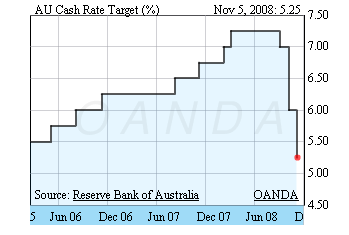

The Reserve Bank of Australia cut their Official Cash rate by 75 basis points and caught the market by surprise after a 50 bps cut was expected.

Taken from FXPedia:

The Cash Rate is the rate financial institutions charge other financial institutions for overnight loans in the Australian banking system. This is a fundamental trend-setting rate and changes to this rate are reflected in other interest rates including commercial bank rates. The Cash Rate Target is the rate that the government feels is appropriate given the current economic conditions.

After the RBA hiked the rates in the past two years, Australia received an influx of currency flows to take advantage of their record high interest rates. The AUD was one of the favorite currencies to buy and the Cash rate reached 7.25% on March 2008. After that four swift cuts (25bps 100bps, 50bps and now 75 bps) have reduced the Cash rate to 5.25%.

For more Australian Economic Indicators visit FXEconostats Australian Data

All Major Central Banks around the world are cutting their rate with the intention of restoring economic growth and trying to avoid an even deeper recession. Even the Bank of Japan which at 0.50% had the lowest rate in the developed world, was forced to cut by 20 basis points. The Japanese benchmark is now 0.30%.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.