David Munro, Consulting Market Strategist for OANDA Asia Pacific

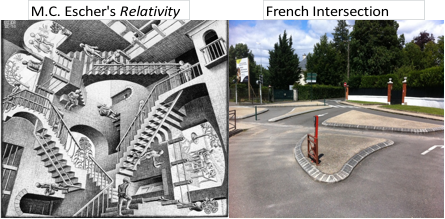

Planning engineers thoughtfully designed an intricate and imaginative intersection in Fontainebleau, France, which looks perfectly suited for small cars, bicycles, baby carriages, skate-boards, horses and Escher art aficionados. I wasn’t sure where the intersection started or where it led to and was tempted to drive right down the middle at the risk of damaging the undercarriage of our rental car. I can visualize six engineers sitting around a drafting table and, in the interest of social harmony choosing the average of six unique plans. Commuters would be forever baffled, but the engineers would live in harmony.

In stark contrast to the chaotic and perplexing intersection (and less than one kilometre away) is the splendid 16th Century Chateau de Fontainebleau – an architectural marvel. The palatial country residence of Francois 1 has improved with age thanks to the French obsession with preserving the monuments they fought so hard to dismantle during the French revolution.

Certainly, France does history very well; art, music, cathedrals, chateaus and tossing out rulers. The present poses a potentially intractable problem though. While old is beautiful, functional and well maintained, new is lazy, odd and ephemeral. As soon as modern France gets rid of an ineffective leader, a new and potentially more destructive one appears in his place.

You have to be Eccentric to See the Centre

It is difficult for those living in Europe to objectively assess their surroundings. Immersion can prevent the formation of a broad perspective. Often, the best way to appreciate and ultimately solve a problem is to step out of your environment or comfort zone and look back in with an objective yet critical eye. Yet, if eccentricity is the norm – if you are always an outsider – a visit to the centre can provide a different perspective. I felt it was time to immerse myself in the centre of the maelstrom; to get a street-level view of a country that should be in a severe recession by this time next year. It is no small coincidence that my desire for an on-the-ground perspective of the European train wreck coincided with my family’s summer vacation in France.

St Tropez Demographics

Brigitte Bardot put modern St Tropez on the map in 1955 when she appeared in a bikini for the movie And God Created Women. Expecting modern images of the jet-setting village in the South of France to resemble those created by Bardot and her glamorous peers over half a century ago, we were surprised to find the beaches populated by the same people. Not similar people, but the same people. The September to June (off-season) population of St Tropez is less than 6,000 and it appeared that many of the resident sun-seekers were in their sixth, seventh or eighth decade of life. The unexpected lesson in skin elasticity was a reminder that economies are less capable of bouncing back when youthful energy is replaced by relaxing retirees. Seemingly unable to afford swim attire, these senior sand surfers are unlikely to help pay off French sovereign debt or contribute to the recapitalization of ailing French banks.

Fortunately, the month of July ushered in a more collagen-friendly group of tourists. But the knowledge that the Mediterranean is awash in antiquity for ten months of the year has forever dissuaded me of the notion that French over-indebtedness can be resolved by growth.

A Debate in Fontainebleau

Besides boasting the enormous Chateau, Fontainebleau is surrounded by ancient forests that have for centuries been the playground of hunters and horsemen. Cobblestone streets, old stone fences with ornate iron gates, numerous splendid restaurants and the obligatory carousel (merry-go-round) in the town centre make this a typically quaint French village. It is also home to INSEAD, a global business school with campuses in Singapore and Abu Dhabi.

The Executive MBA class on risk management knew they were at the epicentre of the most obvious global risk and had asked for a talk on the European “situation.†Being in the neighbourhood, I accepted the challenge. These weren’t bright-eyed students in their 20’s but global executives whose businesses were impacted in a variety of different ways (some positive, most negative) by the unfolding European farce. They sought actionable solutions to their unique problems.

