US Stocks enjoyed a wonderful bullish rebound today, with both S&P 500 and Dow 30 gaining 2.18%, reversing the entire losses incurred during the week and coming up tops. The good news that started this bullish run? House Speaker John Boehner has announced that he will present a plan for a 6-week debt ceiling increase to House Members, which is likely to be passed and hence averting the supposed 17th Oct US Default dateline. This would kick the can down the road to December, postponing default risk for now.

This bullish sentiment is not only limited within US region, with US Index Futures starting to climb during late Asian/ early European hours yesterday when rumors of Boehner impending announcement emerged. What is interesting is that US traders continued to push prices up even higher despite other region traders already pricing in the Boehner announcement way before hand, suggesting that this increase in risk appetite has good bullish follow-through and is not simply a one-time event based revaluation. Currently, Asian market continues to enjoy the bullish sentiment, with not just Asian stocks rising but US Stock Futures are rallying as well, a surprise considering that US stock futures tend to be rather insensitive to Asian risk appetite flows. Therefore, from a sentiment point of view, it is clear that current bullish sentiment may have legs to run which may inspire further rallies during US session as well.

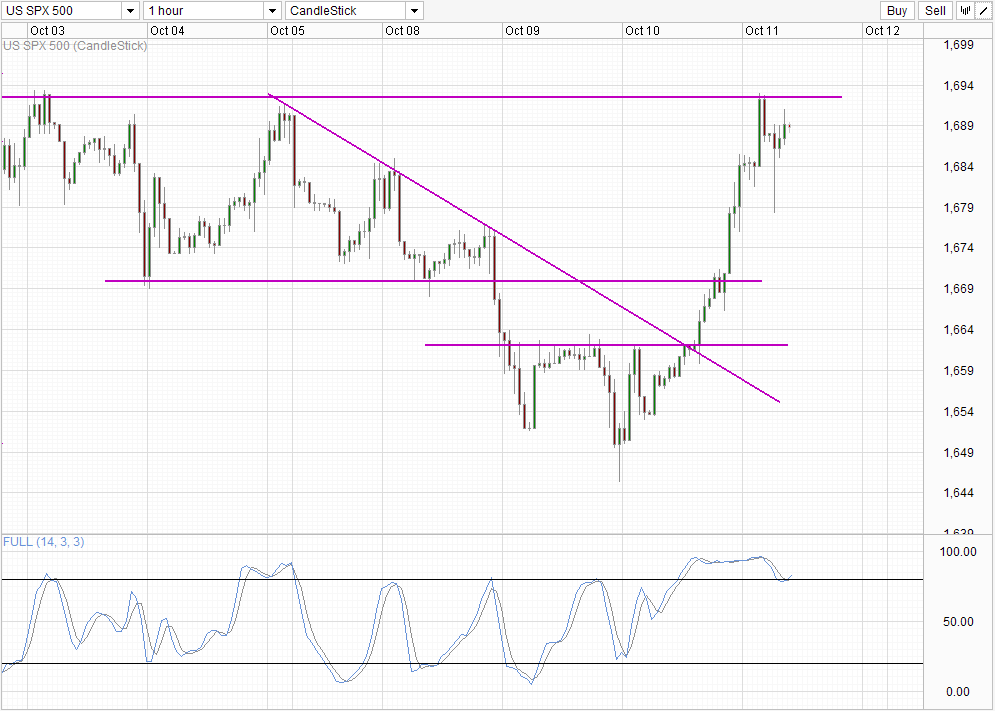

S&P 500 Hourly Chart

From a technical perspective, the chances of further bullish continuation is high. Bulls has shrugged off a rebound of the 1,692 resistance which started towards the end of the US session – a technical pullback following a strong bullish rally. The ability of Asian bulls to pull prices back up above the soft 1,685 former resistance turned support suggest that a retest of 1,692 during Asian hours is certainly possible.

Furthermore, given that Stochastic readings are bouncing off the 80.0 level instead of forming a bearish cycle signal is a strong testament for the overall bullish sentiment. Assuming that sentiment of European and US trades remains bullish, it is easy to imagine prices being able to forge out new weekly highs during these sessions if not accomplished during Asian hours.

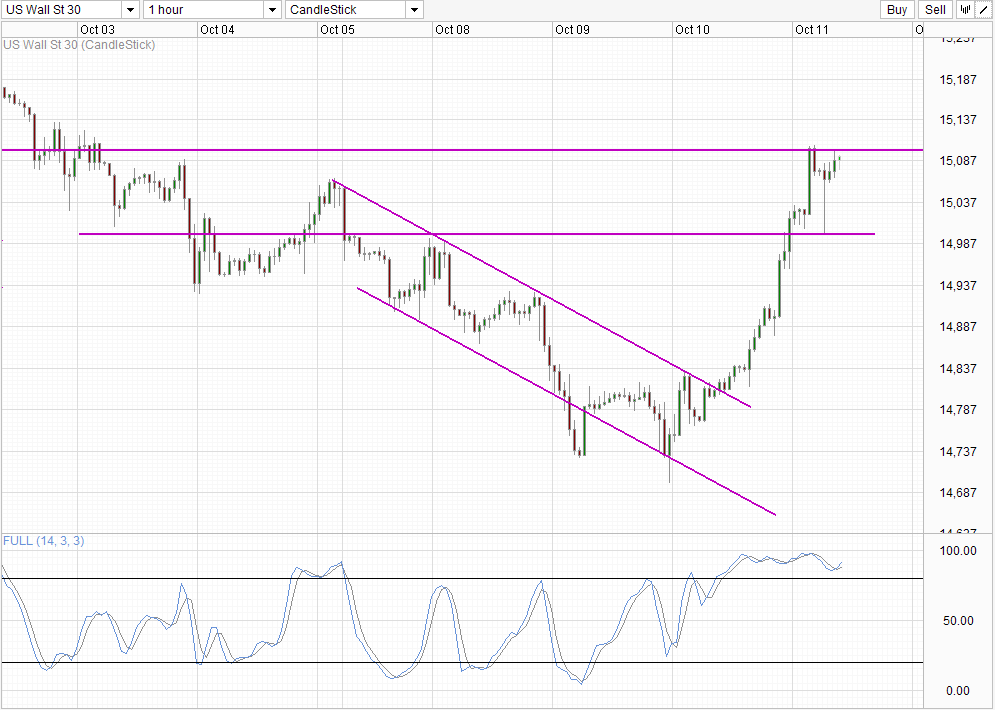

Dow 30 Hourly Chart

The same technical interpretation applies for Dow 30. However, Dow 30 appears to be relatively more overbought compared to S&P 500. Hence should even Dow 30 manage to clear its 15,100 resistance, we should be able to expect even further bullish movements in S&P 500 today. Conversely, should S&P 500 falters and trades below 1,685 or perhaps even below the recent Asian swing low of 1,679, we could see even stronger bearish movements coming out of Dow 30.

Fundamentally, it is certainly good news that US will definitely not default on 17th October, but the main issue still remain and we could see fear creep in a month later should nothing improve from now till then. Considering that trading volume tend to dry up during end November and the entirety of December, we could potentially see even bigger exaggerated downside moves. With this in mind, it is unlikely that current short-term bullish momentum will eventually last for the full 6 weeks of leeway Boehner has given Obama, and traders intending to chase the rally – as bullish as it seems now – will be highly risky.

More Links:

GBP/USD – Relying on Support at 1.5950 Level

AUD/USD – Remains Subdued with Solid Support at 0.94

EUR/USD – Finds Solid Support at 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.