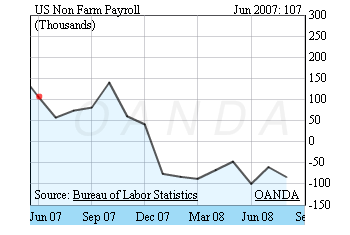

The August release of this important employment measure was a loss of -84k jobs. Analysts are forecasting that September’s losses could be higher, some hinting at -150 less jobs due to the current uncertainty surrounding the US Economy.

The graph shows how US employment have been hit by the effects of the Housing recession starting all the way back to August of 2007. As the economy cooled and more Financial Institutions reporter further losses, the US workforce contracted. The Non Farm Payroll is one of the most important economic indicators in Forex Trading, but this Friday’s is potentially more important because it could coincide with the US House of Representatives vote. That is if, the bill passes today’s vote in the Senate.

For more United Sates employment data, and other major economic indicators please visit FXEconostats

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.