A Swedish manufacturer, was rapidly becoming less productive than his competitors to the south as the Krona soared to new highs, yet he was reluctant to move production to a EURO-based country. An Asian investor wanted to know if European assets were cheap enough to scoop up. China (COSCO Group) already operates much of the Greek port of Piraeus and is a likely investor if Greek privatization plans proceed as expected. While value is apparent in many assets, most investors are prohibited from buying value if the assets (or the countries in which those assets are domiciled) don’t carry an investible credit rating. Besides, the continent still feels expensive. An Argentinean economist questioned why he ever studied macroeconomics, and a former executive of the World Economic Forum said he expected European problems to continue, without a solution, until something broke. His sombre opinion was based on many years of personal experience trying to encourage European leaders to agree on something – anything.

If Germany Leaves

Of all the discussions with this inquisitive group of mature students, the suggestion that generated the most concern, surprise and confusion was the possibility of a German departure from the EURO. Since Germany’s Chancellor Angela Merkel has often been the only person standing between the ECB printing press and a pan-European solution, a German exit might just clear the path for some real decision making. Without the Germans, France, Italy, Spain and the other peripherals could move forward on a monetary solution.

But since the Greeks, Italians and Spaniards now keep as much of their EUROs as possible in German bank accounts, devaluation – not default – would become a new and less-anticipated risk. A new Deutschmark would probably soar and both the EUR/USD and EUR/DEM would likely collapse in the event of a German departure. Germany would probably only convert domestic EURO deposits into Deutschmarks, so the non-Germans would get 100% of their EUROs back (as they expected), but those EUROs would have much less purchasing power (as they might not have expected). Recall that the original Greek safety-seekers placed their EUROs with German banks to avoid having their Greek-based EUROs converted into Drachmas at a deep discount (as much as 70 to 80%) in the event that Greece pulled the EURO ripcord. A German exit would instead weaken the EURO.

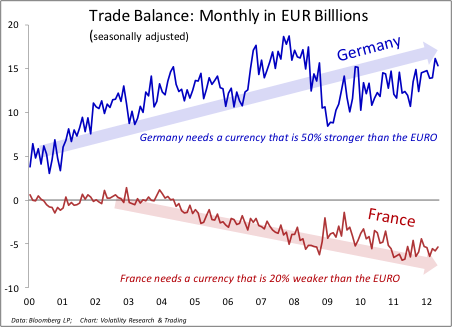

We concluded that the common currency was a political idea from the start, that Germany is the biggest beneficiary (the weak EURO contributes to their significant trade surplus) and that Germany would very rapidly fall into recession if they departed the union. Their productivity would collapse and their trade surplus would instantly disappear if they reclaimed the Deutschemark.

Midday in Paris

The proposed French tax increases appear to have encouraged Parisians to spend all their cash before the President Holland can get his hands on it. The high end and funky fashion shops, cafes and restaurants on the right bank of the Seine were so packed with shoppers, diners and pedestrians that author Earnest Hemmingway might have re-worded his oft-quoted 1920s utterance to “Paris is an [un]moveable feast.†One would never suspect that France is beset with severe economic difficulties by a stroll in the right bank on a Sunday afternoon. But Paris is not France.

The 14th of July Bastille Day parade down the Champs Elyse, which celebrates the 1789 French Revolution where the people stormed the Bastille fortress and reclaimed their country from the monarchy, was a splendid display of the military (jets, tanks, horses). It reminds the French that they have a fighting spirit despite the numerous white flag jokes.

How ironic that the French Franc was introduced (in decimal form) following the French Revolution, and surrendered just over 200 years later in favour of the EURO. France has fought many battles in the past and always (in the long run) managed to retain their sovereignty. By voluntarily surrendering their monetary sovereignty in 1999, they have reduced their chances of winning the current financial battle. The French balance of trade is in steady decline and could benefit from a currency that is 20% weaker than the EURO. Their German neighbours enjoy a large and persistent trade surplus and would be better balanced with a currency 50% stronger than the EUR.

The Past

We had petit dejeuner in Gassin, a tiny walled village from the 10th century, where the Knight Templars supposedly built the castle. The village was immaculately preserved and the views of the Mediterranean magnificent.

Dinner for ten in a 14th century wine cave in Grimauld was sumptuous, the wines outstanding and the two entertaining waiters easily served seven tables with humour and history lessons.

