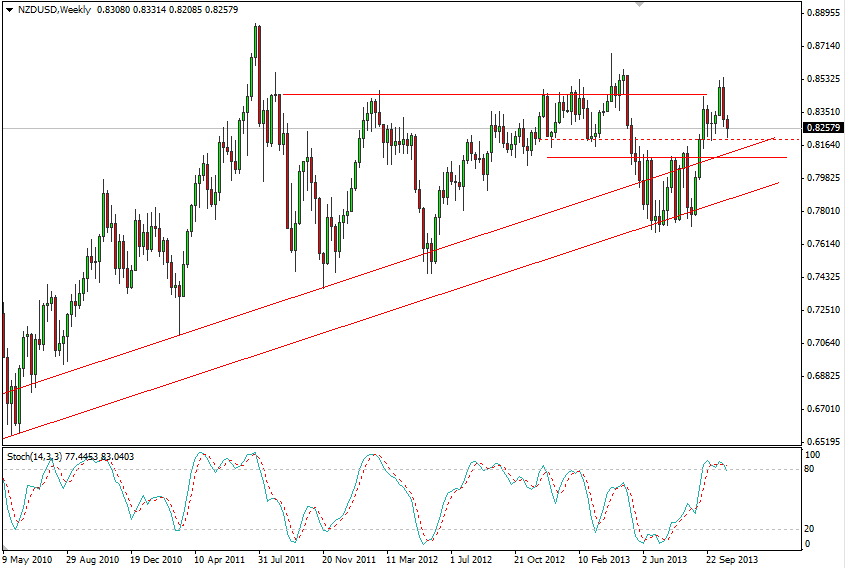

Weekly Chart

This notion seems to be corroborated on the Weekly Chart where momentum seems to favor bear side with Stoch readings giving us an initial bearish cycle signal. However price remains above 0.82 support level, with more support levels expected even if 0.82 is broken.

Fundamentally, USD may strengthen further later today if FOMC surprises the market with a hawkish announcement. On the flip side, the likelihood of a USD weakening surprise is lower as market has already priced in the scenario of QE taper only coming in March/April 2014. As it is almost impossible that the Fed will announce even more stimulus, the most dovish scenario USD bears can hope for would be an omission of any talk of QE taper or interest rate hike today – which may result in a short-term USD weakness but unable to inspire long-term weakness in USD especially since QE taper/ending is a certainty moving forward.

Hence, bulls can only rely on Kiwi’s inherent strength for a long term NZD/USD rally, and that will hinge largely on whether RBNZ remain hawkish or not tomorrow. If tomorrow’s RBNZ statement reflects dovishness, we could see a strong bearish correction for NZD/USD in the long run especially given the bullish USD outlook.

More Links:

EUR/USD – Drops Sharply Below 1.38

AUD/USD – Breaking Through Key Level at 0.95

GBP/USD – Moves to Two Week Low at 1.6050

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.