The museums and art galleries of Paris, the Chateaus of Fontainebleau, Versailles and Vaux le Vicomte and the Roman architectural remains on the Mediterranean were all great testimonies to France’s incredible history and mastery of their past.

The Present

The taxi driver cursed violently. “Things were bad with Sarkozy in power and now they are impossible with Holland and his leftists running the show! Government employees are overpaid, don’t show up for work and just don’t care!â€

We had advanced just one kilometre in one hour, stuck in a near motionless traffic jam en route to Paris from Fontainebleau. Two and a half lanes of the three-lane highway had been blocked in preparation for unscheduled road repairs – only someone forgot to inform the road repair people. Upon reaching the end of the jam, we found two men standing idly beside road blocks, and absolutely no work in process and no repair crew in sight (and nothing apparently wrong with the road).

Conclusion

France displays their past very well and with pride. The present appears to be well served by the private sector but abysmally by the public sector. The future looks bleak as increasing taxes insure the private sector shrinks while the public sector grows. Add in cubist intersections, road repairs with no road repairers, expensive wireless connections, antique sun seekers, rainy 12 degree summer weather in Paris and the rosy picture becomes more sombre. Get ready for the 2013 French recession. Fortunately the French have many splendid fermented grape products to help ease their pain.

Sources:

•M.C. Escher’s “Relativity†http://trese.cs.utwente.nl/taosad/escher.htm

•Fontainebleau intersection photo by the author. This aerial view of the same intersection is from Goggle Earth

•COSCO eyeing further Piraeus port investment. http://www.chinadaily.com.cn/business/2012-06/19/content_15514418.htm

•Ernest Hemingway was a member of the group of American expatriate writers that lived and wrote in Paris in the 1920s. He once said to a friend (A.E. Hotchner, who wrote a biography of Hemmingway called Papa Hemingway) “If you are lucky enough to have lived in Paris as a young man, then wherever you go for the rest of your life, it stays with you, for Paris is a moveable feast.â€

•A Moveable Feast, Ernest Hemingway, Scribner 1996. (First published in 1964)

•Gassin information http://www.residencesainttropez.com/en/gassin-information

•French Franc information http://en.wikipedia.org/wiki/French_franc

•Chateau Fontainebleau picture http://queenmimicorner.blogspot.sg/2012/05/chateau-de-fontainebleau.html

•Chateau Fontainebleau information. http://www.canada-tourist.com/chateau-de-fontainebleau.html

Disclaimer

Any opinion in this material may not necessarily represent the opinion of OANDA or any entity in the OANDA Group. OANDA makes no representation or warranty of any kind, express, implied or statutory regarding this material or any information contained or referred to in this material. The material is provided for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration. Past performance is not indicative of comparable future results and no representation or warranty is made regarding future performance.

OANDA accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your receipt of this material, howsoever arising, and including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection, fault, mistake or inaccuracy with this material, its contents or associated services, or due to any unavailability of the material or any part thereof or any contents or associated services. The information presented in this material has been obtained from sources we believe to be reliable but we do not make any representation or warranty nor accept any responsibility or liability as to its accuracy, completeness or correctness. Opinions and views expressed in the material are subject to change without notice. Copyright: OANDA Asia Pacific Pte Ltd 2012. Copyright in all materials, text, articles and information presented in this set of material is the property of, and may only be reproduced with permission of an authorised signatory of OANDA Asia Pacific Pte Ltd.

Copyright in materials created by third parties and the rights under copyright of such parties is hereby acknowledged. Copyright in all other materials not belonging to third parties and copyright in these materials as a compilation vests with and shall remain at all times copyright of OANDA Asia Pacific Pte Ltd and should not be reproduced or used except for business purposes on behalf of OANDA Asia Pacific Pte Ltd or save with the express prior written consent of an authorised signatory of OANDA Asia Pacific Pte Ltd. All rights reserved. © OANDA Asia Pacific Pte Ltd 2012. OANDA’s Terms of Use and Privacy Policy apply. Trading in the leveraged over-the-counter market carries a high level of risk and may not be suitable for all investors. You should never put at risk, any amount that you cannot afford to lose. More details under: http://www.oanda.sg/risk-disclosure.shtml

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.